Worrying downturn

The war-triggered devaluation of rupee is negatively impacting current account deficit, stock markets, commodity pricing and the lives of people in general

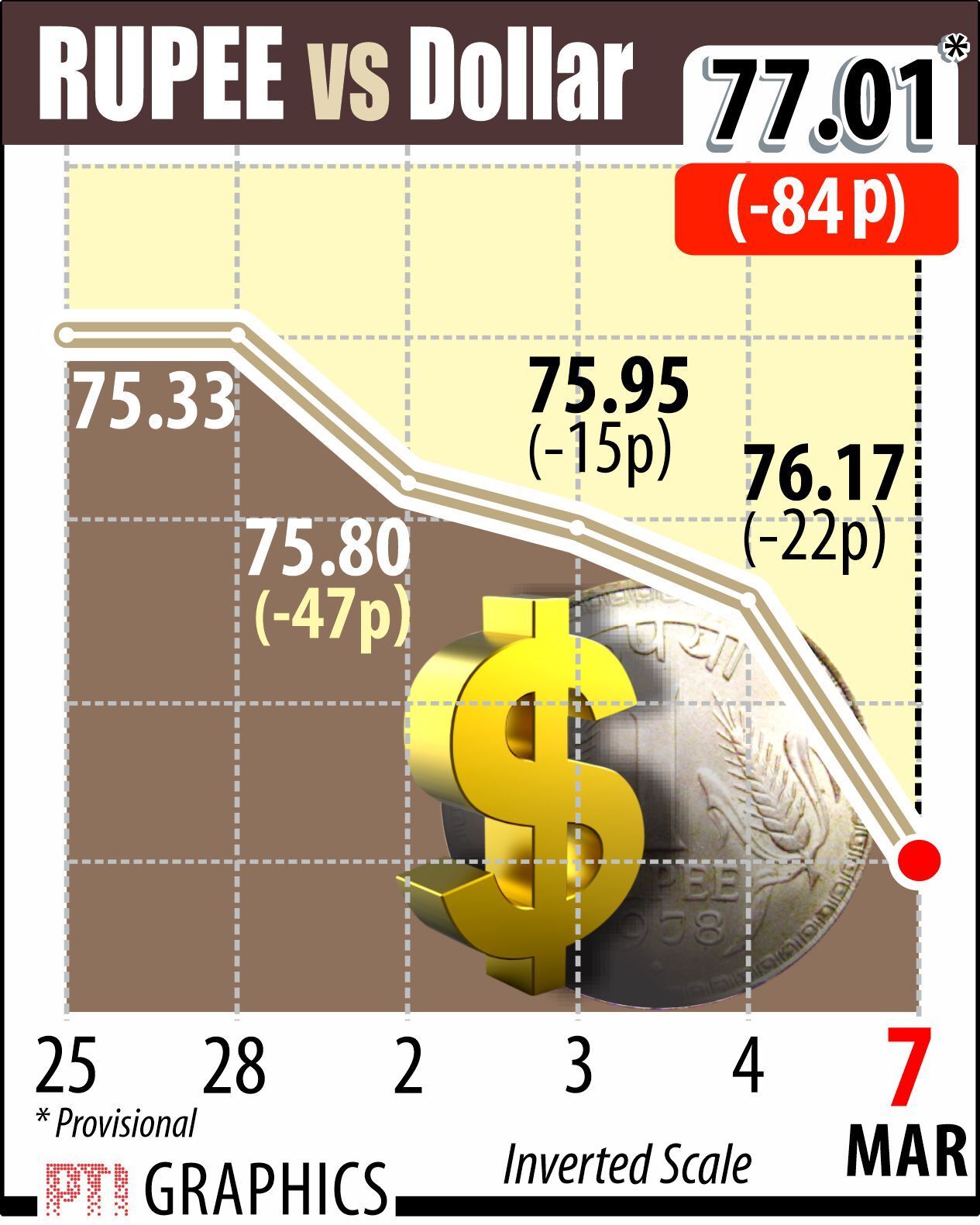

Owing to the ongoing war between Russia and Ukraine, the value of the rupee has weakened to 77 against the dollar. Earlier, the lowest level of the rupee was recorded on April 16, 2020 — at that time, the rupee had closed at 76.87 against the dollar. In just one day i.e., on March 7, the rupee depreciated by 1.1 per cent against the dollar, while it had fallen by 3.42 per cent in the past. It is noteworthy that among Asian currencies, the rupee has seen the sharpest devaluation.

The current account shows the net difference in foreign exchange on account of exports and imports. If this difference is negative, then it is called current account deficit (CAD), and if it is positive, then it is called current account surplus. According to the data from the Reserve Bank of India, the current account deficit in the second quarter of the current fiscal was USD 9.6 billion (1.3 per cent of GDP), while in the June quarter it was USD 6.6 billion (0.9 per cent of GDP). At the same time, in the first quarter of the last financial year, the current account stood at a surplus of USD 15.3 billion (2.4 per cent of GDP). In the present scenario, geopolitical risks and rising fuel and commodity prices are expected to widen the current account deficit further.

Due to the high price levels of crude oil in the international market, the rise in the USD index and the continuous withdrawal of foreign portfolio investors (FPIs) from the Indian stock market, the condition of the rupee is deteriorating. According to depository data, FPIs have withdrawn Rs 17,537 crore from the Indian stock market in three trading sessions in the first week of March. So far this year, FPI has sold Rs 1 lakh crore from the Indian stock market — Rs 2,200 crore daily. At the same time, after the start of the war between Russia and Ukraine, FPIs are selling Rs 4,500 crores per day. Since the withdrawal of the stimulus package by the US Federal Reserve, there has been an increase in selling by FPIs from the Indian stock market.

The price of crude oil was USD 139 per barrel on March 7, 2022, for the first time since 2008. According to experts, if the price of crude oil continues to soar, then the rupee may weaken further and reach the level of 80 against the dollar. However, the Reserve Bank of India has been interfering in currency trading for the last 10 to 12 trading sessions to prevent devaluation of the rupee — maintaining its stability against the dollar.

However, experts believe that the Central bank should not try to stop the weakness in the rupee in a hurry. A hike in policy rates can curb inflation to some extent, but it may reduce investment, credit growth, job creation, etc., which play a key role in accelerating the pace of growth. Therefore, the Central bank should take a decision in the matter only after assessing the merits of the decision taken.

India imports 85 per cent of its crude oil requirement from other countries and, except Iran, all other countries export crude oil in dollars. Iran exports crude oil to India in rupees but, due to the US pressure, India has been importing crude oil from Iran in limited quantities only.

Owing to the devaluation of rupee against dollar, more rupees have to be spent for importing crude oil, which has increased the possibility of increase in the prices of fuel, petroleum products and other commodities. This can have a negative impact on vehicles, aviation, paint business etc. Therefore, there has been a sharp decline in the shares of such companies. The sharp rise in the price of some commodities has also seen an increase in the stock of some companies.

Benchmark Sensex closed at 52,824 on March 7, 2022, down 1,491 points (3.74 per cent), its lowest level since July 30. The Sensex has registered a decline of 14.4 per cent after reaching a high of 61,766 in October 2021. This year it has registered a decline of 9.3 per cent till March 7, 2022. However, Nifty fell 382 points (2.3 per cent) to end at 15,863 during this period.

According to an estimate, the price of diesel and petrol may increase considerably after the election results, because the government always imposes more VAT and excise duty on petrol and diesel to increase the revenue.

According to the Union Finance Minister Nirmala Sitharaman, in the last three financial years, the Central Government has earned 8.02 lakh crore rupees by taxing petrol and diesel. At the same time, only in FY 2020-21, the Central government got revenue of Rs 3.72 lakh crore by levying tax on petrol and diesel, which was more than double from FY 2019-20. In the FY 2019-20, the Central government earned Rs 1.78 lakh crore from the tax imposed on petrol and diesel.

From the year 1960, the consumption of crude oil in India started accelerating, as more crude oil was needed in the country to keep the various aspects of development moving. Until 1965, the value of the rupee in the international market was measured in pounds, whereas from 1966, it was measured in dollars. In 1966, the price of 1 dollar was 7.5 rupees, which is now on the verge of reaching 80.

According to rating agency ICRA, if the price of crude oil in the international market remains at an average of USD 130 a barrel, then India's current account deficit can increase to 3.2 per cent of the gross domestic product (GDP) in the FY 2023. In the current scenario, the price of crude oil can reach USD 150 to 200 per barrel. Therefore, there is a possibility of more losses on this front.

For the health of the economy of any country, it is not considered good for its currency to fall, it adversely affects the growth rate of the country. The rise in inflation makes life difficult for the public. However, Indians who repatriate a major part of their earnings to India from abroad may benefit from the current situation.

Views expressed are personal