Growth-oriented policy

Even if RBI sheds its accommodative policy stance in the next MPC meeting to increase policy rates, growth prospects will likely remain stable

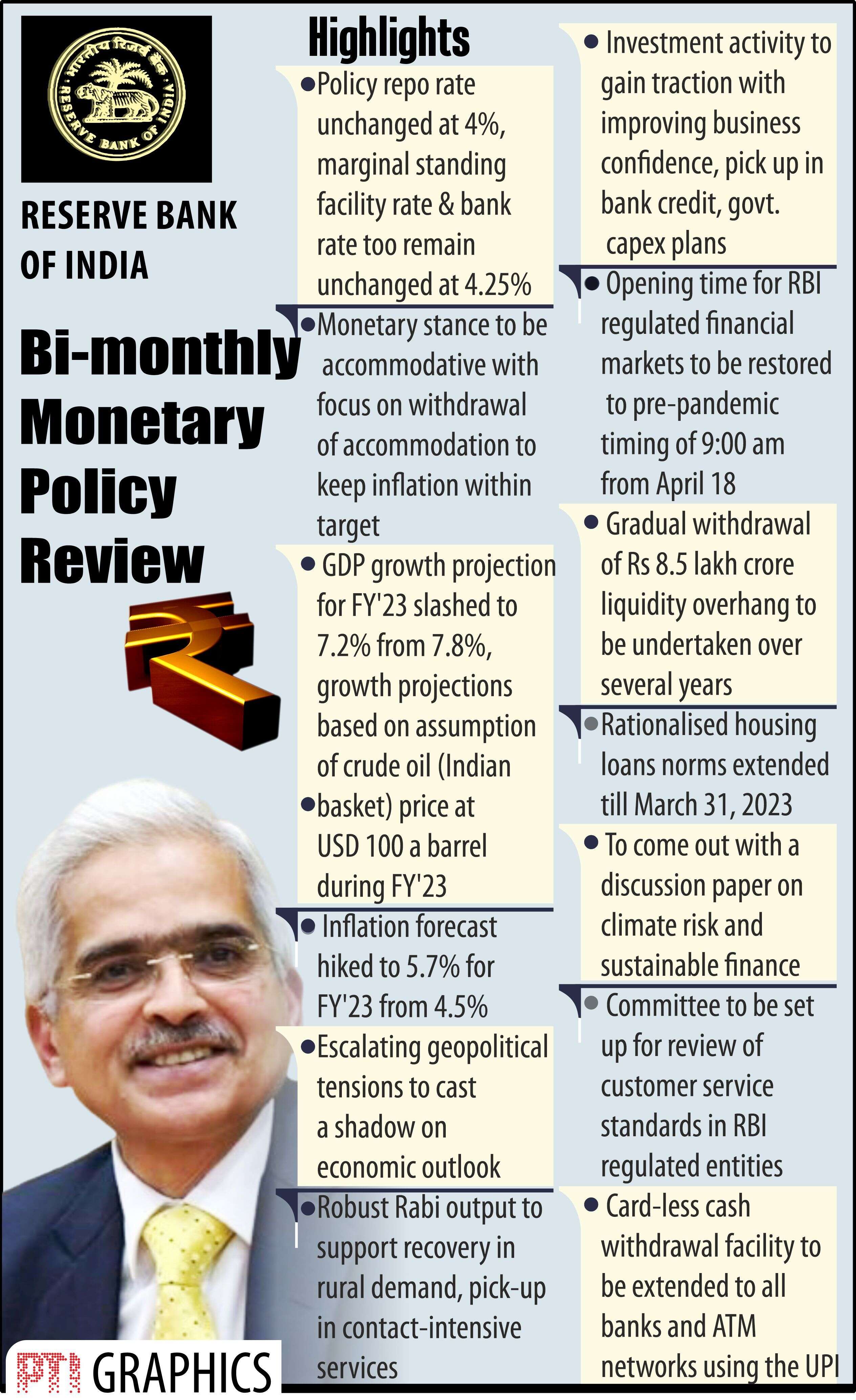

On April 8, 2022, the Reserve Bank of India did not change the policy rates in the monetary review. Repo rate at 4 per cent, reverse repo rate at 3.35 per cent, marginal standing facility rate and bank rate at 4.25 per cent remain unchanged. This means that the Central bank is going to maintain its accommodative stance for the time being. However, due to rising inflation and the ongoing war between Russia and Ukraine, the Reserve Bank may have to change its accommodative stance in the coming days.

The RBI has not changed the repo rate for the 11th time in a row. Earlier, the Central bank had changed the policy rates in the monetary review conducted on May 22, 2020. Repo rate is the rate at which RBI lends to banks. Banks give loans to the needy, businessmen and entrepreneurs from the loans taken from the Reserve Bank and the money deposited in the banks. A low repo rate means that the Reserve Bank is giving loans to banks at a cheaper rate. Reverse repo rate is the rate at which the Central bank pays interest on deposits from banks. Through the reverse repo rate, the RBI controls the liquidity in the market.

The revision in the estimates of both gross domestic product (GDP) and inflation in the latest monetary review indicates that policy rates may be increased in the coming days.

The interest rate on ten-year bonds is also increasing, and its yield has reached a 3-year high of 7.12 per cent. This year its interest rate is estimated to reach 7.25 per cent. The five-year overnight index swap has also risen 30 basis points to its highest level since May 2019. All these signs indicate that policy rates may be increased by the Reserve Bank soon. In the current scenario, the market expects that the Central bank may increase policy rates in the June monetary review.

According to the RBI data, bank credit grew by 8.6 per cent during FY 2022, in which retail and agricultural credit played a crucial role, while in FY 2021, bank credit grew at the rate of 5.6 per cent. Credit growth in the industrial sector has been possible due to the boom in the activities of MSMEs. The activities of large industries are also increasing gradually.

By September 2021, the growth in the economy had stalled due to the pandemic but, from October 2021, credit distribution to the retail and industrial sector accelerated. Credit growth rate stood between 5.5 to 6.7 per cent in the first half compared to last year and then it increased rapidly. Banks have given loans of Rs 9.41 lakh crore in FY 2022, compared to Rs 5.8 lakh crore in FY 2021 and Rs 5.99 lakh crore in FY 2020. In the total loan of FY 2022, Rs 1.78 lakh crore was given in the last fortnight ending March 25, 2022. At the same time, the growth in deposits in FY 2022 was 8.94 per cent, which was 11.4 per cent in FY 2021. An increase in bank credit suggests a pick-up in economic activity, while a decline in bank deposits indicates a pick-up in private spending, which is likely to boost demand and industrial activities.

In the 11 months from April 2021 to February 2022, the retail sector — including housing, credit cards, vehicles, personal loans etc. — has grown at the rate of 11.4 per cent. The growth rate in retail credit stood at 8.9 per cent between April 2020 and February 2021. The credit growth rate in the industrial sector stood at 3.4 per cent in the 11 months of FY 2022, as against a contraction of 2.6 per cent in February 2021.

The RBI has projected the GDP growth rate to be 7.2 per cent for the financial year 2022-23, against the previous estimate of 7.8 per cent. According to Das, the GDP growth rate can be 16.2 per cent in the first quarter of the FY 2022-23, 6.2 per cent in the second quarter, 4.1 per cent in the third quarter and 4 per cent in the fourth quarter.

Further, as per the RBI, consumer price index (CPI) inflation is likely to be 5.7 per cent in the FY 2023, with quarterly figures being 6.3 per cent, 5 per cent, 5.4 per cent and 5.1 per cent in the same order.

Regarding inflation, Das says that there has been a lot of uncertainty at the global level due to high volatility in crude oil prices and geopolitical tension since the end of February. Due to the ongoing war between Russia and Ukraine, there is a huge jump in the price of crude oil and metals. In the domestic market, the price of petrol and diesel has increased by up to Rs 10 per litre in the last 15 days. Petrol (Power) is being sold in Mumbai at the rate of Rs 125 per litre.

During the monetary review, Das said that cardless cash withdrawal facility will now be made available at all banks and ATM networks using Unified Payment Interface (UPI). Adjustment of such transactions will be done through the ATM network. At present, few banks are providing the facility of withdrawing money from an ATM without a debit card, which is being operated through a mobile banking app. Presently, 10,000-20,000 transactions are being done through this facility. Some banks are charging additional charges from their customers in lieu of this facility. It is believed that the introduction of this facility at all banks will help bank customers to avoid frauds like card skimming and card cloning.

It can be said that the Reserve Bank's accommodative stance has supported the economy now, but due to rising inflation and the ongoing war between Russia and Ukraine, the Reserve Bank cannot maintain its accommodative stance for long. Therefore, it is being speculated that the Reserve Bank may increase the policy rates in the monetary review to be held in June. Bank credit has now started to increase and bank deposits have decreased, indicating that private spending and economic activity are picking up. Therefore, a hike in policy rates may have a partial negative impact on the economy, but overall, the Indian economy will remain strong in the days to come.

Views expressed are personal