The Nobel Series: Pathfinders of new frontiers

The works of both Daniel Kahneman and Vernon Lomax Smith challenged the assumptions of neoclassical framework; while the former applied psychological research to economics, the latter initiated the new trend of experimentation

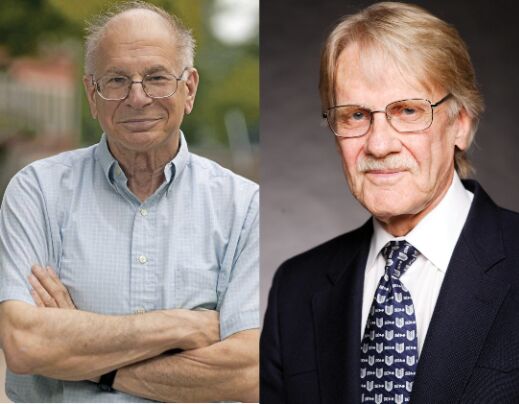

The 2002 Nobel Prize in Economic Sciences was awarded to Daniel Kahneman of Princeton University "for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty" and Vernon L Smith of George Mason University, "for having established laboratory experiments as a tool in empirical economic analysis, especially in the study of alternative market mechanisms".

Kahneman did his undergraduate studies with a major in psychology, and a minor in mathematics, from the Hebrew University, Jerusalem in 1954. Thereon, he was drafted as second lieutenant and, after an eventful year as a platoon leader, was transferred to the psychology branch of the Israel defence forces. There, one of his occasional duties had been to participate in the assessment of candidates for officer training. In 1961, he completed his PhD from the University of California at Berkeley in psychology. His dissertation was on statistical and experimental analysis of the relations between adjectives in the semantic differential. The semantic differential (SD) was introduced and mainly developed by the US psychologist Charles E Osgood (1916–91). It is a type of semantic rating scale measuring the connotative meaning of concepts like terms, objects, events, activities, ideas, etc. In Kahneman's own words: "This allowed me to engage in two of my favourite pursuits: the analysis of complex correlational structures and FORTRAN programming". After his PhD, Kahneman began teaching psychology in the Hebrew University and later moved to the US to take up teaching positions at different places. In 1966, he was a scientist at the University of Michigan and a faculty at Harvard University. He was a researcher at Cambridge, England in the late 60s. But he continued to teach at the Hebrew University, first as a lecturer (1961-1970) and later as a professor (1970-1978). After this, he taught at the University of British Columbia in Vancouver (1978–86) and the University of California, Berkeley (1986–94). Kahneman moved to Princeton in 1993 and stayed there till he retired in 2007. Post-retirement, he left both posts as emeritus professor.

Vernon Smith received his bachelor's degree in electrical engineering from Caltech in 1949, an MA in economics from the University of Kansas in 1952, and his PhD in economics from Harvard University in 1955. His PhD was on experimental economics, which he first did in Harvard, while teaching microeconomics. His experiment was inspired by a similar experiment done by Chamberlin on monopolistic competition. Smith began teaching at Purdue University in 1955 and stayed there till 1967. He was also a visiting professor at Stanford in 1961-62, a faculty at Brown University (1967-68), University of Massachusetts (1968-72), Caltech (1973-1975), before settling down at the University of Arizona in 1976. He did most of his ground-breaking research at Arizona, where he stayed until 2001. In 2001, he moved to George Mason University, where he continues.

In this article, we will review the main works of Kahneman and Smith and look at how they continue to be applied even today.

Main works of Daniel Kahneman

Kahneman did most of his important works with Amos Tversky, who died in 1996. His work can broadly be classified into four areas: a) Challenging the rationality assumption of the neoclassical model b) Issue of availability heuristics c) Introduction of prospect theory and the concept of loss-aversion therein where a model of choice under risk was introduced d) Framing effects. Let us discuss these.

Kahneman and Tversky challenged the rationality assumption based on their observations. They contended that the human mind simply does not have the capacity of being rational as required by the neoclassical model. It cannot comprehend all the possible alternatives, rank them and then choose the one which gives him maximum utility. Instead, humans have bounded rationality, a term Kahneman borrowed from Herbert Simon. Further, they 'satisfice', rather than maximize. Bounded rationality simply means that there are limits to one's rationality and that one takes decisions that satisfy, rather than maximize or optimize.

The issue of 'availability' heuristics is basically a model of decision-making under uncertainty. It means simply that people judge probabilities based on the available examples, rather than a detailed analysis of all the choices and outcomes. In other words, it is a mental shortcut that aids decision-making. The availability heuristic is an extension of the criticism of the rationality assumption discussed above. This approach of Kahneman gave us a fresh understanding of cognitive processes that explained human error.

Kahneman and Tversky also introduced 'prospect theory' to explain how choices are made under risk. This is another extension of the critique of rationality discussed above. They introduced the concept of loss aversion, wherein the pain of losing is assessed to be far greater than the pleasure of gaining. If we consider two options: One, where there is a guarantee of winning Rs 1,000 and two, where there is a 50 per cent chance of winning Rs 2,000, most people will prefer the guaranteed amount even though, in expected utility terms, both options are the same. According to Kahneman and Tversky, this showed that individuals tend to be loss-averse under risk. Loss aversion is common in cognitive psychology, decision theory, and behavioural economics and we see it in our everyday lives, e.g. in financial decisions and marketing. An individual is less likely to buy a stock if it's seen as risky with the potential for a loss of money, even though the reward potential is high. Notably, loss aversion gets stronger in individuals as the stakes of their choice grow larger.

This takes us to the final contribution of Kahneman and Tversky — framing effects. Continuing with the loss-aversion example above, the outcome will also depend on whether a transaction is framed as a loss or as a gain. The same change in price framed differently, for example, as a USD five discount or as a USD five surcharge avoided, leads to different effects on consumer behaviour. Another example of framing effects is the following: Many people will drive an extra ten minutes to save USD 10 on a USD 50 toy, but they will not drive ten minutes to save USD 20 on a USD 20,000 car, even though the gain is higher. According to Kahneman and Tversky, instead of comparing the absolute saving in price against the cost of going the extra distance, people compare the percentage saving. Kahneman has also authored many influential books such as 'Thinking Fast and Slow', 'Attention and Effort', 'Judgment Under Uncertainty: Heuristics and Biases', 'Well-being: The Foundations of Hedonic Psychology' and many others.

Main works of Vernon Smith

Unlike Kahneman, Smith was an economist by training. He began looking beyond the neoclassical model while he was only a student. One of his early noteworthy works was the testing of Chamberlin's model of monopolistic competition by conducting experiments, while he was teaching microeconomics at Purdue in 1955. It helped that Chamberlin was his teacher and did many experiments to test various models of competition. Smith thought of the experiments as a tool to help him teach since he was finding it difficult to teach microeconomics. And in doing so, he laid the groundwork of experimental economics.

The results of Smith's experiments were published in 1962 in an article titled 'An Experimental Study of Competitive Market Behaviour' published in the 'Journal of Political Economy'. In this article, he arrived at a theoretical equilibrium, which was what the market would also predict. He found that the prices discovered in the experiments were close to those predicted by the theory, which convinced him that

free markets actually work. Smith also devised "wind-tunnel tests," where trials of new alternative market designs, such as those for a deregulated industry, could be tested.

In 1976, Smith solved this problem with the 'induced-value method', which has become a standard tool of economics. This was published as an article titled 'Experimental Economics: Induced Value Theory' in the 'American Economic Review'.

Many of his experiments focused on the outcome of public auctions where he showed that the way in which the bidding was organized affected the selling price. The most familiar auction system is the English system in which buyers bid sequentially and in increasing order until no higher bid is submitted. Another auction system beloved by economists (like William Vickrey) is the second-price sealed-bid system, in which the buyer pays only the second-highest bid. Smith found that English and sealed-bid second-price auctions produced similar experimental outcomes. Interestingly, though, Dutch auctions (in which a high initial bid by the seller is gradually lowered in fixed steps at fixed times until a buyer yells "buy") yielded lower prices than sealed-bid second-price auctions, which is contrary to the basic economic theory of auctions.

Smith also worked on the issue of provisioning of public goods. In his Nobel lecture, Smith laid out a number of examples of private enforcement of rules that seemed to have worked well — in cattle ranching, mining, lobster trapping in Maine, and Eskimo polar bear hunting. He found that privately set rules are more likely to solve the public goods and free rider problems, as opposed to the government setting the rules. In the cattle-ranching example he found that private entities solved the public-good problem. In a sense, Smith's work was a vindication of the Coase theorem. It may be recalled that Coase had argued that with well-defined property rights and low transaction costs, people would come to an efficient and mutually acceptable outcome.

Smith has authored many well-known books such as 'Humanomics: Moral Sentiments and the Wealth of Nations for the Twenty-First Century' (2019), 'A life of Experimental Economics' (Volume I and II) (2018), 'Rethinking Housing Bubbles' (2014), 'Rationality in Economics: Constructivist and Ecological Forms' (2007) and many more.

Conclusion

Steve Pinker called Daniel Kahneman the world's most influential living psychologist. Working independently, Smith was the first economist to introduce experiments to test theories. Both Kahneman (along with Tversky) and Smith created the field of behavioural and experimental economics. Their work had an impact beyond economics, particularly in cognitive psychology and social psychology. Within economics, there was now an influential

body of research that moved away from man as Homo Economicus. While Kahneman highlighted the fallacies and systematic errors in human decision making, Smith tweaked the assumptions of the neoclassical model and proposed alternative methods and explanations.

It is a tribute to the fundamental work of Daniel Kahneman and Amos Tversky that even though they were not economists, they made behavioural economics possible. Not only that, they established the link between economics and psychology. Kahneman showed that humans have a strong bent towards risk aversion and are far from being rational. Humans tend to be instinctive and look for shortcuts or 'heuristics' in decision-making. Similarly, Smith created a totally new field of experimental economics and set standards of reliable laboratory experiments in economics.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal. Views expressed are personal