The Nobel Series: Alternative economic governance

While Elinor Ostrom dealt with overcoming collective action dilemmas in managing natural resources, Oliver Eaton Williamson is well-known for building the foundation of transaction economics through laying the distinction between firm and market transactions

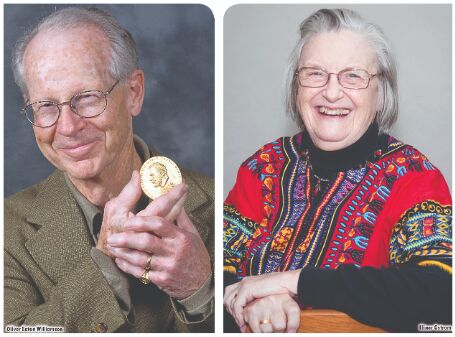

The Nobel Prize in Economic Sciences in 2009 was jointly awarded to Elinor Ostrom, then at Indiana University "for her analysis of economic governance, especially the commons" and Oliver E Williamson, then at University of California, Berkeley, "for his analysis of economic governance, especially the boundaries of the firm".

Ostrom did her BA in 1954, MA in 1962 and PhD in 1965 — all in political science from the University of California, Los Angeles. She joined the faculty at Indiana University in Bloomington after her PhD and stayed there till she passed away in 2012. In 1973, she co-founded the Workshop in Political Theory and Policy Analysis at Indiana University, with her husband Vincent Ostrom — a political scientist. She was a research professor and the founding director of the Centre for Study of Institutional Diversity at Arizona State University, Tempe. Ostrom was also associated with Virginia Tech.

Williamson did his undergraduate in management from the MIT Sloan School of Management in 1955. After this, he worked for a while at General Electric and the CIA, before joining the MBA programme at Stanford, which he completed in 1960. He got his PhD in economics from Carnegie Mellon University in 1963. Williamson's dissertation 'The Economics of Discretionary Behavior: Managerial Objectives in a Theory of the Firm' — as a winner in the Ford Foundation dissertation competition — was published by Prentice-Hall. He was a student of the eminent economist Ronald Coase and the polymath social scientist Herbert Simon — both of whom were Nobel laureates. After his PhD, he joined the economics faculty at the University of California, Berkeley, where he stayed till 1965. From 1965 to 1983, he was a professor at the University of Pennsylvania, and from 1983 to 1988, professor at Yale University. At Yale, Williamson founded 'The Journal of Law, Economics, & Organization'. He returned as Professor of Law and Economics to the University of California, Berkeley in 1988. He was also a consultant to various entities, including the RAND Corporation (1964–66), the US Department of Justice (1967–69), the National Science Foundation (1976–77) and the Federal Trade Commission (1978–80).

In this article, we will review the main works of Ostrom and Williamson and see how they continue to guide us in various areas of public policy.

Main works of Elinor Ostrom

Ostrom was one of the rare non-economists to have been awarded the Nobel Prize in Economics. She was also the first woman to have won the award. Her main contribution was to look at alternatives to private property for governing natural resources. She challenged the established wisdom that natural resources such as forests, pastures and fishing grounds were over-exploited when used collectively. Instead, if the users/community came together collectively, and agreed on rules to exploit these resources, it would lead to a sustainable and optimal outcome for all. She basically foresaw Garett Hardin's work, 'Tragedy of the Commons', and suggested that there need not be any tragedy after all. Interestingly, Hardin's famous article was published in the magazine 'Science' after Ostrom had completed her dissertation. Similarly, Olson's famous work, 'The Logic of Collective Action', which spoke of ways to overcome collective action dilemmas and the importance of cooperation was also published after Ostrom had completed her dissertation. All these works had a similar issue being discussed — overcoming collective action dilemmas in managing natural resources.

It may be recalled that Hardin had suggested that a natural resource, such as a natural pasture, would be over-exploited since there would be no regulation or control on such usage. In other words, individuals would maximize their private benefit over social benefit and lead to an exploitative situation. Ostrom used field studies and interaction with communities as her tools for research. And her research extended to a wide variety of natural resources — ranging from irrigation and fisheries to forest use. She also covered a fair amount of geography in her work, which included developed (Sweden, USA and Spain) and developing (Nepal, Nigeria, Indonesia and Bolivia) countries. Most of her work is captured in the seminal book, 'Governing the Commons', which was published in 1990.

As the Nobel website tells us:

Ostrom's work set out carefully defined rules on who gets what, penalties for violating rules and conflict resolution mechanisms in the management of the common property resource. The governance structure was largely self-driven and horizontal, rather than a vertical hierarchy.

However, before returning to her favourite topic of common pool resources, Ostrom worked for the first 15 years in Indiana University on police industry across the USA. She analysed various issues in policing such as patrol, traffic control, response services, and criminal investigation.

In 1973, Ostrom and her husband Vincent founded the Workshop on Political Theory and Policy Analysis at Indiana University. (I had a chance to participate in the Workshop in the summer of 1999 and was lucky to work directly with Ostrom. On my request, she also agreed to be on my doctoral dissertation committee). Ostrom had proposed a framework called the Institutional analysis and development framework (IAD) in which collective action, trust, and cooperation are key to the management of common pool resources (CPR).

Main works of Oliver Williamson

Williamson did not set out to be an economist and wanted to be an engineer — having taken courses in math and physics at the undergraduate level. In an interesting parallel between the world of engineering and economics, he pointed out that transaction costs in economics played the role of friction and resistance. And it is these costs that determine what kind of an organization will be ideal for carrying out economic activity. As we noted above, he enrolled for a PhD in the Graduate School of Business at Stanford. However, his interest in economics was triggered only after he took a class with Kenneth Arrow.

The basic question which Williamson sought to answer was: Why do certain transactions take place within a firm and others in the market? Williamson made a distinction between horizontal structures (markets) and hierarchical or vertical structures (firms) and suggested that when the transaction costs of doing business within a firm is greater than that of doing so in the markets, activities will shift to the market. In this way, he laid the foundations of transaction cost economics and clarified the steps to integrate it with organization theory.

Williamson drew upon the work of the 1991 Nobel laureate, Ronald Coase, who had asked the simple question: "Why do firms exist"? We may recall that Coase's seminal paper, 'The Nature of the Firm', published in 1937, asked this question. According to Coase, firms exist to minimise transaction costs. Williamson took this work forward and suggested that Coase's work did not go into the mechanics of how these costs were minimized. Further, if the firms were indeed more efficient, why don't they replace the market completely? Williamson, in his book, 'Markets and Hierarchies', published in 1975, offered a comprehensive theory of the market and the firm. He proposed the 'organizational failures framework' wherein he departed from the neoclassical assumption of rationality and instead introduced Herbert Simon's concept of bounded rationality. He also introduced environmental factors like uncertainty and their relevance in decision making. In brief, he made the following suggestions:

❋ Like Coase, he suggested that firms are not a black box, as has been assumed in the neoclassical framework.

❋ The internal organization of the firm is critical for deciding which activities will be taken up within the firm.

❋ Transaction costs are positive and not zero, as assumed in the neoclassical framework.

❋ Economic agents are boundedly rational as told to us by Herbert Simon; they are not rational as the neoclassical framework tells us.

With this framework, Williamson integrated a modified economic theory, which tweaked the neoclassical framework with a modified industrial organization theory and gave us the new transaction cost economics. As Williamson claimed, his experience in the Antitrust Division of the US Department of Justice helped him to formulate these views. It was his work there that led him to understand the importance of organization theory and contracts. It was also his work here that helped him distinguish between markets and hierarchies. This work was captured in his 1968 article, 'Economies as an Antitrust Defense', where he showed that horizontal mergers of companies in the same industry can create efficiency. The reason is that if mergers reduce costs, the reduction in costs can create more gains for the economy than the losses to consumers from the higher price. In his 1971 paper, 'The Vertical Integration of Production: Market Failure Considerations' — which was a precursor to his 1975 work, 'Markets and Hierarchies' — he continued to explore the boundaries of the firm and the market.

An example will illustrate what Williamson was talking about: An auto manufacturer depends on the railways to ship the raw material (steel) as well as the finished product (cars). The auto maker wants to ensure that the railways won't charge a monopoly price and the railways want to ensure that they will be compensated for the high cost of a new track to be laid till the auto factory. One solution that Williamson suggested was to vertically integrate — i.e., the automaker buys out the railway track. But the interesting question that Williamson asked was: How far should the firm go? Williamson suggested that firms will buy standardized inputs from the market and produce the specialized inputs internally.

Other important writings of Williamson included: 'Transaction Cost Economics: The Governance of Contractual Relations' (1979), which took forward the theory of transaction cost economics outlined earlier; 'Credible Commitments: Using Hostages to Support Exchange' (1983), which talked of contracting; and 'Comparative Economic Organization' (1991), which took forward the work of the 1983 paper and spoke of differing contracts for the market and hierarchies. His later work in the decade of 2000s was mostly on New Institutional Economics — of which he was an important founding father.

Conclusion

Both Ostrom and Williamson explored alternative models of economic governance. Ostrom gave us an alternative to public and private property in the governing of commons in the shape of common property management. This involved the participation of the community in setting rules to govern common properties such as forests, fisheries or pastures. On the other hand, Williamson explored the boundaries of the firm and the market, the importance of contracts and transaction cost economics. Taking forward Coase's initial formulation of why firms exist, Williamson showed that firms solve problems that arms-length market transactions have trouble solving. In other words, firms internalise the costs of transacting in the market. As the Nobel website tells us of Williamson's work:

Oliver Williamson has argued that markets and hierarchical organizations, such as firms, represent alternative governance structures which differ in their approaches to resolving conflicts of interest. The drawback of markets is that they often entail haggling and disagreement. The drawback of firms is that authority, which mitigates contention, can be abused. Competitive markets work relatively well because buyers and sellers can turn to other trading partners in case of dissent. But when market competition is limited, firms are better suited for conflict resolution than markets. A key prediction of Williamson's theory, which has also been supported empirically, is therefore that the propensity of economic agents to conduct their transactions inside the boundaries of a firm increases along with the relationship-specific features of their assets.

The works of both Ostrom and Williamson continue to guide us in formulating policy in a wide range of areas from climate change to forest policy to issues of privatisation and contract design.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal.. Views expressed are personal