Proponents of dynamic macroeconomics

Contrary to the Keynesian view that changes in aggregate demand drove business cycles, the works of Finn Erling Kydland and Edward Christian Prescott established that technological changes and supply shocks could also be major drivers of business cycles

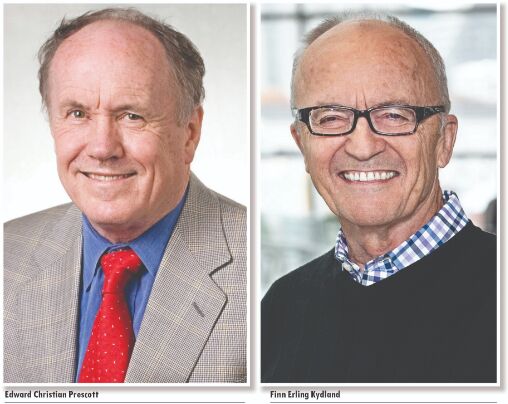

The Nobel Prize in Economic Sciences in 2004 was jointly awarded to Finn E Kydland, then at Carnegie Mellon University, Pittsburgh and University of California, Santa Barbara; and Edward C Prescott, then at Arizona State University, Tempe and Federal Reserve Bank of Minneapolis "for their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles".

Kydland was educated at the Norwegian School of Economics and Business Administration (NHH) from where he completed his BSc in 1968. He then moved to Carnegie Mellon University for his PhD which he completed in 1973. The joint winner of the Nobel, Edward Prescott, was his dissertation supervisor. The title of his dissertation was 'Decentralized Macroeconomic Planning'. After finishing his PhD, Kydland became an assistant professor of economics at NHH (1973–78) and later taught at Carnegie Mellon (1978–2004) before joining the faculty at the University of California, Santa Barbara, in 2004. He also served as a consultant research associate to the Federal Reserve banks of Dallas and Cleveland.

Edward Prescott did his undergraduate studies in mathematics from Swarthmore College in 1962, and thereafter did his Masters in operations research from Case Western Reserve University in 1963. He did his PhD in economics from Carnegie Mellon University in 1967. He began teaching while he was a student in 1966 at the University of Pennsylvania where he taught until 1971. After this, he joined the faculty at Carnegie Mellon and stayed there from 1971-80. He later taught at the University of Chicago, the University of Minnesota, and Arizona State University, among others. In addition, he became an advisor to the Federal Reserve Bank of Minneapolis in 1981. Prescott was also a fellow of the Brookings Institution, the Guggenheim Foundation, the Econometric Society, and the American Academy of Arts and Sciences; he was elected a member of the National Academy of Sciences in 2008. He had been editor of several journals, including the 'International Economic Review' (1980–90), and wrote on wide-ranging topics such as business cycles, economic development, general equilibrium theory, and finance.

Prescott and Kydland made fundamental contributions in understanding the causes of business cycle fluctuations and how these impact fiscal and monetary policies. In this article, we will review the main works of Kydland and Prescott and see how they continue to influence public policy.

Main works of Finn Kydland and Edward Prescott

The most well-known work of Kydland and Prescott was on time consistency of economic policies and a fresh look at the driving forces of business cycles. On time consistency of economic policy, their argument was simple: A policy is time consistent if a policymaker has no incentive or motive to renege on his commitment in the future. In other words, the policy maker gives a credible commitment that can be enforced. To give an example from monetary policy: Suppose that the mere promise of price stability persuades price- and wage-setters to set steady prices and wages. In that event, a monetary policy maker with a short horizon has an incentive to ease policy and boost economic activity. Knowing this, however, price- and wage-setters have little reason to believe the initial announcement. Instead, since policymakers' statements lack credibility, private-sector inflation expectations lead to higher price and wage inflation. To get around this problem, central banks have become independent to make rule-based policy, rather than that based on discretion. Indeed, inflation targeting is practised by most central banks routinely and they do so transparently, communicating their actions regularly. They not only announce a quantitative target for inflation over at least the next several years, but also routinely report publicly on their progress in realising their objectives. As a matter of fact, it is the work of Kydland and Prescott which influenced the monetary and fiscal policies of governments and laid the basis for the increased independence of many central banks.

Their main ideas on time consistency and business cycles are encapsulated in two articles. In 'Rules Rather than Discretion: The Inconsistency of Optimal Plans' (1977), they demonstrated how a declared commitment to a low inflation rate by policymakers might create expectations of low inflation and unemployment rates. If this monetary policy is then changed and interest rates are reduced — for example, to give a short-term boost to employment, the policy makers' (and thus the government's) credibility will be lost and conditions worsened by the "discretionary" policy. The other article was 'Time to Build and Aggregate Fluctuations' (1982), in which they laid out the microeconomic foundation for business cycle analyses. They suggested that supply-side shocks such as technology changes or supply shocks such as oil price hikes could be reflected in investment and relative price movements and thereby create short-term fluctuations around the long-term economic growth path. In other words, Prescott and Kydland speculated that changes in technology could generate many of the fluctuations in employment and output that had been noted in the past, and that changes in aggregate demand were not necessary to explain such fluctuations. This view was therefore a challenge to the Keynesian view that changes in aggregate demand drive business cycles, and was more in conformity with the research of Robert Lucas who had proposed the rational expectations theory. We may recall that this theory, in its simplest form, says that economic agents factored in the impact of fiscal and monetary policy in their actions. In other words, Lucas did away with the assumption that the government could fool the people all the time.

In his Nobel lecture, Prescott noted some important conclusions that follow from his research (with Kydland) on business cycles:

We learned that business cycle fluctuations are the optimal response to real shocks. The cost of a bad shock cannot be avoided, and policies that attempt to do so will be counterproductive, particularly if they reduce production efficiency. During the 1981 and current oil crises, I was pleased that policies were not instituted that adversely affected the economy by reducing production efficiency. This is in sharp contrast to the oil crisis in 1974 when, rather than letting the economy respond optimally to a bad shock so as to minimize its cost, policies were instituted that adversely affected production efficiency and depressed the economy much more than it would otherwise have been.

Prescott concluded that the gains in well-being from eliminating business cycles are small or negative, while the gains from eliminating depressions such as the Great Depression and from creating growth "miracles" are large.

Conclusion

Prescott, who was trained as a statistician, credits Lucas and Phelps with getting him interested in economics. It may be recalled that Milton Friedman and Phelps had earlier expressed scepticism with the Keynesian view that changes in aggregate demand drove business cycles. But it was Lucas who put it all together in a theoretical framework, particularly through the Lucas critique. The research of Kydland and Prescott carried the work of Lucas forward and suggested that technological changes and supply shocks could also drive business cycles. In addition, their work on time consistency of economic policy did a great service to central bankers all over the world by ensuring their independence and pushing them towards rule-based monetary and fiscal policy rather than discretion-based policy.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal. Views expressed are personal