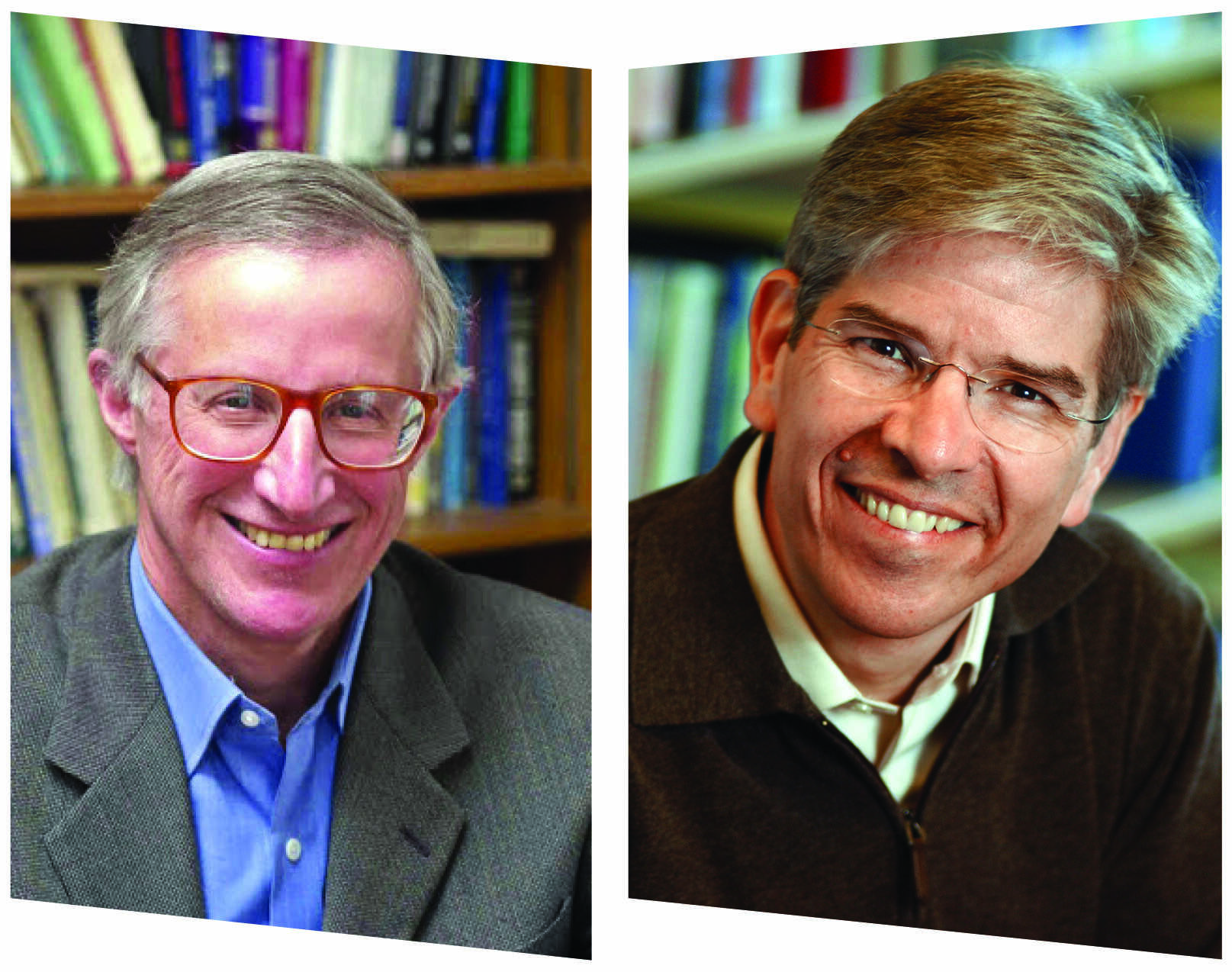

Pacesetters in macroeconomics

While William Dawbney Nordhaus incorporated climate change in economic models and emphasised on cooperative multinational policies for tackling the issue, Paul Michael Romer gave endogenous growth theory model with technical innovation at its core

The Nobel Prize in Economic Sciences for 2018 was awarded to William D Nordhaus, then at Yale University, "for integrating climate change into long-run macroeconomic analysis" and Paul M Romer, then at NYU Stern School of Business "for integrating technological innovations into long-run macroeconomic analysis".

Nordhaus completed his undergraduate degree from Yale University in 1963. He began his undergraduate studies, not in economics, but in a mish-mash of interdisciplinary areas. Only in his senior year did he get interested in economics after he took a course with James Tobin. He then went to MIT for a PhD in economics which he completed in 1967. At MIT, his teachers included the Who's Who of the economics discipline such as Paul Samuelson, Kenneth Arrow, Joe Stiglitz, Robert Solow and George Akerlof. Nordhaus's doctoral thesis was titled 'A Theory of Endogenous Technological Change' and his dissertation advisor was Robert Solow. After his PhD, Nordhaus joined Yale University as a faculty in the Economics Department and the School of Forestry and Environment Sciences, where he continues even today.

Paul Romer completed his undergraduate studies in math and physics from the University of Chicago in 1977. He did a bulk of his graduate studies at MIT and Queen's University, Canada, and completed his PhD in economics from the University of Chicago in 1983. His advisor was Scheinkman and Robert Lucas, and his thesis was titled 'Dynamic Competitive Equilibria with Externalities, Increasing Returns and Unbounded Growth'. After his PhD, Romer taught at various universities such as Rochester, Chicago; the University of California at Berkeley, Stanford and finally settled down at the Stern School of Business at NYU.

In this article we will review the main works of Nordhaus and Romer and look at their continued importance in various areas of public policy.

Main works of William Nordhaus

Nordhaus is known for his work on incorporating climate change in economic models. He first started working on climate models in the 1970s. Koopmans, the Nobel laureate in 1975, suggested that he work with activity analysis and linear programming models, which are ideal for the analysis of resource constraints such as oil, coal etc. and their relationship with society's preferences which, in turn, leads us to the best way to either deplete or conserve the resource. Nordhaus took a major step in his climate economy models after he attended the International Institute of Applied Systems Analysis in 1974 in Vienna, which was an interdisciplinary programme. It was here that he learned about the science of climate change from his peers. Here, he took forward the 'Bulldog' model, which he had developed at Yale earlier and which predicted the price of oil. This came to be known as the IIASA model and was published in 1977. The model was the first to calculate the social cost of carbon dioxide emissions in dollar terms. In calculating this cost, Nordhaus was inspired by the earlier work of Koopmans and Kantorovich (Nobel laureates of 1975) on shadow prices. Shadow prices, as we know, are costs that are not captured by the market because of externalities, and indicate the social cost and value of the product.

Nordhaus approached the problem of climate change as a global negative externality or a global public good (bad). Greenhouse gas emissions can be thought of as a public 'bad', which needs to be targeted. Global externalities are however difficult to resolve since there is no international legal mechanism that mandates countries to come to a solution. Most of the targets and commitments are best-endeavour efforts, with no scope or provision for deterrence or penalties in case of non-conformity. This leads to free riding and many countries not joining the international climate accords and ignoring targets for Greenhouse gas emissions. Climate change is also viewed differently by different countries, with developed countries seeking sacrifices from developing countries without committing to transfer of technology or funds to fight climate change. This is very different from public goods in a national context, where the national law ensures compliance against negative externalities such as air and water pollution. To quote from Nordhaus's Nobel lecture:

Governance is a central issue in dealing with global externalities because effective management requires the concerted action of major countries. However, under current international law, there is no legal mechanism by which disinterested majorities of countries can require other nations to share in the responsibility for managing global externalities. Moreover, extra-legal methods such as armed force are hardly recommended when the point is to persuade countries to behave cooperatively rather than free-riding. It must be emphasized that global environmental concerns raise completely different governance issues from national environmental concerns. For national public goods, the problems largely involve making the national political institutions responsive to diffuse the national public interest rather than concentrated national private interests – responsive to public health rather than private profits. For global public goods, the problems arise because individual nations enjoy only a small fraction of the benefits of their actions. In other words, even the most democratic of nations acting non-cooperatively in its own interest would take minimal action because most of the benefits of cooperation spill out to other nations. It is only by designing, implementing, and enforcing cooperative multinational policies that nations can ensure effective climate-change policies.

As we know, climate change and science involve complex systems and require an inter-disciplinary approach with inputs from varied subjects such as atmospheric science, ecology, economics, political science and international law. Nordhaus pulled everything into a single model, and his models are referred to as Integrated Assessment Models (IAM). His first IAM was the 'Bulldog' model referred to above. Nordhaus proposed many IAMs such as an analytical model, a small macroeconomic model, and finally in the 1990s, he settled on the DICE (Dynamic Integrated Model of Climate and the Economy) model. The DICE model did a long-run cost-benefit analysis of different policy-mixes and suggested that welfare would be maximised with a carbon tax and prevent global temperature rise of more than two degrees centigrade. Nordhaus gave more weight to the welfare of future human generations than the present in his calculations. His recommendations were accepted not only by the Intergovernmental Panel on Climate Change but also by many countries.

Nordhaus has written a number of books, prominent among which are 'A Question of Balance: Weighing the Options on Global Warming Policies' (2008) and 'The Climate Casino: Risk, Uncertainty, and Economics for a Warming World' (2013).

Main works of Paul Romer

Romer is best known for developing the endogenous theory of economic growth in the 1980s. Before Romer proposed that economic growth is endogenous, the dominant model was the Solow model developed by Robert Solow in the 1950s. We may recall that Solow did give importance to technological change as a driver of economic growth, but he treated it as exogenous to the model.

In the 1980s, Romer proposed the AK model, where he assumed diminishing marginal returns to capital. He also assumed that investment in capital also generates human capital, which is non-rivalrous and non-excludable and is therefore available to all the firms. This positive externality of investment in capital was a different way of looking at economic growth. Further, Romer was also able to keep the assumption of perfect competition by simply saying that a broader measure of capital (physical plus human capital) would have constant returns to scale. However, Romer revised his model in 1990 and assumed monopolistic competition. This meant that firms have market power, which they use to exclude other firms from using. However, such technology is also non-rivalrous because it does not reduce its availability to other firms (note that this is different from excludability where a firm can be expressly excluded from using the technology, but this doesn't reduce its general availability). This gives a firm incentive to innovate. We see this play out in the pharma market, where the invention of a new molecule by a firm allows it to use its market power to exclude other firms from using the formula. However, this can't last for too long and once the drug is available in the market, other firms can reverse engineer the molecule and profit from it. One way to prevent this is patents, which allow the monopoly to extend for a fixed period of time. According to Romer, another way is to use public funds for research and development.

While endogenous growth theory gave a new insight, Romer was also conscious that it could be used as an excuse for government intervention. To quote him:

A lot of people see endogenous growth theory as a blanket seal of approval for all of their favourite government interventions, many of which are very wrong-headed. For example, much of the discussion about infrastructure is just wrong. Infrastructure is to a very large extent a traditional physical good and should be provided in the same way that we provide other physical goods, with market incentives and strong property rights. A move towards privatization of infrastructure provision is exactly the right way to go. The government should be much less involved in infrastructure provision.

More recently, Romer developed Aplia in 2000, which is an online set of assignments which professors can assign to students. This came out of his online experiments with his students at Stanford University. In 2009, Romer came up with the idea of Charter Cities, which basically allowed the creation of a model city in a country by an external agency. His idea came from Britain's promotion of Hong Kong and he suggested that a country could create charter cities in other countries, which would serve as magnets for people to move to.

Romer served as the Chief Economist of the World Bank from 2016 to 2018, but had to resign under controversial circumstances related to Chile's ranking in the Ease of Doing Business project of the Bank.

Conclusion

Both Nordhaus and Romer addressed the same broad issue: externalities arising out of global public goods. While Nordhaus analysed the global negative externalities arising out of climate change (or greenhouse gas emissions and global warming), Romer looked at the global externality arising out of knowledge and innovation. On one hand, the integrated assessment models of Nordhaus gave us a tool to analyse the complex interaction between climate change and the economy, on the other hand, Romer gave us the endogenous growth theory model that allowed growth to arise within the model as a result of technological innovation. Their work has guided public policy in a variety of areas ranging from climate policy to patents policy.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal. Views expressed are personal