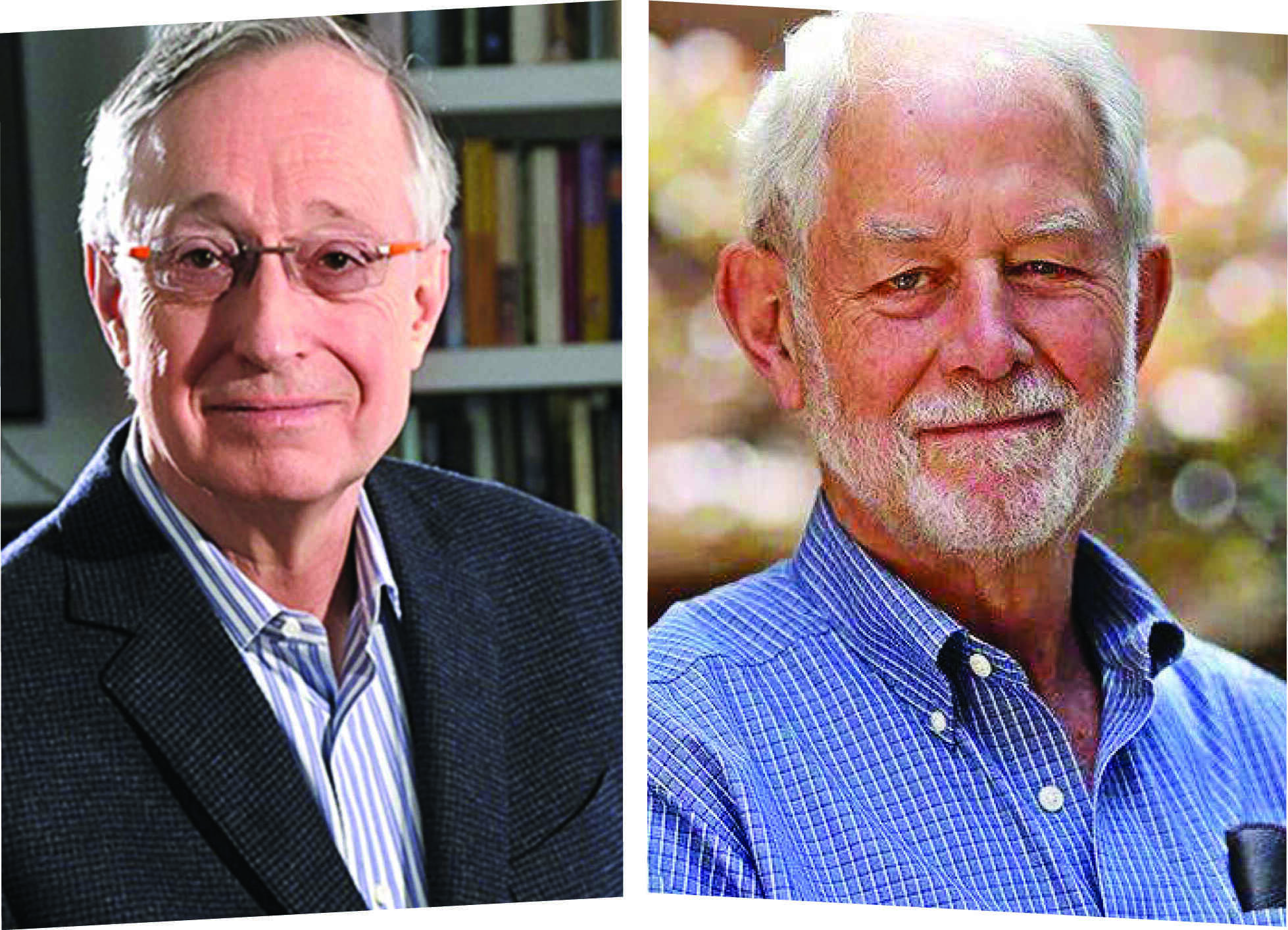

Innovators in auction theory

Apart from using game theory to design alternative auction formats, Paul Robert Milgrom and Robert Butler Wilson carried out influential works in industrial organisation and information economics

The Nobel Prize in Economic Sciences for 2020 was awarded jointly to Paul R Milgrom and Robert B Wilson, both of whom were at Stanford University at the time of conferment of the award, "for improvements to auction theory and inventions of new auction formats".

Paul Milgrom completed his undergraduate studies in mathematics from the University of Michigan at Ann Arbor. After this, he worked in the insurance industry as an actuary in San Francisco and Ohio for five years, before enrolling for the MBA programme at Stanford. His MBA teacher noticed his prowess in mathematics and suggested he do a PhD instead. His senior in the PhD programme was Nobel laureate Bengt Holmstrom. Milgrom got an MS degree in statistics in 1978 and doctorate in business management in 1979. After his PhD, Milgrom taught briefly at the Kellogg School of Management at North-western University, before moving to Yale in 1981. In 1987, Milgrom moved to his alma mater, Stanford University, and continues there.

Robert Wilson completed his undergraduate studies from Harvard in 1959, MBA in 1961 and PhD in 1963 from Harvard Business School. After his PhD, Wilson began teaching at UCLA, briefly before joining Stanford in 1964, where he continued till his retirement. Wilson was also Milgrom's doctoral advisor at Stanford.

In this article, we will review the main works of Milgrom and Wilson.

Main works of Paul Milgrom

While Milgrom was awarded the Nobel prize for his work on auction theory, he has a significant body of work in game theory as well. In fact, at the beginning of his career, Milgrom was more occupied with using game theory to explain the behaviour of firms when there were incomplete contracts. His early work was on explaining limit pricing (the practice of setting a low price to deter entry) in terms of influencing beliefs of competitors. His early collaborators were David Kreps and Robert Wilson. He also used game theory to explain human cooperation in finitely repeated games, which was contrary to the Nash result that cooperation would never ensue in finite games.

In auctions, Milgrom extended Wilson's work and explored equilibrium strategies. Wilson had suggested a 'common values' auction model in 1977, where there was a single asset for sale with an equal value to all bidders. Wilson had shown that under certain conditions, the equilibrium auction value converges to the common value. Wilson's work focused on the extent to which bidders' private information was reflected in auction prices and the sellers' expected revenue depended on auction rules (I will discuss Wilson's model in more detail in the section below). Milgrom extended this analysis with mathematical modelling to arrive at a necessary and sufficient condition for the convergence to occur. This work was published in 1982, in a paper co-authored with Weber. Milgrom's work was also used as a basis for the auction of radio spectrum rights by the Federal Communications Commission in the early 1990s. Later, Milgrom proposed a more general model where the items for sale were not substitutes. In Milgrom's words, these were the three eras of his auction work. To quote him from his Nobel lecture:

However, it was my research in auction theory and my discovery of new auction designs that the Prize committee named in the prize citation. My auction-related research evolved through three distinct eras. In the first, which began with my Stanford dissertation under Wilson's mentorship and continued for about five years, I extended Wilson's research program, mostly in joint work with Robert Weber. Our best-known paper (Milgrom and Weber, 1982) characterized the equilibrium strategies of auction games and studied the extent to which bidders' private information became reflected in prices in auctions and securities markets and how a seller's expected revenue depended on the auction rules. The second era, beginning around 1993, was launched when Congress authorized the FCC to sell radio spectrum rights using an auction. The FCC order establishing and justifying the auction rules cited me by name more than 100 times and adopted virtually all of Wilson's and my proposals.

Despite the praise the auction had received, I worried that the rules were not well-enough grounded in economics and game theory. Like others at the time, I had based my analyses on the assumptions that the items for sale were substitutes and optimization was tractable. The third era, which began around 2001, relaxes those assumptions. In this era, the teams I led aimed to solve practical problems, which sometimes required solving research problems in computer science, economics, and game theory.

It may be recalled that Vickrey had dealt with the allocation of indivisible goods through the process of auctions. He analysed the advantages of the English (ascending-bid) auction since it is Pareto efficient, as compared to a Dutch auction (descending asking price), which is not. Vickrey also suggested that a sealed-bid auction is Pareto efficient if the indivisible good is awarded to the highest bidder but sold at the price equal to the second-highest bid; such an auction is now termed as Vickrey auction. As a special case of auctions, Vickrey had also analysed those auctions where the items have only private values and each bidder's value is independent of other bidders. Vickrey found that the English and Dutch auctions yield the same revenue for the seller in such private value auctions. Wilson and Milgrom took forward this work as we noted above in the case of 'common values', where bidders have the same value of the items to be sold.

In general, Milgrom's contribution was to analyse how bidders behave when the items to be sold have, both common and private components. He found that English-style auctions are less likely to involve the winner's curse (where the winner ends up paying more than the value he attaches to the item), and they generally yield greater revenues for sellers as compared to the Dutch auction. This is because the English auction allows bidders to get the real value that other bidders attach to the item, which is not the case with the Dutch auction (since the auction involves descending prices). This finding was contrary to what Vickrey had found.

Milgrom also worked on industrial organisation theory and principal-agent problems and analysed what would be the best incentive design in different scenarios. For example, Milgrom collaborated with Bengt Holmstrom to analyse the best incentive design when the agents are involved in works in multiple dimensions. When one particular dimension is incentivised, the agent may end up neglecting other important dimensions. In a series of papers in the 1980s and 1990s, Milgrom and Holmstrom analysed the issue and suggested the optimal incentive design in various situations — when the tasks are substitutes, when they are complements or when the tasks are easy to monitor or difficult to monitor.

In addition, Milgrom collaborated with John Roberts to study organisations using tools of game theory. They suggested that coordination in an organisation leads to complementary activities and therefore leads to better utilisation of the resources within the firm. In this context, Milgrom also collaborated with Holmstrom to study complementarities in incentive design.

Main works of Robert Wilson

Wilson's main contribution was in the theory of auctions. As noted above, Wilson, in a series of papers in the 1960s and 1970s, had looked at the behaviour of bidders when the items to be sold had 'common values'. These 'common values' are uncertain initially, but converge to the same value since it is determined by market forces. As opposed to 'common values', Wilson also looked at auctions with private values, i.e., values which vary with bidders because of the unique value each bidder attaches to the item to be sold. Wilson found that bidders in entirely common-value auctions will bid lower than their best estimate of the item's value for fear of falling victim to the 'winners curse'— the situation in which the bidder unwittingly pays more for an item than what its common value turns out to be. Thus, the final price of the item will be lower than it would be if bidders had more information relevant to determining the item's common value. In cases in which some bidders have more information than others, those who have less (and are aware that they have less) will bid even lower or choose not to participate.

Wilson collaborated with Milgrom on various auction formats. They mixed common values and private values of items to be sold and applied these to a variety of areas. We have one such application above, namely, radio spectrum auctions in the 1990s. Wilson and Milgrom developed the Simultaneous Multiple Round Auction (SMRA) for the Federal Communications Commission, which used it successfully for the 1994 spectrum auctions, as noted above. This format was later used by many other countries to allocate spectrum.

Wilson's initial years had him working for varied clients, from a timber company to oil companies, all of which involved bidding and auction strategies and formats. Interestingly, it was his work with auctions in a timber company that attracted the attention of an official from the Department of the Interior of the US Government, who hired him to work on bidding for exploration leases. It is this work that led to Wilson's most well-known innovation of common values auction. To quote from his Nobel biographical note:

My work on auctions led Bobby Abraham at Weyerhaeuser timber company to have me present a series of lectures, for which I also devised a set of short hypothetical cases to exemplify how game theory could be used. This work attracted the interest of Darius Gaskins at the U.S. Department of Interior who hired me as a consultant for studies of bidding for exploration leases that continued for several years. After 1978 I also consulted with oil companies on bidding strategies and in the process developed explicit models with practical applications to bidding. The culmination was an article that showed how with many bidders in a symmetric auction with bidders having imperfect information about a common value the winning bid could converge to the true value, which is the classic problem of 'rational expectations' or alternatively the 'efficient markets hypothesis' that the market-clearing price summarizes all participants' information. My analysis was awkward because with my limited skills I had to assume that the support of bidders' estimates moved monotonically with the unobserved true value – later results by Paul Milgrom were more general, and his work with Robert Weber established rigorous foundations for much of what is known about auctions. I also published a model of auctions of shares of a fixed supply that led to later models of double auctions with both buyers and sellers bidding. I showed that, when traders have unit demands or supplies and independent value distributions, a double auction is an incentive efficient mechanism if the number of traders is sufficiently large, but I was frustrated that I needed that proviso. I was especially interested in Chris Avery's dissertation showing that an auction that allows jump bids has many equilibria with revenue outcomes spanning a wide range. Over the next decade I occasionally did other theoretical work on auctions, and related markets run via posted ask and bid prices, wrote several chapters published in books, and started but never finished my own book. In the 1990s I was absorbed by practical design of spectrum auctions with Milgrom and then consulting on the design of restructured wholesale markets for electric power. Besides rational expectations, which even now I work on with Paulo Barelli and Srihari Govindan, another continuing interest is showing that a double auction is an optimal mechanism.

In the 1980s, when he was tasked with creating an economics group within the Stanford Business School, he hired Ben Bernanke and John Roberts among others. David Kreps, the famous game theorist, joined this group later. With Kreps, Wilson worked on the importance of reputation and how it leads to a barrier to entry for firms.

Wilson was also a great teacher. In particular, his PhD course, Multiperson Decision Theory, which included current research in game theory, was popular and was taken by other Nobel laureates such as Alvin Roth, Bengt Holmstrom and his co-awardee Milgrom. His other work in game theory included the tweaking of Nash equilibrium, and how these cannot always be found.

Conclusion

Milgrom and Wilson taught us how to design auction formats which have been helpful in selling and allocating goods and services that have no ready market and are therefore difficult to sell in traditional ways. Following the footsteps of earlier auction theorists such as Vickrey, the two laureates were trying to find alternatives to the market to sell products. While Wilson worked on auctions where the items sold have 'common values' for the bidders, Milgrom developed this further to include goods which have 'private values', which are unique for each bidder for one reason or another (taste, preference etc.).

Wilson and Milgrom have also done considerable work in industrial organisation and information economics. While their work transformed the way the telecommunications industry works, it also saw applications in the auction of

airport landing slots and efficient use of natural resources. In contrast with the maximisation of profit, their work taught us to maximise benefits to society as well as to maximise efficiency in the use of resources.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal. Views expressed are personal