Information asymmetry

Based on the concept that two parties involved in an economic transaction share differing information — works of James Mirrlees and William Vickrey continue to hold relevance in areas of taxation and pricing

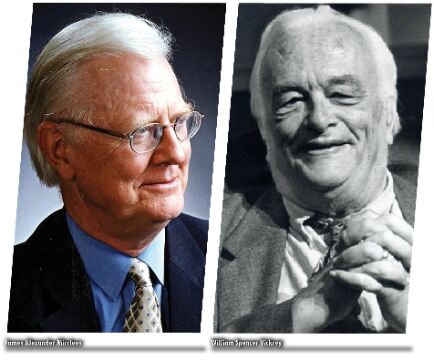

The Nobel Prize in Economic Sciences for 1996 was awarded to Professor James A Mirrlees of the University of Cambridge, UK and Professor William Vickrey of Columbia University, USA "for their fundamental contributions to the economic theory of incentives under asymmetric information".

James A Mirrlees received his MS in mathematics from Edinburgh in 1957, and his PhD from the University of Cambridge in 1963. He was Edgeworth Professor of Economics at Oxford University between 1969 and 1995. In 1995, he returned to Cambridge where he became Professor Emeritus in 2003. Between 1968 and 1976, Mirrlees was also a visiting professor at MIT. He had also served as visiting professor at the University of California, Berkeley in 1986 and Yale University in 1989. Mirrlees is best known for his work on moral hazard and other implications of asymmetric information, as well as optimal income tax rate.

William Vickrey received his BS from Yale University in 1935; Master's degree from Columbia University in 1937 and PhD also from the same University in 1941. He later also became Professor Emeritus at Columbia University, where he remained for most of his career. Vickrey is best known for his work on auctions, income tax rates, congestion pricing and marginal cost pricing.

In this article, we will review and analyse the main works of Mirrlees and Vickrey and see how these continue to be applied in various public policy areas.

Main works of James Mirrlees

Mirrlees's main contributions were broadly in two areas— moral hazard and the problem of taxation (income tax and consumption tax).

We know that problems of adverse selection and moral hazard arise out of asymmetric and incomplete information. It may be recalled that adverse selection involves unobservable characteristics — those that are known only to the informed party in present time. Moral hazard arises on account of unobservable actions whereby, at the time of the transaction, one party's future actions will be unobservable to the other. If this asymmetry leads the informed party to behave in a way that is detrimental to the uninformed party, then there is a moral hazard (Arrow 1971). Going back to the health insurance example, once an individual buys health insurance (even a healthy individual) and the person indulges in risky behaviour (like smoking and drinking), but the insurer can't observe this behaviour, then a moral hazard is said to have occurred. Another example of moral hazard is when a firm pays an employee but can't observe the output or productivity from the employee. With a fixed wage, the employee has the incentive to shirk. Other economists such as Akerlof and Spence have also worked on the issue of moral hazard. Akerlof had suggested two ways around the problems of adverse selection and moral hazard — signalling and screening. In signalling, the party with the information credibly discloses private information, while screening occurs when the uninformed party provides a mechanism to incentivise the informed party to credibly disclose its private information. Michael Spence had proposed in 1973 that signalling could fix the problem of asymmetry by allowing people to signal their type. Mirrlees' insight was arrived at through a complex mathematical model. He suggested that the problem can be solved with an optimal combination of carrots and sticks. Insurance payments are essentially a carrot. But "stick" could be designed so that an insured person who takes risks pays a penalty for doing so. With this combination of carrots and sticks, the insured person acts almost as if he/she is uninsured, and the insurer acts almost as if he/she were the insured. In other words, the principal and the agent share the cost of unfavourable outcomes as well as the profits from favourable outcomes. The Nobel website explains the contribution of Mirrlees as:

The technical difficulties encountered in analysing these so-called moral hazard problems are similar to the income tax problems emphasised by Vickrey and solved by Mirrlees. In the mid-1970s, by means of an apparently simple reformulation of the problem, Mirrlees paved the way for an increasingly powerful analysis. He noted that an agent's actions indirectly imply a choice of the probabilities that different outcomes will occur. The conditions for the optimal terms of compensation thus provide "probability information" about the agent's choice and the extent to which insurance protection has to be restricted in order to provide the agent with suitable incentives. In designing an incentive scheme, the principal has to take into account the costs of giving the agent incentives to act in accordance with the principal's interests. The higher the agent's sensitivity to punishment and the larger the amount of information about the agent's choice contained in the outcome, the lower these costs. This is stipulated in a contract; the agent bears part of the cost of undesirable outcomes or receives part of the profits from favourable outcomes. The policyholder takes care of the insured object almost as if it were uninsured, and the executive manages the firm almost as if it were his own.

On taxation, Mirrlees wanted to use taxation as an instrument of equity and equality. The trade-off between equality and efficiency is another problem that economists have grappled with. It was Mirrlees who suggested a flat tax of 20 per cent on everyone, rather than a higher tax rate on high income individuals. He suggested that a flat rate would be optimum and maximise social welfare as opposed to progressive taxation. He even made a case for a zero rate at the top (at a level of income beyond the highest income, the zero rate has no revenue effects and, presumably, might have positive incentive effects). Mirrlees used theoretical developments in asymmetric information and suggested a general principle — the revelation principle — which requires individuals to reveal their true preferences while protecting their self-interest at the same time. Mirrlees was also responding to the earlier works by Edgeworth in 1897 and Vickrey in the 1940s, both of whom had suggested progressive taxation (higher taxes on higher incomes). Mirrlees also worked on consumption taxes with an American economist, Peter Diamond. He found that small economies should not impose tariffs on foreign trade and that taxation should be on consumption rather than production.

Main works of William Vickrey

Vickrey is known for two broad areas of work — taxation and auctions. However, it was his insight on auctions that stood out and proved to be useful in many public policy issues.

On taxation, Vickrey took forward the work of Edgeworth, as noted above. It may be recalled that Edgeworth had proposed a progressive income tax. He had suggested that the optimal tax (and transfer) system equalised incomes by taxing above-average incomes at 100 per cent and transferring the proceeds to those below the average. Vickrey proposed 21 tax reforms to make a practical system of personal progressive taxation. The two most famous proposals made by him were cumulative lifetime averaging and decreasing power succession taxes. These proposals are detailed in his work 'Agenda for Progressive Taxation' (first published in 1947 and reprinted in 1972). In this work, the constant theme was the use of the tax system for social policy, and achieving equity through redistribution of income from the wealthy to the poor. We saw above that a quarter of a century later, Mirrlees (1971) presented an alternative view.

While Vickrey had a major body of work on taxation to his credit, it was his work on auctions which made him famous. Auctions is an area where asymmetric information operates with full force. Vickrey's most famous paper is 'Counterspeculation, Auctions and Competitive Sealed Tenders' (1961). Vickrey was basically attempting to find an alternative mechanism to arrive at the price of a good — an alternative to the market mechanism. In the said paper, Vickrey dealt with the allocation of indivisible goods through the process of auctions. He analysed the advantages of the English (ascending-bid) auction since it is Pareto efficient, as compared to Dutch auction (descending asking price), which is not Pareto efficient. Vickrey also suggested that a sealed-bid auction is Pareto efficient if the indivisible good is awarded to the highest bidder but sold at the price equal to the second-highest bid; such an auction is now termed a Vickrey auction. And the third is the Revenue Equivalence Theorem which states the equivalence of the expected price under several auction procedures. The paper also contained a section on the allocation of a divisible commodity with a small number of demanders and suppliers. The sections on auctions have given rise to a voluminous literature on auction theory that has been applied to a wide range of practical problems, including the sale of timber and drilling rights and bandwidth.

The importance of the Vickrey auction lies in the fact that it gave bidders a dominant strategy; that of quoting the true valuation. The mechanism ensures that the bidder quotes his true willingness to pay. This strategy also minimises wastage since the object goes to the bidder who values it the most and is therefore socially efficient.

In public economics, Vickrey extended the marginal cost pricing approach of Harold Hotelling and showed how public goods should be provided at a marginal cost. The relevant concept, according to Vickrey, is that of short-run marginal social cost (SRMSC). In 1948, Vickrey was concerned with the assessment of SRMSC over time, when the demand for a service at a given future date is imperfectly predicted by the seller, but is known to some buyers apt to make advance reservations. For example, seats on long-distance flights or rooms at vacation resorts. He suggested "a fairly elaborate pricing scheme in which the price quoted would vary according to the proportion of seats on a given flight already sold and the time remaining to departure, in simulation of what an ideal speculator's market might produce, the price at any time being an estimate of the price, which, if maintained thereafter, would result in all the remaining seats being just sold out at departure time" (1948). Today, some airlines and tour operators follow precisely this advice, using a technique known as yield management for which elaborate software is produced commercially.

Vickrey also suggested that replacing taxes on production and labour (including property taxes on improvements) with fees for holding valuable land sites "would substantially improve the economic efficiency of the jurisdiction". Vickrey further argued that land value tax had no adverse effect, and that replacing existing taxes in this way would increase local productivity to an extent that land prices would rise instead of falling.

Vickrey's applied research extended to taxation, public utilities, transportation, and urban problems. He undertook a number of tax missions — notably to Japan, Puerto Rico, Venezuela, and Liberia. Vickrey also spent a year as an advisor on fiscal matters for the United Nations, working in Singapore, Malaysia, Iran, Zambia, Ivory Coast, Libya, and Surinam. His work on public utilities started with the electric power industry in 1939 and gained momentum in 1951 with the famous study of subway fares in New York. In 1959, he studied traffic congestion in Washington. Further studies on urban planning and transportation took him to India, Argentina, and Venezuela. Over the years, he developed ideas for efficient pricing of electricity, telephone services, urban transportation, street and road use, municipal services and airlines.

Conclusion

Both Mirrlees and Vickrey worked on important issues arising out of asymmetric information. While Mirrlees' main works were in the area of optimal taxation and moral hazard, Vickrey's contributions were in the areas of taxation and auctions. Mirrlees' work on taxes and his revelation principle led him to work on the best design of incentives that would produce maximum effort. Vickrey, as we saw above, gave a pathbreaking insight into an alternative way — Vickrey auction — to arrive at a price for an indivisible good. Additionally, his work on taxation, which predated that of Mirrlees, was also a landmark. We saw above that Mirrlees spoke to the work of Vickrey and Edgeworth on optimal taxation. Mirrlees and Vickrey have provided public policy with efficient tools in a variety of areas — ranging from public utilities to taxation and pricing of subway and flight tickets. Their work continues to be relevant and is still applied widely.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal. Views expressed are personal