Growth through a fresh perspective

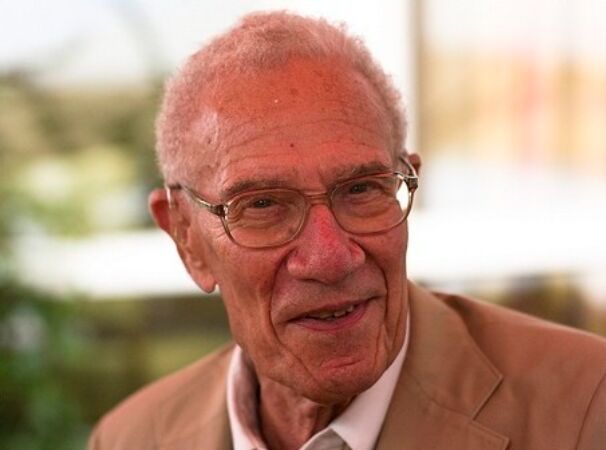

The Nobel prize in economics in 1987 was awarded to Robert Solow for his contributions to the theory of economic growth. Solow was at the Massachusetts Institute of Technology (MIT) at the time of getting the prize. As the Nobel website tells us:

It is eminently reasonable to imagine that increased per capita production in a country may be the result of more machines and more factories (a greater stock of real capital). But this increased production may also be due to improved machines and more efficient production methods (which may be termed technical development). In addition, better education and training, and improved methods of organizing production may also give rise to increased productivity. The discovery of fresh natural resources, or improvements in a country's position on the world market, may also lead to higher standards of living. Solow has created a theoretical framework that can be used in discussing the factors which lie behind economic growth in both quantitative and theoretical terms. This framework can also be exploited to measure empirically the contributions made by various production factors in economic growth.

Solow went to Harvard for his undergrad and had to discontinue his studies to join the US Army during the War. After being discharged from the Army in 1945, Solow returned to Harvard and continued his studies. He became Wassily Leontief's research assistant, which led him to statistics and probability theory. In 1949, he went to Columbia for a year to study statistics and refine his doctoral thesis. He finished his PhD at Harvard and then joined MIT as faculty in 1950. At MIT, Solow became interested in macroeconomics but later focussed on growth models. He collaborated with his colleague at MIT, Paul Samuelson on many such growth theories.

In this article, we will review the main works of Solow and their continued importance for public policy and development plans across the world.

Main works

While Solow's doctoral dissertation was on issues related to unemployment and the distribution of wages, he is best known for his theory of economic growth. Solow outlined his ideas in two seminal articles: A Contribution to the Theory of Economic Growth, published in the Quarterly Journal of Economics in 1956 and Technical Change and the Aggregate Production Function, published in the Review of Economics and Statistics in 1957.

In A Contribution to the Theory of Economic Growth Solow presented a mathematical model describing how increased capital stock generates greater per capita production. Solow's model basically showed that economic growth occurs by raising the factors of production such as capital and labour in the economy. But growth can be sustained only by technological progress. Technological progress leads to higher labour productivity, which in turn leads to higher capital accumulation by slowing down the diminishing returns to capital. Hence, if there is no technological progress, any growth will have to come from a rise in the supply of labour. Of course, Solow linked this to the assumption of a constant savings rate. This is explained nicely on the Nobel website:

Solow's starting point is that society saves a given constant proportion of its incomes. The population and the supply of labour, grow at a constant rate and capital intensity (capital per employee) can be regulated. Capital intensity is determined by the prices of the production factor. Due to diminishing yields, however, additional capital injections (increasing capital intensity) will make ever-smaller contributions to production. This means that, in the long term, the economy will approach a condition of identical growth rates for capital, labour and total production (on the condition that there is no technological progress). This involves a situation in which per capita production and real wage no longer increase. An increase in the proportion of incomes that is saved cannot, therefore, lead to a permanent increase in the rate of growth. In contrast, an economy with a higher savings ratio experiences higher per capita production, and thus higher real income. But, in the absence of technological progress, the rate of growth will be the same, irrespective of the savings quotient, and will be purely dependent on an increased supply of labour.

Solow's growth model is rooted in the neoclassical framework and is a must in any undergrad course in Economics. One of the interesting results of the model is the concept of the Solow residual. This residual is the economic growth that is not attributable to the rise in labour or capital supply, but technological progress.

In the 1957 article referred to above and in a later article Investment and Technical Progress (1960), Solow further developed his ideas. Solow took the time series numbers for the three important variables: production and the two inputs, labour and capital. The change in production which could not be imputed to the changes in labour or capital was interpreted to be due to technical progress. Interestingly, Solow found that only a small part of growth could be explained by changes in labour and capital and that technology was extremely important.

Solow's model was also the first to measure capital using the 'vintage' method. Even though the method was criticised, it enabled Solow to measure the capital of different vintages and this made the formulation of his mathematical model much easier. As the Nobel website tells us about the vintage method:

Solow assumed that technical progress is "built into" machines and other capital goods and that this must be taken into account when making empirical measurements of the role played by capital. This idea then gave birth to the "vintage approach" (a similar idea was discussed by Leif Johansen in Norway at about the same time). The vintage approach assumes that new investments are characterized by the most modern technology and that the capital that is formed as a result does not change in qualitative terms over its remaining life. Thus, the investment decision ties up future technology to some extent, since technological knowledge is rooted in the physical capital object. Solow's formulation of a mathematical model based on these ideas enabled him to develop a theory that permitted empirical calculations to be made. In principle, the model established a new way of aggregating capital from different periods. Solow's empirical results naturally gave the formation of capital a markedly higher status in explaining the increase in production per employee.

Solow's model was a valuable addition to the theory of economic growth. Solow took forward the work of Harrod-Domar. It may be recalled that the Harrod-Domar model prescribed the conditions under which an economy would achieve a 'steady state' or steady growth at a constant rate. These conditions are that the national saving rate equals the product of the capital-output ratio and the rate of growth of the labour force. This would balance labour and capital so that there would be neither labour shortage nor labour surplus for a given level of plant and equipment. Solow suggested that there was no single 'steady state' but a range of them, provided that technological progress is allowed. Solow also suggested that the permanent growth rate, in the long run, was more a function of technological progress than the savings rate.

Solow's model took the savings rate and technological progress to be given and hence his models are referred to as 'exogenous' growth models. Endogenous growth models such as that the one proposed by Paul Romer takes a different view from the neoclassical models such as Solow's. These models suggest that innovation and investments in human capital lead to technological progress and that these factors are determined endogenously. Solow's model also ignores the role of institutions in economic growth as Douglass North had shown.

While Solow's theory of economic growth is his best-known work, he also worked in the area of natural resource economics. Solow looked at the importance of natural resources as an input in addition to labour and capital, from a theoretical perspective Solow also studied the environmental consequences of growth.

Public policy

Solow was interested in public policy from his early years. He worked for the RAND corporation in 1952 after obtaining his PhD. While working with the US President's Council of Economic Advisors (1962-68), he drafted Keynesian economic policies of the Kennedy and Johnson administrations. Solow served as the Chairman of the Federal Reserve of Boston in 1975. Solow was also a founding trustee of the Economists for Peace and Security, a body that routinely comments on issues of individual liberty and freedom.

Solow's work has found application and relevance in various growth debates across the world. In particular, after the 2008 crisis, Solow's view that capital accumulation must be revived through bank lending as soon as possible so that technological progress is allowed to get growth back on track was widely accepted.

Solow's prescription for growth and his emphasis on technological progress is also relevant for the growth trajectories that the developed countries such as Japan, the US, UK and EU take in the future. For Japan to come out of the 'lost decades' that began in the 1990s, Prime Minister Shinzo Abe had outlined three policy tracks: expansionary monetary policy, restrictive fiscal policy in the form of raised taxes to cut down debt and structural reforms to raise productivity. The third reform was inspired by Solow's ideas on innovation and technological progress. Similarly, the UK's policy prescription to raise output per worker or productivity to come out of the post-2008 recession is also inspired by Solow's work. The policies of the US and the EU to get out of the low growth equilibrium in the post-2008 crisis involved capital accumulation and raising productivity, which were also inspired by Solow.

In fact, Solow grappled with the slow growth scenario faced by developed countries, particularly in the post-2008 period. For example, Solow pointed out that the high unemployment rates in the EU in 2010 would keep growth in check. And long periods of unemployment would lead to a situation of hysteresis, whereby the workers' skill sets are rendered obsolete. Here again, Solow's prescription was a higher investment.

Solow was not without critics. As pointed out above, the endogenous growth models, challenged Solow's model where technological progress is given from the outside. Economists like Romer, who proposed endogenous growth theory suggested that technological progress and innovation development within the system and it is important to understand how they develop. According to this theory, technological progress is a function of investment in human capital and knowledge. Hence, such progress should not be assumed to be exogenous. Similarly, Douglass North's analysis, which gave a central role to institutions in economic growth, does not find mention in Solow's model.

Solow's views that technological progress would not have any impact on unemployment has proved to be controversial. In 1989, Solow had remarked: "For the advanced economies, technology hasn't created an unemployment problem. The unemployment rate has no trend, if anything it's a little lower than it used to be." In fact, Solow had mixed feelings about the ICT revolution since it was not 'real' technological progress in the tradition of the industrial revolution: it could not match the impact of the steam engine or the internal combustion engine.

Conclusion

Notwithstanding the criticism of Solow's model, it continues to be useful for public policy in respect of growth trajectories as we discussed above. Solow's 'residual', which was attributable to technological progress and his sources-of-growth accounting (which separates the effects of technological change on growth from those of capital and labour), are still useful heuristics in theory. It may be recalled that Paul Samuelson and Solow, who were both at MIT in the 1960s, were referred to as 'growth men' for their growth models. Samuelson even included a separate chapter on the theory of growth in 1964 to reflect the policy importance of the issue. Solow's ideas continue to guide us during these times of rapid technological progress.