Cause-effect relations

Analysing the effects of external shocks on macroeconomy, Thomas John Sargent factored in rational expectations and their impact, while Christopher Albert Sims used statistical methods to analyse the efficacy of fiscal and monetary policies

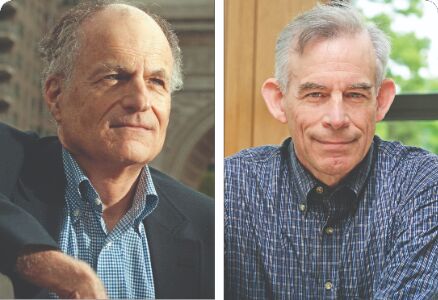

The Nobel Prize in Economic Sciences in 2011 was awarded to Thomas J Sargent, then at New York University, and Christopher A Sims, then at Princeton University "for their empirical research on cause and effect in the macroeconomy".

Thomas Sargent did his undergraduate from the University of California, Berkeley in 1964 and his PhD from Harvard in 1968. His supervisor was John Meyer. After his PhD, he joined the faculty at the University of Pennsylvania in 1970, where he stayed for a year before moving to the University of Minnesota where he stayed till 1987. After this, he did stints at Chicago, Stanford and Princeton, before settling down at New York University in 2002. He was also the president of the American Economic Association and the Econometric Society at various points in his career.

Christopher Sims did his undergraduate studies in mathematics from Harvard in 1963 and his PhD from the same university in 1968. His supervisor was Hendrik Houthakker. He was the classmate of his co-awardee Thomas Sargent. Sims joined the faculty at Harvard for a few years before

moving to Minnesota, where he joined his Harvard classmate Sargent. He stayed in Minnesota till 1990 and then moved to Yale. Sims finally settled down at Princeton University in 1999, from where he retired.

In this essay, we will review the main works of Sargent and Sims and look at how they continue to be relevant for public policy around the world.

Main works of Thomas Sargent

Sargent is best known for his work on rational expectations, done along with his co-authors Robert Lucas (winner of the Nobel Prize in 1995) and Neil Wallace. As we have discussed in these columns, the theory of rational expectations was first proposed by John Muth in the 1960s. His basic idea was that economic outcomes depend on the expectations of the people. Further, these expectations are based on the standard assumptions of utility maximisation by the consumer and profit maximisation by the producer. It was, however, Robert Lucas, who formalised the rational expectations theory in mathematical terms, as we discussed in the essay on Lucas. Lucas' interpretation of the theory suggested that economic agents factored in the impact of fiscal and monetary policy in their actions. In other words, Lucas did away with the assumption that the government could fool the people all the time. Sargent took forward the work of Lucas and even co-authored many papers with him.

It may be recalled that Sargent was looking at the failure of the Keynesian models in explaining the high inflation of the 1970s, which co-existed with high unemployment (referred to as stagflation). In other words, the inverse relation between inflation and unemployment reflected in the Phillips curve was not holding up. Sargent, Lucas and Wallace proposed alternative econometric models that could explain the shortcoming of the Phillips curve. More specifically, Sargent looked at the implications of rational expectations for more credible fiscal and monetary policy. He analysed how fiscal and monetary policy must complement each other over the time.

In 1975, Sargent and Wallace proposed the policy ineffectiveness proposition that challenged a basic assumption of Keynesian economics. It simply stated that fiscal and monetary policies often fail to meet their desired objectives because people's expectations factor in the effect of these policies. Hence, if the Central Bank increases the money supply to raise employment, workers also expect higher inflation and consequently demand higher wages. As a result, employment does not really rise, as was the original policy objective of the Central Bank. Sargent suggested that governments need to be credible to get around this policy ineffectiveness, and one way to do so would be to pursue a long-term credible and non-inflationary fiscal policy with balanced budgets.

Some more landmark papers by Sargent and Wallace came during the 1970s and 1980s. In 1976, Sargent and Wallace wrote 'Rational Expectations and the Theory of Economic Policy' where they argued against Freidman's prescription that growth in money supply should be pegged at a fixed rate year after year. In the papers written during the 1980s, there are two which are worth mentioning — 'Some Unpleasant Monetarist Arithmetic,' and 'The Ends of Four Big Inflations.' While the first paper spoke of the need for fiscal and monetary policies to be complementary, in the second paper, Sargent studied four countries that had hyperinflation in the early 1920s — Germany, Austria, Hungary, and Poland. Sargent's point was that these countries had managed to conquer hyperinflation by running high deficits, but they did so by making credible commitments of lower deficits and balanced budgets in the future.

Sargent's models have been referred to as structural macroeconometric models and have been used to "study macroeconomic relationships when households and firms adjust their expectations concurrently with economic developments".

Sargent also worked with Ljungqvist on macroeconomic policies in the US and Europe in the past decades, and on the issue of unemployment insurance. Specifically, they looked into the causes of unemployment in Europe and USA: Why was unemployment higher in the USA in the 1950s and 1960s as compared to Europe and how did the trend get reversed in the 1980s? They found that Europe had better social security, which kept unemployment low in the 1950s and 1960s. However, this long-term unemployment insurance also lowered the quality of human capital in Europe, which led to higher unemployment rates in the 1980s. Further, in the 1980s, the workers' incentives were better in the USA, which reversed the trend.

Some of Sargent's books are 'Rational Expectations and Econometric Practice' (with Robert E Lucas Jr); 'The Big Problem of Small Change' (with Francois Velde); 'Recursive Macroeconomic Theory' (with Lars Ljungqvist); and 'Robustness' (with Lars Peter Hansen).

Main works of Christopher Sims

Like Sargent, Sims was also interested in the effects of fiscal and monetary policy on economic growth. He also inquired into the impact of external shocks such as rise in oil prices, currency shocks or interest rate changes. Unlike Sargent, Sims relied on a statistical tool called vector autoregression to differentiate between independent shocks and other shocks. Sims then segregated changes in policy that were rationally expected from those that were not. While Sims methodology was different, he was nevertheless influenced by the work of Sargent and Wallace. In his own words:

In macroeconomics, my thinking was of course influenced by my two colleagues Sargent and Wallace, who were part of the core group fomenting the "rational expectations revolution" in macroeconomics. My own research made little use of rational expectations theory at first, focusing instead on using simpler, minimal theory to find the effects of policy by analysing time series data. This is not because I was opposed to rational expectations ideas – I thought they represented an advance. I just thought the "revolution" aspect of it, in particular the deprecation of the ideas and efforts of the Keynesian econometricians, was overdone. My own work involved criticising the statistical underpinnings of the Keynesian econometric models, but I viewed them as flawed but important, not worthless. I found the story that those Keynesian models had led to the inflation of the 1970s implausible, unsupported by evidence, and recent research seems to confirm that.

Sims' best-known work was the analysis of the money-income causality. It may be recalled that Friedman had argued that changes in money supply caused changes in income, while Tobin had argued the opposite, i.e., changes in income caused changes in money supply. Sims used the test of causality developed by Clive Granger and found that the post-war data in the US upheld Friedman's view.

Sims was critical of the interpretation of the large-scale econometric models which Keynesians proposed, as also the analysis of Lucas which criticised these Keynesian models. In an article, 'Macroeconomics and Reality', published in 'Econometrica' in 1980, Sims argued that the theoretical assumptions underlying the large Keynesian econometric models were not always accurate. Sims was also critical of Lucas, who had claimed that if 'rational expectations' of people were not taken into account, the econometric models would be useless for policy analysis. Sims contended that the Lucas critique was useful only if there was a change in the policy regime. However, such changes may or may not occur. Instead, the vector autoregression (VAR) models were better since they did not rely on any theoretical assumptions.

Sims's latest work was on inflation and its link to fiscal policy. He suggested that inflation was in fact a fiscal issue. He also suggested that fiscal crises were contagious and would spread from one country to another, particularly in the EU. This was borne out by the experience of Greece in recent years.

Conclusion

Both Sargent and Sims have moved away from the large-scale econometric models of Keynes and suggested ways of analysing how exogenous shocks affect macroeconomic variables. While Sargent worked with Lucas and Wallace to factor in rational expectations and their impact on macroeconomic models and forecasting models, Sims used vector autoregression models to analyse the efficacy of fiscal and monetary policy. In other words, they untangled the cause and effect of policy on macroeconomic variables, with an important role of expectations. As the Nobel website tells us:

These occurrences are usually two-way relationships – policy affects the economy, but the economy also affects policy. Expectations regarding the future are primary aspects of this interplay. The expectations of the private sector regarding future economic activity and policy influence decisions about wages, saving and investments. Concurrently, economic-policy decisions are influenced by expectations about developments in the private sector. The Laureates' methods can be applied to identify these causal relationships and explain the role of expectations. This makes it possible to ascertain the effects of unexpected policy measures as well as systematic policy shifts.

To be sure, the rational expectations theory has been criticised on the ground that its assumption of all economic agents having perfect knowledge of the economy and policy changes is simplistic. Even economists differ on how policies work or what a true model of the economy is. Others have criticised the theory saying that even if economic agents form rational expectations of the economy, they may not be willing to alter their expectations since this may give away their true positions. Both Sargent and Sims took forward the work of other economists and also provided tools of macroeconomic analysis, which continue to guide policy makers even today.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal. Views expressed are personal.