Unrestrained loot of Bengal

Thanks to Union government’s irrational measures like freight equalisation scheme and an incongruous credit policy, West Bengal has been forced to face an economic decline ever since independence

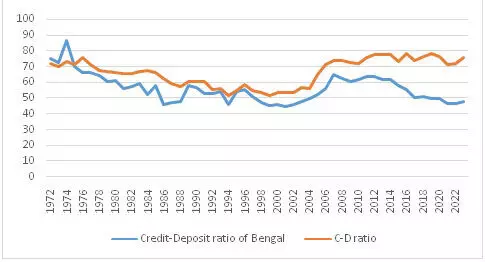

Credit-deposit ratio West Bengal vis-à-vis all India 1972-2022

Union Finance Minister Nirmala Sitharaman, in a recent seminar, voiced her serious concern about the state of economy of West Bengal when she quoted few grim statistics to flag West Bengal’s decline in industrial production since 1947 when Bengal was divided into two nations. According to her, in 1947, West Bengal’s share in the total industrial production of the country was 24 per cent which declined to 3.5 per cent. What she did not mention is that with a land share of only 2.7 per cent, West Bengal contributes 5.85 per cent to India’s GDP and houses 7.25 per cent of the country’s population.

Ranajit Roy (1973) in his book 'Agony of West Bengal: a study of Union-State Relations’, has depicted numerous examples on how the state had declined from prosperity within twenty-five years of independence. He documented, in detail, how the policies of the Union government, namely – freight equalisation policy and industrial licensing policy — had made a substantial contribution to the drain of wealth from West Bengal. The present Finance Minister may not be aware that on the very night of the Partition of Bengal (August 14), the Union government slashed West Bengal's share of jute export duty from 62.5 per cent to 20 per cent.

It may be recalled that the Freight Equalisation Scheme (FES), which was in force from 1952 to 1993, subsidised the long-distance transport of certain key manufacturing inputs, such as iron, steel, coal fertilisers, and cement, to promote “the dispersal of industries all over the country”. It has destroyed the resource-rich, thriving manufacturing sector of Bengal. According to this policy, a factory established anywhere in India could transport, using Indian railway network, its mineral inputs at a nominal fixed rate. Thus the locational advantage of the resource-rich eastern India was robbed off.

A study by John Firth and Earnest Liu (2018), titled, ‘Manufacturing Underdevelopment: India’s Freight Equalisation Scheme, and the Long-run Effects of Distortions on the Geography of Production’, reveals that:

(i) Over the long-run, FES contributed to the decline of industry in eastern India, pushing iron- and steel-using industries towards more prosperous states.

(ii) Though the effects of repealing FES were equal and opposite to those of its implementation, still, due to changing locations of the processing of basic iron and steel materials, the resource-rich states suffering under FES never fully recovered.

In addition to the above policies, another novel approach has been used, since the early 1970s, to deprive Bengal of its huge amount of savings in the commercial banks. The authors have made a gross estimate of those savings which were not disbursed in Bengal. Refer to the table for details. It reveals:

✼ Since 1975, the credit-deposit (C-D) ratio of Bengal has remained lower than the all India average and the gap has widened during last ten years. (see fig1)

✼ Between 1972 and March 2023, around Rs 48,68,19,316.4 lakh (=Rs 48.68 trillion) of Bengal savings was not credited to Bengal. The present value (PV) of this amount is Rs 1,30,99,44,304 lakh (=Rs 130 trillion).

✼ During 2015-March 2023, the corresponding amounts were Rs 36,27,44,105 lakh (=Rs 36.2 trillion) and Rs 45,19,78,723 (=Rs 45.2 trillion).

Thus, since the 1970s, a huge amount of local savings of Bengal were not disbursed in the state and a large share of it might have been transferred, through organised banking system, to other regions of India at the cost of Bengal’s economic development.

This incongruous credit policy of the scheduled commercial banks, operating in Bengal, might be responsible for the proliferation of dubious ‘chit funds’ like Sanchayita, Sarada, Rose Valley etc. which created an illicit banking system in the state.

Views expressed are personal