Lethal foes

Through its use of general awareness campaigns and policy recommendation documents, CASCADE continues to battle the twin evils of smuggling and counterfeiting that plague the nation

Smuggling is among the oldest professions, with its origins lost in obscurity. As Adam Smith, a philosopher and towering figure in the history of economic thought had noted in his "An Inquiry into the Nature and Causes of the Wealth of Nations" Customs, meaning customary payments, has existed since time immemorial (incidentally, he had in his book, defended smuggling as a legitimate activity till ironically by a twist of fate, he was appointed as the Scottish Commissioner of Customs and had to enforce laws to curb smuggling!).

Customs have evolved considerably since; they act as guardians of the economic frontiers of the country. Smuggling has come to mean any act whereby the fiscal laws of the land are sought to be evaded-be it to not pay taxes, to pay less taxes than due, to evade restrictions or prohibitions imposed.

India has a 15,200 km long land border contiguous with seven countries, 85 land customs stations, 7,516 km long coastline, 13 major ports, 34 international airports, customs freight stations and inland customs depots over hundred. It has an economic policy where there were and are some restrictions on imports, and a tariff on the higher side. Consequently, it has always been vulnerable to smuggling. Smuggling, after all, at its most basic is an economic activity — the movement of goods from one place to another to take advantage of restrictions and cater to demand.

Once the twin criteria of demand and restrictions are met, the range of goods vulnerable to smuggling is mind-boggling. From gold, textiles, VCR's, cassettes, silver, zip fasteners in the days of yore, to gold, tobacco, drugs, red sanders wood, violations of CITES, now. This is apart from misdeclaration — of value or description to pay less taxes than due or avoid restrictions.

Every time there is smuggling, it triggers a host of other violations. There is a loss of revenue and generation of unaccounted money which contributes to the black economy. There is a consequent violation of income tax, illegal transfer of funds abroad to settle accounts with the supplier, resulting in violations of the Foreign Exchange Management Act (FEMA), and Prevention of Money Laundering Act (PMLA). And most importantly such illicit money funds terrorist activities.

Closely linked are violations of a different kind — but with the same insidious consequences. Violations of intellectual property rights. At its most basic it is little better than theft-theft of somebody's work. Intellectual property manifests itself as copyright. It manifests itself as a patent; an exclusive right granted for an invention. As a trademark, a sign capable of distinguishing the goods or services; as an industrial design which constitutes an ornamental aspect of an article, and sometimes as a geographical indication — qualities or reputation because of the origin.

Tragically violations of intellectual property are not viewed seriously — though the consequences are as pernicious as smuggling. Enforcement of intellectual property violations are primarily with the hard-pressed police — and it figures very low in their list of priorities.

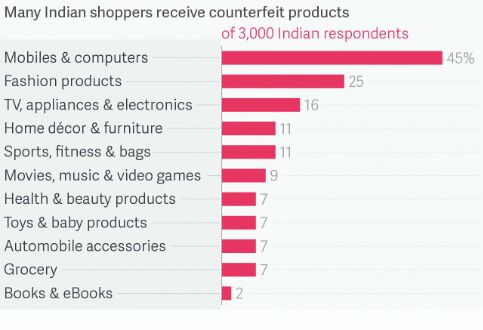

The sale proceeds generated out of counterfeit goods, like those of smuggled goods, are outside the pale of taxation. Worse, safety standards are compromised like in the case of auto components or pharma products, responsible for innumerable deaths. Consumers are cheated-buying products which they think are genuine and paying genuine prices for what are imitations of the original.

The 73rd report of the Parliamentary Standing Committee of Finance in its report submitted to the Lok Sabha in March 2019 had estimated the illicit financial flows from out of the country were on an average annually in the region of 10 per cent of the total unaccounted money generated in the country. This translated into illicit outflows in the region of USD 219 billion to USD 490 billion. These estimates were based on the reports of the leading economic think tanks of the country — National Institute of Public Policy and Finance (NIPFP), National Council of Applied Economic Research (NCAER) and National Institute of Financial Management (NIFM). It has been estimated in yet another study that India's black economy is about 62 per cent of GDP (at 2016-17 prices) — about Rs 93 lakh crore. To put things in perspective, this is larger than the size of the government (both centre plus states) spending.

This is humongous. The public at large have an idea of smuggling thanks to the romanticization of this illegal activity in films. They have very little idea of violations of intellectual property. While policymakers and enforcement agencies over the world are engaged in curbing these menaces, the fact remains that all such activities of smuggling and IP violations are a consequence of the twin factors of policies and demand. This is where FICCI CASCADE steps in.

CASCADE which is an acronym for Committee Against Smuggling and Counterfeiting Activities Destroying the Economy has taken upon the challenging task of generating awareness among the citizens about the hazardous impact of smuggled and counterfeit products through a series of brilliant social media campaigns. CASCADE believes in catching them young and has focused on schools to spread awareness across the country.

CASCADE has engaged with policymakers to tighten loopholes. CASCADE generates regular reports which provide ample food for thought to the policymaker — the last study being on the impact of these activities on employment, an area on which little research has been done thus far. CASCADE has engaged with enforcement officials keeping them abreast of the latest in the fight against smuggling and counterfeits.

But enforcement and policies can only do that much. It is public awareness which ultimately is the key. The Department of Consumer Affairs' awareness campaign of 'Jaago Grahak Jaago' is an essential step in this direction. If the public is made conscious of the fact that smuggled and fake goods hurt them as much as the country; if they are made aware that money collected from taxes is money which is used for the public good which is lost now; if they become aware that that illicit proceeds finance criminal activities, then perhaps they would not compromise their health and the health of the nation to buy a cheaper product. If they put up a united front to never buy a smuggled or a counterfeit product, if demand can dry up then the very basis of these activities will also cease. That will be the day. Till then, policymakers, enforcement agencies and CASCADE have their work cut out.

The writer is Former Chairman, CBIC, and Think Tank Member, FICCI CASCADE. Views expressed are personal