Coping with Covid blues

It was a blessing in disguise that the pandemic was marked by a rally in gold prices, which provided an incentive for Indian households to pledge their gold

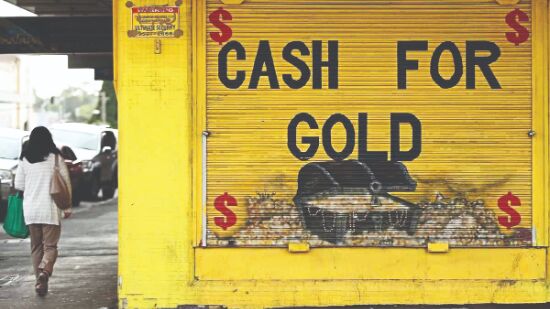

The pandemic has demonstrated, yet again, why Indians set store by their gold. Faced with a squeeze on incomes, people have increasingly turned to gold to raise the much-needed cash to survive what has been for a majority of Indians one of the most difficult phases of their lives.

It was a blessing in disguise that the pandemic was marked by a rally in gold prices, which provided an incentive for people to pledge their gold. According to the World Gold Council, the demand for gold loans, both through banks and non-banking financial companies (NBFC) has grown in response to the economic impact of Covid.

Given a 28.8 per cent rally in the domestic gold price this year, borrowers have benefited from higher loan value for the same collateral while lenders have benefited from lower loan-to-value (LTV) ratios on their existing loans and higher demand. With a higher gold price and greater liquidity needs arising with the onset of Covid, it was believed that the pandemic would induce higher gold recycling from consumers. However, consumers used their gold holdings as collateral to obtain their financing needs rather than outright selling.

Banks have aggressively promoted and launched gold loan schemes since the outbreak to capitalise on these lucrative schemes. Several banks started to promote gold loan schemes, such as lower interest rate on gold loans, option of bullet payments, fixed interest rate and foreclosure payment option.

Gold occupies a vital place in the hearts and homes of Indian consumers and is often considered as a symbol of social status, financial security, and cultural legacy. Indian households are emotionally attached to gold jewellery and prefer to use gold as collateral to meet their financing needs rather than outright selling. For generations, farming communities and rural households have used gold as a means of financing, often pledging it as collateral to raise funds to plant the following year's crops. Today, gold loans are used to meet the expenditures for health, business, education, and marriage.

Gold loans are popular in both urban and rural areas. They compare favourably with personal loans regarding quicker processing time, no requirement of income proof or prior credit history, and low processing fees. With such advantages, the overall gold loan market has grown from INR 600 billion in 2009-10 to INR 9,000 billion in 2019-20, a compound annual growth rate (CAGR) of 31.1 per cent over the last decade.

Organised gold loan market includes banks, both in the public and private sector as well as cooperatives, non-banking financial companies (NBFCs) and Nidhi companies. There also exists an unorganised gold loan market, comprising pawnbrokers and money lenders. Unorganised gold loan market still accounts for 65 per cent of the gold loan market but the organised gold loan market has grown with the market penetration and geographical expansion of financial service institutions and financial inclusion.

The origins of informal gold lending can be traced back to traditional money lenders such as the Chettiars of Tamil Nadu and landowners in India who provided loans against the jewellery held by villagers. The evolution of the gold loan market began in Kerala. Leading Kerala-based gold loan companies, Muthoot Finance and Manappuram Finance can trace their origins back to 1939 and 1949, respectively. Another Kerala-based gold loan company – Muthoot Fincorp – ventured into the gold loan business in the 1950s. Prior to that, the gold loan market was mostly informal where money lenders and pawn brokers disbursed the loans. But the scene began to change after the entry of banks in the 1960s. The formalisation of the gold loan market gained further momentum when the RBI granted a license to Manappuram Finance and Muthoot Finance to work as an NBFC in 1998 and 2001 respectively.

Banks primarily offered loans to gold loan NBFCs to meet their requirements for priority sector lending, such as agriculture and allied services. But this changed in 2011 when RBI removed the lending of banks to gold loan NBFCs from priority sector lending. Although the banks have played a key role in the growth of the organised gold loan market, they lacked the turnaround time to disburse gold loans and flexibility of non-banking financial companies (NBFC).

Gold loan NBFCs have gained competitive strength in their fast gold loan processing and auctioning off gold jewellery which has not been reclaimed by consumers. Gold jewellery kept as collateral against gold loan by top three gold loan NBFCs, namely Muthoot Finance, Fincorp and Manappuram, totalled 298.8 tonnes at end of 2019-20.

In early August, the RBI increased the loan to value (LTV) ratio to 90 per cent from 75 per cent until March 31, 2021. This potentially could further increase the demand for gold loans through banks. In case of a sharp decline in gold prices, banks ask consumers for part-prepayment or additional collateral to bring the LTV to the desirable level. Banks also adopt the lower of either the previous month's moving average or current gold price for gold valuation for short-term fluctuations in gold prices. With these measures, banks control any increase in their credit risk for gold loans in case of a sharp decline in gold prices and grow their gold loan share.

Views expressed are personal