Treading the tightrope

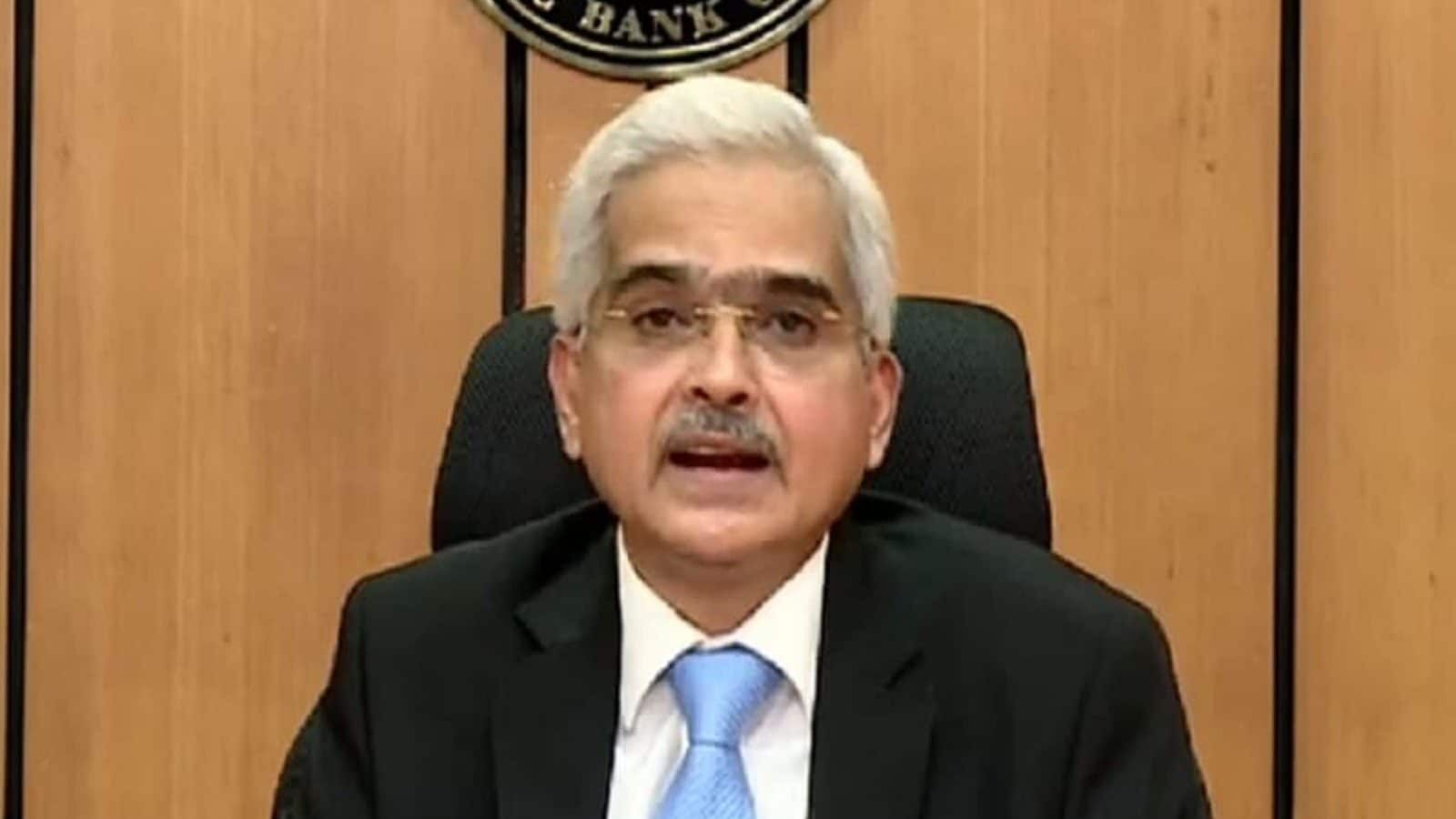

The Reserve Bank of India unanimously raised the repo rate by 50 basis points in its recent Monetary Policy review meeting. This is the third straight policy hike since May — amounting to a cumulative increase of 140 basis points across this fiscal. The repo rate currently stands at 5.40 per cent, as compared to 4 per cent in May. The Reserve Bank of India (RBI) has been concentrating lately on containing inflation. However, it has not yet announced a neutral stance. Though RBI's policy stance continues to be accommodative, it aims to achieve "withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth." Apparently, the Central bank is using the country's sustainable growth status as a leverage to control inflation. Inflation in India, hovering over the RBI's tolerance band for well over months, has been a serious concern. The RBI, going forward, has two possible pathways to contain it — by raising interest rate or using forex reserve as a leverage. In using forex reserves, the RBI is faced with a limitation in the current scenario as the exchange rate of Indian Rupee against dollar had touched a historical low recently. Furthermore, amid the turbulent times we are into, a strong forex reserve is a prerequisite for maintaining a safety valve against any potential geopolitical shocks. Against this background, the pathway adopted by the RBI appears to be balanced and time-relevant. Despite making several policy rate hikes over the past few months, the RBI has retained its inflation projection at 6.7 per cent for 2022-23. This suggests that either the positive effects of rate hikes are yet to fructify or the Central bank aims to keep itself ahead of the curve in containing inflation. Quarterly breakdown of inflation forecasts goes as follows: Q2 at 7.1 per cent; Q3 at 6.4 per cent and Q4 at 5.8 per cent. Furthermore, in the first Quarter of FY 2023-24, the inflation is expected to come down to 5 per cent. If there aren't large deviations along this trajectory, inflation can be seen to be returning to the right track. At the same time, the real GDP forecast is also retained at 7.2 per cent for FY 2022-23. Quarterly breakdown provides for: Q1 at 16.2 per cent; Q2 at 6.2 per cent; Q3 at 4.1 per cent and Q4 at 4 per cent. The more or less stable growth projections in these tough times provide a leeway for the RBI to raise policy rates further. It should not come as a surprise if the Central bank increases repo rate in upcoming MPC meetings. However, apart from containing inflation, the core challenge before the RBI at this point is twofold — to maintain the stability of the Indian Rupee and augment its forex reserves. The RBI's interventions following the exchange rate of Indian Rupee against the US dollar crossing the psychological threshold of Rs 80, coupled with improvement in global factors, have led to stabilisation of rupee to a certain extent. The RBI should keep coming with more meaningful interventions. It should also grab every opportunity to provide a boost to its forex reserve, and make all-out efforts to stem the outflow of foreign capital. The Reserve Bank of India must be credited for braving through the storm of the global economic crisis to date. It may face further challenges as the US Fed is expected to increase its policy rate in the near future. Also, given the rising tensions between the US and China over Taiwan, further risk of destabilisation of the global economy cannot be ruled out. It may be noted that global inflation projections are expected to stand at around 6.6 per cent in advanced economies and 9.5 per cent in emerging market and developing economies this year. Comparatively, at least in numbers, India — riding on its strong economic foundations — has positioned itself firmly in the fight against the global turmoil. The RBI seems to be walking the tightrope successfully, which is a reassuring sign for the present.