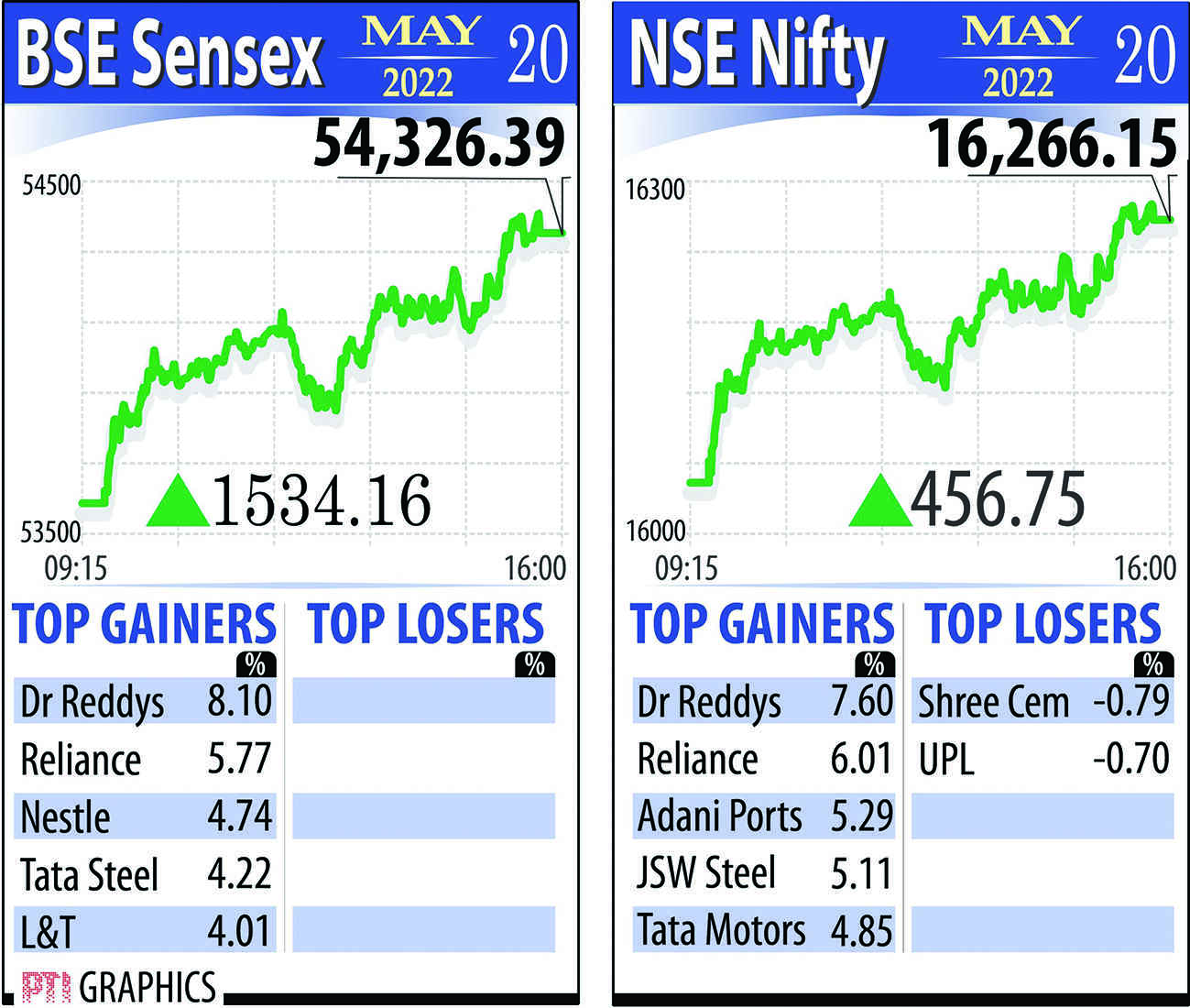

Sensex rises over 1,500 points as markets claw back lost ground

Mumbai: The Sensex surged over 1,500 points while the Nifty reclaimed the 16,000-mark on Friday, reversing the previous session's sharp decline in tandem with a recovery across global markets as investors resorted to bargain-hunting.

A sharp rebound in equity markets made investors richer by over Rs 5 lakh crore on Friday, while the market

capitalisation of BSE-listed firms jump by Rs 5,05,143.44 crore to reach Rs 2,54,11,537.52 crore.

Snapping its two-day losing run, the BSE Sensex rallied 1,534.16 points or 2.91 per cent to close at 54,326.39. This was its biggest single-day jump in over three months.

Similarly, the broader NSE Nifty soared 456.75 points or 2.89 per cent to 16,266.15.

All the 30 Sensex firms ended in the green.

Dr Reddy's topped the gainers' chart with a jump of 8.10 per cent, followed by index heavyweight Reliance Industries which zoomed 5.77 per cent.

Nestle India, Tata Steel, Larsen & Toubro, Axis Bank, Sun Pharma and IndusInd Bank were among the other major winners.

On a weekly basis, the Sensex climbed 1,532.77 points or 2.90 per cent, while the Nifty gained 484 points or 3.06 per cent.

In the broader market, the BSE smallcap gauge jumped 2.13 per cent and the midcap index spurted

1.98 per cent.

As many as 2,497 stocks advanced, while 777 declined and 144 remained unchanged.

All BSE sectoral indices closed higher, with realty jumping 4.22 per cent, followed by metal (3.75 per cent), capital goods (3.14 per cent), industrials (3.05 per cent), healthcare (3.04 per cent) and energy (2.97 per cent).

Asian markets jumped after China slashed its five-year loan prime rate (LPR) -- a key lending benchmark — by 15 basis points to spur demand.

Bourses in Europe too were trading with significant gains in the afternoon session. Stock markets in the US had ended lower on Thursday.

International oil benchmark Brent crude dipped 0.11 per cent to $111.9 per barrel.

The rupee slipped 7 paise to close at an all-time low of 77.63 against US dollar on Friday.

Foreign institutional investors remained in selling mode, offloading shares worth a net Rs 4,899.92 crore on Thursday, as per stock exchange data.