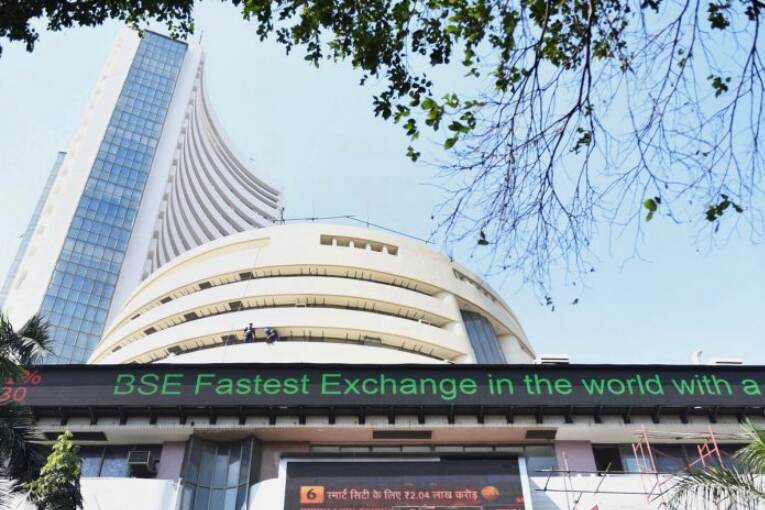

Sensex rallies 460 points, Nifty reclaims 14,800 as RBI holds rates

Mumbai: Equity indices darted up on Wednesday, propelled by banking, auto and IT stocks, after the RBI expectedly left interest rates unchanged and maintained its accommodative stance to boost growth amid a resurgence in coronavirus cases.

The 30-share BSE Sensex jumped 460.37 points or 0.94 per cent to finish at 49,661.76. The broader NSE Nifty advanced 135.55 points or 0.92 per cent to 14,819.05.

Interest-rate sensitive bank and auto stocks led the gainers' chart on the Sensex.

SBI was the top performer, spurting 2.25 per cent, followed by ICICI Bank, Nestle India, IndusInd Bank, M&M, Bajaj Auto, Bharti Airtel and Maruti.

IT counters also posted robust gains after the rupee tanked 105 paise against the US dollar. A weak rupee is seen as a positive for export-oriented Indian IT firms.

On the other hand, Titan, NTPC and HUL were the laggards, shedding up to 0.78 per cent.

The Reserve Bank of India (RBI) on Wednesday kept key interest rates unchanged at record lows while pledging to buy Rs 1 lakh crore of government bonds this quarter to cap borrowing costs in a bid to support an economy facing a resurgence of the pandemic.

In the first monetary policy of the 2021-22 fiscal, the central bank stuck to its accommodative stance amid concerns of rising infections that could derail the nascent economic recovery.

The central bank also retained the economic growth projection for the current financial year at 10.5 per cent.

"In line with expectations, RBI has maintained status quo on policy rates and reassured the financial markets on its commitment to retain accommodative policy stance till the prospects of sustained economic recovery is secured," said Gaurav Dua, SVP, Head - Capital Market Strategy, Sharekhan by BNP Paribas.

Even on liquidity front the signals are dovish, he said, adding the bond market has reacted positively with the 10-year bond yield easing by 6-8 bps during the day.

"The easing of yield curves and commitment of keeping interest rate low with ample liquidity are positive for the equity markets too. The consistency and continuity in the monetary policy stance is welcome and will cheer up market sentiments," he noted.

All sectoral indices ended on a positive note, with BSE auto, bankex, telecom, metal, basic materials and finance indices surging up to 1.69 per cent.

Broader BSE midcap and smallcap indices rallied up to 1.30 per cent.

World stocks hovered near record highs, boosted by IMF's projections of robust global growth this year.

Elsewhere in Asia, bourses in Seoul and Tokyo closed in the green, while Shanghai and Hong Kong nursed losses.

Stock exchanges in Europe were largely trading with gains in mid-session deals.

Foreign institutional investors were net sellers in the capital market as they offloaded shares worth Rs 1,092.75 crore on Tuesday, according to exchange data.