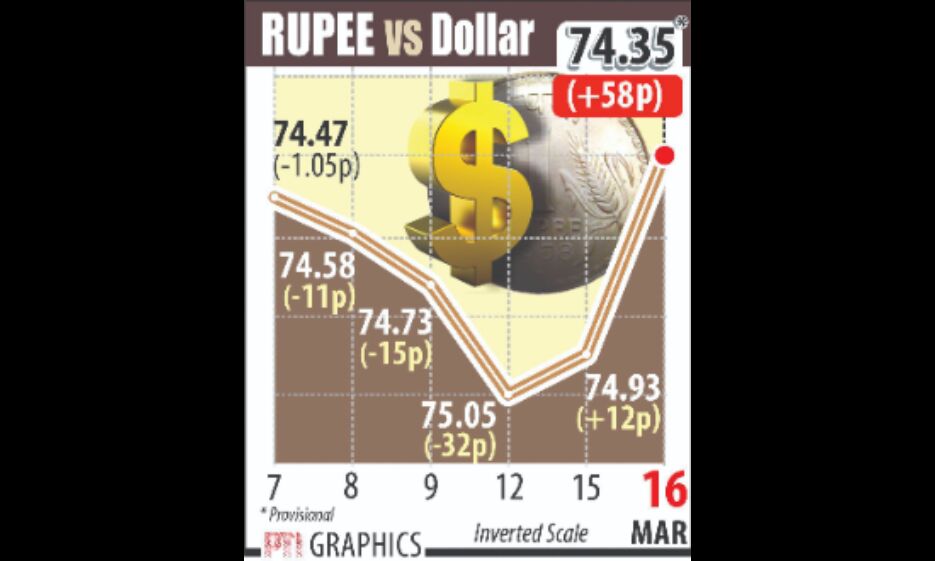

Rupee rises by 58 paise to over 1-week high against US dollar

Mumbai: The rupee on Friday soared by 58 paise to end more than one-week high of 74.35 against the US dollar on easing US bond yields and positive domestic equities.

A weak dollar overseas and foreign fund inflows also supported the rupee.

At the interbank forex market, the local unit opened at 74.76 against the greenback and witnessed an intra-day high of 74.28 and a low of 74.76.

It finally ended at 74.35 against the American currency, registering its best single-day gain of 58 paise in more than a month. On Thursday, the rupee had settled at 74.93 against the American currency.

"Indian Rupee gained strength amid weakness in dollar and rise in risk appetite in the domestic markets," said Saif Mukadam, Research Analyst, Sharekhan by BNP Paribas.

Mukadam further noted that dollar dipped on extended decline in US treasury yields.

"US treasury yields fell as US Federal Reserve policy-makers signaled that central bank is not in hurry to reduce its support," he said.

The dollar index, which gauges the greenback's strength against a basket of six currencies, fell 0.09 per cent to 91.59.

"Indian rupee gained the most in Asia buoyed by exporters' dollar selling and foreign fund inflows. It also got support from a softer dollar and slide in US yields and higher equities. Bond gathered pace following a slate of stronger-than-expected US data which dragged dollar lower," said Dilip Parmar, Research Analyst, HDFC Securities.

According to Sriram Iyer, Senior Research Analyst at Reliance Securities, the rupee appreciated on Friday against the US Dollar tracking softening yields and firm risk appetite in the region.

"RBI's intervention also aided the local unit," Iyer said.

On a weekly basis, the rupee appreciated by 38 paise.

"Rupee continued to appreciate for the second successive session following suspected RBI intervention and also as domestic equities extended gains," said Gaurang Somaiyaa, Forex & Bullion Analyst, Motilal Oswal Financial Services.

Market participants ignored the weaker-than-expected economic data that were released earlier this week.

"... focus will be on preliminary consumer sentiment number, and better-than-expected data could extend gains for the greenback. We expect the USDINR (Spot) to trade sideways and quote in the range of 74.05 and 74.80," Somaiyaa said.

According to Mukadam, further gains for the local unit were prevented on surge in crude oil prices and on concern that rising COVID-19 cases in India and lockdown restriction in some states may hurt economic recovery.

Brent crude futures, the global oil benchmark, rose 0.40 per cent to $67.21 per barrel.