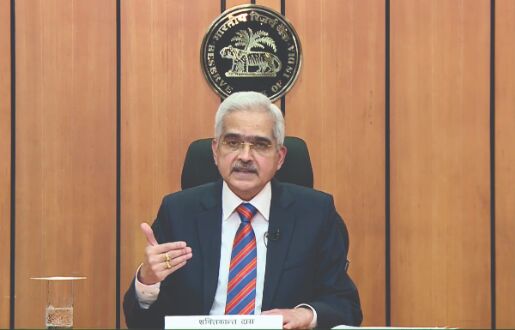

'RBI positive about 9.5% GDP estimates for FY22 being met'

Mumbai: The Reserve Bank is "quite optimistic" about its 9.5 per cent GDP growth estimate coming true for FY22, and will take steps to "gradually move" for a cool off in headline inflation to its 4 per cent target, Governor Shaktikanta Das said on Thursday.

The RBI had decided to use the 2 percentage point cushion to keep the inflation within the 2-6 per cent target band as a result of the pandemic to push growth, Das said, adding that the Monetary Policy Committee (MPC) will take a call on continuing with the accommodative stance.

As a result of high inflation, which also breached the 6 per cent band in between, the RBI has been maintaining a status quo on rates for over a year now and calls for higher attention to its core mandate of price rise are growing. The last MPC meet saw one of the six members dissenting on the stance, and asking for a rollback of the accommodative stance.

According to many watchers, the RBI will first shift the stance before a possible rollback of pandemic measures or eventually a rate hike.

Speaking at the event hosted by The Indian Express and Financial Times, the governor said fast moving indicators on the economy are "upbeat after the reverses faced as a result of the second wave of the pandemic beginning in mid-April.

Going forward, many of the fast moving indicators are looking upbeat. At this point of time our projection of 9.5 per cent growth for this financial year stands and I think it will hold good At this point in time we are quite optimistic of the 9.5% growth we have projected for the current year, Das said.

He said the growth will keep rising from a sequential perspective with every quarter, and expected the September quarter to be better than June. The only uncertainity is the possibility of a third wave, he said, adding that businesses and companies have not learnt how to deal with the impact of such disruptions.

Meanwhile, on inflation, he said the RBI does not expect a sustained increase beyond the 6 per cent number and some moderation as well going forward.

" we are watchful, we are very serious about anchoring inflation expectations and anchoring the inflation around the target of 4 per cent going forward and we remain committed to anchor that, to achieve that over a period of time in a very non-disruptive manner," Das said. "Going forward, our effort being an inflation targeting institution, will be to gradually move to 4 per cent (inflation) over a period of time. That timing has to be decided, today is not the time and we will take a call depending on the incoming numbers," he said.

This is the first time that the governor has explicitly spoken about the desire to get inflation back to the 4 per cent target, which is the medium term target set by the government.

He attributed the surge in inflation, which had stood at 5.7 per cent in July, on the supply side factors including the high commodity prices.

Pointing out that the high price of diesel and petrol at filling stations is among the factors pushing inflation, Das said the RBI is engaged with the government on such issues and also noted the government's measures to reduce prices of edible oils and pulses.

The RBI had decided to focus on growth by giving extra emphasis to it because if the growth gets completely decelerated, then it will pose huge long term challenges for the economy to revive. "During the pandemic therefore, instead of the exact (inflation) target of 4 per cent, the MPC has decided to operate within the band of 2-6 per cent," Das said.

Moreover, RBI Governor Shaktikanta Das on Thursday said the central bank continues to have "serious and major" concerns about the cryptocurrencies like Bitcoin and has conveyed them to the government.

It is for the government to take a call on what to do in the matter, Das said, adding that he would like to have credible explanations and answers on the value such instruments can get to the Indian economy.

Reserve Bank Governor Shaktikanta Das on Thursday said the stressed assets situation "looks manageable" as the stock of gross non-performing assets (NPAs) remained stable even after the second wave of pandemic.

The banking system's gross NPAs were at 7.5 per cent while the same for non-bank lenders were even lower, Das said.

Further, the RBI said it has streamlined the process for redressal of investors complaints related to Sovereign Gold Bond to make it more effective.

The sovereign gold bond scheme was launched in November 2015 to reduce the demand for physical gold and shift a part of the domestic savings -- used for the purchase of gold -- into financial savings.

To streamline the customer complaint handling process and make it more effective, the RBI said the nodal officer of the Receiving Office (RO) will be the first point of contact for attending to the queries/ complaints of their customers.