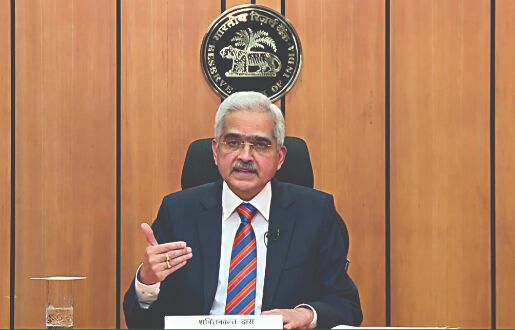

Pandemic threatens to result in balance sheet impairments, capital shortfalls at lenders: Das

Mumbai: Available data obscures the true stress in bank books, and the pandemic will result in balance sheet impairments and capital shortfalls at lenders, RBI Governor Shaktikanta Das said on Monday.

Balance sheet impairment and capital shortfalls will be more evident once the regulatory reliefs are rolled back, Das said in the bi-annual Financial Stability Report, asking lenders to augment capital.

"Congenial liquidity and financing conditions have shored up the financial parameters of banks, but it is recognised that the available accounting numbers obscure a true recognition of stress," Das said in his foreword to the report.

It can be noted that a few years ago, the Reserve Bank of India had done an asset quality review for banks to ensure that the balance sheets represent a true picture of the stress, which had led to a system-wide spike in non-performing assets.

The banking system faced COVID-19 with relatively sound capital and liquidity buffers on the back of regulatory measures, but "the pandemic threatens to result in balance sheet impairments and capital shortfalls, especially as regulatory reliefs are rolled back," Das said.

The RBI had first declared a six-month loan repayment moratorium and later launched a limited-period loan recast scheme for companies impacted by the pandemic, which ended on December 31. Banks will be starting to declare their December quarter results in a few days, but legal challenges have ensured that there is no clarity on NPA recognition as yet.

Das asked banks to exploit the congenial financial conditions and the conducive policy environment to augment their capital and also alter business models to address emerging challenges for future expansion while strengthening the capacity to absorb shocks and supporting the revival of the economy.

The government, which is faced with revenue shortfalls, has increased its borrowing, but the same has imposed additional pressures on banks, Das said, adding that the borrowing programme has been well managed till now and the cost of borrowing is also at a 16-year low. Affirming that financial stability preservation is an overarching goal, Das warned that stretched valuations of financial assets pose a risk to it.