Nifty jumps to fresh peak, Sensex rallies over 500 pts

Mumbai: The NSE Nifty defied gravity for the seventh straight session to close at its fresh lifetime high on Monday as a steady decline in daily COVID-19 cases bolstered investor sentiment amid mixed global cues.

Investors have gained Rs 3,93,349.08 crore in four days following a strong rally in the equity markets amid a declining trend in COVID-19 cases.

Market heavyweights Reliance Industries, HDFC twins and ICIC Bank witnessed robust buying ahead of GDP data.

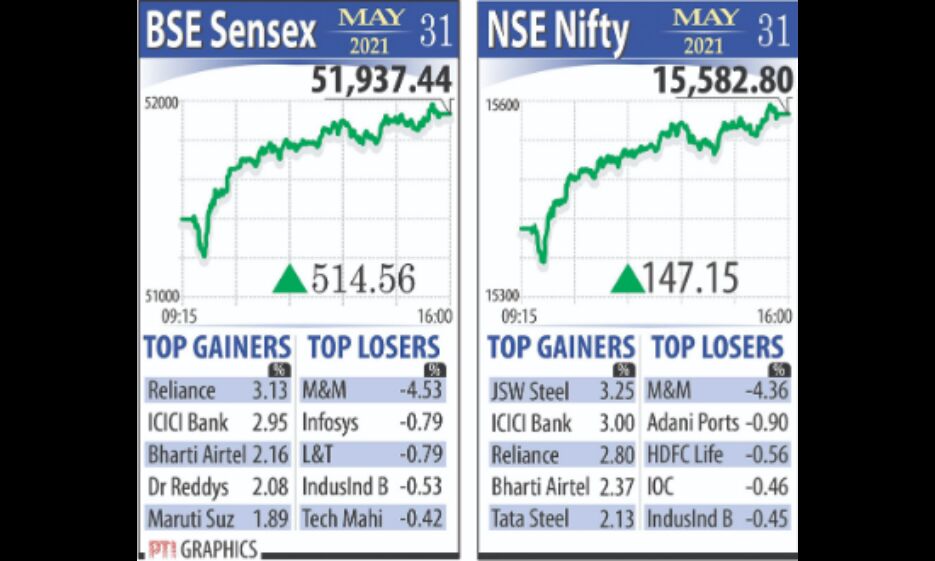

Rising for the fourth day, the 30-share BSE Sensex ended 514.56 points or 1.00 per cent higher at 51,937.44 — around 200 points shy of its closing record hit on February 15 this year. The broader NSE Nifty surged 147.15 points or 0.95 per cent to 15,582.80, closing at a record high for the third consecutive session.

Reliance Industries was the top gainer in the Sensex pack, surging 3.13 per cent, followed by ICICI Bank, Bharti Airtel, Dr Reddy's, Maruti, ITC, NTPC and Axis Bank.

On the other hand, M&M, Infosys, L&T, IndusInd Bank, Tech Mahindra and Sun Pharma were among the laggards, skidding up to 4.53 per cent.

India reported the lowest daily new coronavirus infections in 50 days with 1,52,734 cases, taking the tally to 2,80,47,534 on Monday, while the active caseload declined to 20,26,092, the Health Ministry said.

Barring auto and IT, all BSE sectoral indices finished in the green, led by energy (up 2.46 per cent), metal (2.25 per cent), telecom (1.63 per cent), and oil & gas (1.36 per cent).

In the broader markets, the BSE midcap and smallcap gauges climbed up to 0.50 per cent.

Meanwhile, international oil benchmark Brent crude surged 1.08 per cent to trade at $69.46 per barrel.

Halting its three-day winning run, the rupee on Monday declined by 17 paise to close at 72.62 against the US dollar, tracking the strengthening of the American currency in the overseas market.