Markets at new peak: Sensex ends over 58K; Nifty tops 17,300

Mumbai: The BSE Sensex scaled the 58,000-mark for the first time on Friday, buoyed by a rally in market heavyweight Reliance Industries as investors remained in risk-on mode amid positive macroeconomic data and sustained foreign fund inflows.

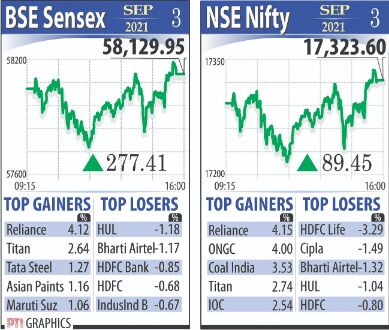

Rising for the second straight day, the 30-share benchmark climbed 277.41 points or 0.48 per cent to its lifetime closing high of 58,129.95. It touched an intra-day record of 58,194.79.

The Sensex has taken just 3 sessions to go from the 57,000-level to 58,000. The index closed at fresh all-time highs in five of the previous six sessions.

Similarly, Nifty advanced 89.45 points or 0.52 per cent to its all-time closing peak of 17,323.60. During the session, it touched a record of 17,340.10.

It was a scintillating week for the benchmarks, with the Sensex rallying 2,005.23 points or 3.57 per cent, while the Nifty surged 618.40 points or 3.70 per cent.

Investors' wealth rose by Rs 4 lakh crore in two days of market rally, with the BSE benchmark Sensex scaling the 58,000-mark for the first time on Friday.

Reliance Industries was the top gainer in the Sensex pack on Friday, darting up 4.12 per cent after its chairman Mukesh Ambani outlined an ambitious green energy roadmap, including a '1-1-1 vision' to bring down the cost of hydrogen to under $1 per 1 kg in 1 decade.

Titan, Tata Steel, Bajaj Auto, Maruti, Dr Reddy's and Asian Paints were the other prominent winners, spurting up to 2.59 per cent.

Maruti Suzuki closed 1.06 per cent higher even as the country's largest carmaker announced a recall of 1,81,754 units of various models to replace faulty motor generator units.

HUL, Bharti Airtel, HDFC twins and IndusInd Bank were among the laggards, skidding up to 1.18 per cent.

India's services sector expanded in August at the fastest pace in one-and-a-half years amid strong inflows of new work and improved demand conditions, a monthly survey showed. Buying remained visible in midcap and smallcap stocks, while volatility index inched up 2 per cent.

Sectorally, BSE energy, oil and gas, metal and consumer durables indices jumped as much as 3.60 per cent, while telecom, finance, FMCG and bankex ended with losses. Broader BSE midcap and smallcap indices rose up to 0.41 per cent. International oil benchmark Brent crude rose 0.51 per cent to $73.40 per barrel.