Jaypee Infratech case: NBCC questions 'jurisdiction' of IRP's

New Delhi: Days after rejection of its bid to buy Jaypee Infratech Ltd (JIL), state-owned NBCC has questioned the jurisdiction of the interim resolution professional in submitting that the offer was non-compliant with the insolvency law and demanded that it should be put to vote.

Asserting that the offer is compliant, NBCC in a letter to the Interim Resolution Professional (IRP) also said the company is fully aware of its responsibilities to be compliant with applicable law in its deeds and actions. On May 20, the Committee of Creditors (CoC) decided to put on vote only Suraksha Group's bid for JIL. NBCC's offer was rejected on the grounds that it was non-compliant with provisions related to treatment of dissenting financial creditors under the Insolvency and Bankruptcy Code (IBC).

The voting on the Suraksha group's offer is scheduled from May 24 to 27. Against this backdrop, NBCC has written a letter to JIL's IRP Anuj Jain protesting against the CoC decision and said it might approach appropriate forum of law for recourse if its bid was not considered.

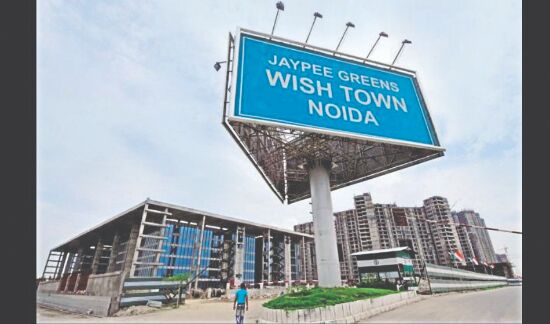

NBCC's bid was rejected in the fourth round of bidding process for JIL and the successful bidder has to complete around 20,000 apartments.

The state-owned company has said the IRP exceeded his jurisdiction and also wrongly interpreted the laws.

"... by declaring the NBCC plan as non-compliant, you have exceeded the jurisdiction beyond what is laid down by the Supreme Court," NBCC said in the letter to the IRP.

According to the company, the role of the IRP is merely to assist the CoC and not to decide whether the resolution plan does or does not contravene the provisions of law.

Earlier, sources had said that NBCC's offer was declared as non-compliant. The decision was based on the IRP's report, which stated that the offer was non-compliant with certain provisions of the IBC and an order of the Supreme Court, they had said.

As per the IRP's report, NBCC's proposals to offer NCDs (non-convertible debentures) to dissenting financial creditors for payment of liquidation value and also include 'Guarantee Security Interest' as well as 'Promoter Security Interest' are non-compliant with the provisions of the IBC.

Along with the letter, NBCC has submitted further clarifications through an addendum to address all the issues raised by representatives of banks and homebuyers as members of the CoC.