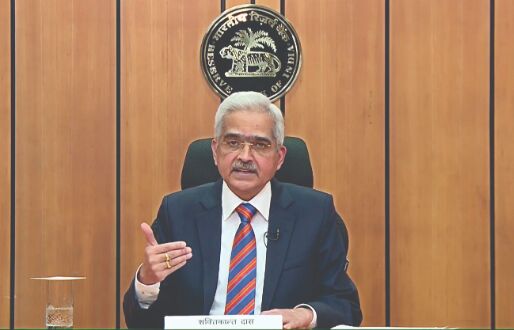

'Financial inclusion to remain policy priority after pandemic'

Mumbai: RBI Governor Shaktikanta Das on Thursday said financial inclusion will continue to be a policy priority for the central bank to make the post-pandemic recovery more equitable and sustainable.

The Reserve Bank of India will very soon be coming out with the first financial inclusion index, which will assess progress in terms of access, usage and quality, Das said, while speaking at the Economic Times Financial Inclusion Summit.

It is the responsibility of all stakeholders to ensure that the financial ecosystem (including the digital medium) is inclusive and capable of effectively addressing risks like mis-selling, cybersecurity, data privacy and promoting trust in the financial system through appropriate financial education and awareness, he added.

Since the start of the last decade, financial inclusion has been a key focus area for the RBI to help formalise the economy by ensuring that banks reach the people. Technological advances made it easier and the government also gave it a greater thrust with the launch of the PM Jan Dhan Yojana scheme.

In order to make the post-pandemic recovery more inclusive and sustainable, FI would continue to be our policy priority, Das said. To measure the extent of financial inclusion in the country, it has been decided to construct and periodically publish a financial inclusion index (FII), he said, adding an announcement was made some time back about such an index.

The index will have parameters across the three dimensions, including access, usage and quality, he said, adding work on FII is underway and the index will be published very shortly by the Reserve Bank .

Das said financial inclusion is a key driver of sustained and balanced economic growth, which helps reduce inequality and poverty, and while we have made tremendous strides on this aspect, the pandemic has created newer challenges and complexities.

The financial system will have a crucial role to fulfil the aspirations and needs of our economy on the mend, he said.

During the pandemic, the RBI's efforts on financial inclusion have helped in enabling the government to provide timely support through cash transfers under the Direct Benefit Transfer schemes, Das said, adding Rs 5.53 lakh crore was transferred digitally across 319 government schemes spread over 54 ministries in FY21.

Meanwhile, the tapering of the second wave of the COVID-19 pandemic coupled with aggressive vaccination has brightened the near-term prospects of the Indian economy, though a solid increase in aggregate demand may take some time, said the Reserve Bank of India on the state of economy.

Attributing the rise in inflation to the supply side disruptions on account of the pandemic and hardening of commodity prices in the international market, the RBI article opined that these factors should ease over the year as supply-side measures take effect.

"The tapering of the second wave, coupled with an aggressive vaccination push, has brightened near-term prospects for the Indian economy.

"While several high-frequency indicators of activity are recovering, a solid increase in aggregate demand is yet to take shape," said the article written jointly by RBI Deputy Governor M D Patra and other officials.

The RBI, however, said views expressed in the article are those of the authors and do not necessarily represent the views of the Reserve Bank of India.

On the supply side, agricultural conditions are turning buoyant with the revival in the monsoon but the recovery of manufacturing and services sectors has been interrupted by the second wave.

"The economy is struggling to regain the momentum of recovery that had started in the second half of 2020-21 but was interrupted by the second wave. "The pick-up in inflation is driven largely by adverse supply shocks due to disruptions caused by the pandemic, including increases in margins and taxes," it said.

There are also specific demand-supply mismatches as in the case of protein-rich food items, edible oils and pulses, which are being addressed by specific supply-side measures, the article said.