Benchmarks rebound from initial losses

Mumbai: Equity indices overcame a wobbly start to clock gains for the third session on the trot on Tuesday, propped up by banking, metal and energy stocks amid a mixed trend in global markets. A recovery in the rupee also bolstered sentiment, traders said.

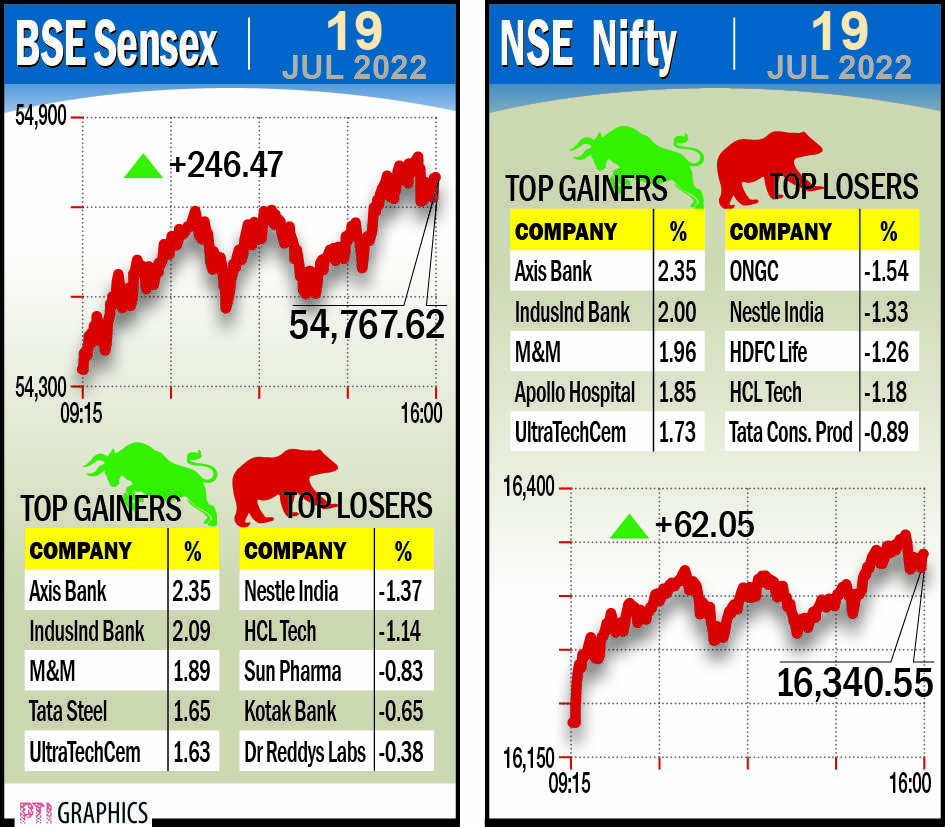

The 30-share BSE Sensex advanced 246.47 points or 0.45 per cent to settle at 54,767.62 after starting the trade on a weak note. In a volatile session, the benchmark hit a high of 54,817.52 and a low of 54,232.82 during the day.

On similar lines, the broader NSE Nifty climbed 62.05 points or 0.38 per cent to close at 16,340.55. Axis Bank topped the Sensex gainers' chart, spurting 2.35 per cent, followed by IndusInd Bank, Mahindra & Mahindra, Tata Steel, UltraTech Cement, Bajaj Finserv, SBI and Bharti Airtel.

However, Nestle India, HCL Technologies, Sun Pharma, Kotak Mahindra Bank, Dr Reddy's, Infosys and Asian Paints were the biggest laggards, dropping up to 1.37 per cent.

The market breadth was positive, with 19 of the 30 Sensex constituents closing higher.

The rupee recovered from its all-time low of 80.05 to close 6 paise higher at 79.92 against the US dollar on Tuesday following forex inflows and suspected RBI intervention.

At the interbank forex market, the local unit opened lower at 80.00 against the greenback and fell further to its all-time low of 80.05 to a dollar due to overnight gains in crude oil prices. Firm stock markets, foreign fund inflows into equities for a second straight day and suspected RBI intervention helped the rupee pare losses later. The local unit settled at 79.92, registering a rise of 6 paise over its previous close.

On Monday, the rupee for the first time declined to the low level of 80 against the US dollar in intra-day spot trading before ending the session 16 paise lower at 79.98 amid a surge in crude oil prices and unrelenting foreign fund outflows.

The dollar index, which measures the greenback's strength against a basket of six currencies, was down 0.66 per cent at 106.66.

Brent crude futures, the global oil benchmark, fell 0.40 per cent to $105.84 per barrel. Crude oil prices had spurted over 5 per cent on Monday.

Foreign institutional investors were net buyers in the capital market on Tuesday as they purchased shares worth Rs 976 crore, provisional exchange data showed. FIIs bought shares worth Rs 156.08 crore on net basis on Monday.