Deep into a quagmire

The root cause behind the looming global stagflation is the failure of supply side economics, the practice of which has been characterised by high wage-productivity gap and widening inequalities; resort to sound economic policies is needed to break the vicious cycle of the crisis

On June 10, Deutsche Bank reported: 'Today's US inflation print continued the trend of upside surprises, coming in at 8.6 per cent year over year'. According to a survey by Pew Research Centre, conducted from April 25 to May 1, just 19 percent of American adults rated the coronavirus outbreak as a very big problem for the country whereas 70 per cent of the Americans viewed inflation as a very big problem. Post pandemic, Inflation has become a global problem. Analysts fear that the UK is set for the highest inflation among G7 countries until 2024, reported Financial Times. As food and energy prices spiralled, UK's inflation soared to a 40-year high of 9 per cent in the consumer price index in April — the highest since records began in their current form in 1989. Inflation in the Euro area hovers around unprecedented 7.5 percent and the annual inflation rate in France was confirmed at 4.8 per cent in April, the highest since October 1985. As per a report by Businessline, in India, the consumer price inflation in April at 7.79 per cent was the steepest rise since the 8.3 per cent recorded in May 2014.

Why this inflation?

Combination of 'cost push' and 'demand pull' factors have contributed to this unprecedented rise of the consumer price index. Driven by food and energy costs in the wake of the COVID-19 pandemic, inflation has been exacerbated by the Russian invasion of Ukraine and disruption of the global supply chain. The monthly food price index of the UN's Food and Agriculture Organization (FAO), which tracks prices of globally-traded food commodities, reported an increase of 12.6% between February and March to reach the highest level since its inception in 1990. The FAO's cereal price index rose by an even greater amount – 17.9% – over the period, reflecting a surge in global prices of wheat and coarse grains, largely due to export disruptions from Ukraine, one of the world's largest wheat exporters. The Ukraine war has also caused oil prices – that were already high due to pent-up consumer demand post-COVID – to soar over USD 110 a barrel, as many Western countries imposed crippling sanctions on Russia in retaliation. The price of a barrel of crude oil has consequences for things like food, airfares, petrol etc – because all of these are reliant on fuel.

UBS Chief Economist Paul Donovan describes the current spike in inflation as "historical", but he says it won't last at these levels for much longer. It has been provoked by the extraordinary demand for goods in 2021 as countries emerged from lockdowns, shops opened and people were able to go out and buy stuff with money saved during weeks of economic inactivity. If real income is not increased, this sudden spike in demand will fizzle out.

Low inflation since late 1970s

According to a report by the Brookings Institution (April 2022), since the late-1970s, the world has achieved a remarkable decline in inflation. But since late 2020, the global inflation rate has risen sharply to over 6 per cent due to unprecedented policy support for inflation, the release of pent-up demand, persistent supply disruptions, and surging commodity prices.

Inflation has been low and stable during the Bretton Woods fixed exchange rate system of the post-war period up to 1971 and during the Gold Standard of the early 1900s. But these two earlier episodes were also followed by high inflation. For example, following the low inflation period until the early 1970s, multiple oil price shocks during the remainder of the decade accompanied a rapid acceleration in global inflation.

The Brooking's report has identified few disinflationary structural forces, namely, globalization, robust policy frameworks, demographic changes, structural factors, and technological advances which were instrumental in keeping inflation low until 2020. According to the authors, these factors provide clues to questions about whether the current surge in prices is transitory or more long-lasting. Should these forces recede, increases in short-term inflation may become much more persistent.

⁕ Globalization. Over the past three decades, the entry of China and Eastern Europe into the global trading system has greatly reduced the prices of many manufactured goods. Global value chains have contributed to lower inflation through outsourcing and greater competition. Countries that are more open to trade and financial flows have often experienced lower inflation. Over the past decade, however, the maturing of global value chains has contributed to slowing trade growth. New tariffs and import restrictions have been put in place in advanced economies and emerging markets and developing economies (EMDEs). Thus far, notwithstanding these concerns and some severe logistical bottlenecks, global value chains appear to have remained resilient. However, rising protectionist sentiment and geopolitical risks may slow or even reverse the pace of globalization.

⁕ Policy frameworks. Over the past four decades, many advanced economies and EMDEs implemented macroeconomic stabilization programs and structural reforms, improved fiscal frameworks, and gave central banks clear mandates to control inflation. In the context of inflation, these reforms have produced clear dividends: Countries with stronger monetary policy frameworks and more independent central banks have tended to experience lower inflation.

⁕ Demographic changes. Rapid labour force growth, due to population growth and increased participation of women, helped dampen increases in wages and input costs. The disinflationary benefits reaped from this process may, however, now be at an inflection point as the share of the working-age population stabilizes even in EMDEs. Global aging is expected to lower saving rates and raise inflationary pressures. Aging in some large emerging markets may amplify this trend. In addition, recent data from advanced economies indicate that a growing proportion of the population is choosing to leave the labour force early—the "Great Retirement."

⁕ Structural factors. In both advanced economies and EMDEs, the large-scale shift of labour and other resources from agriculture to higher-productivity manufacturing offered productivity gains. Over the past decade, however, momentum for productivity-enhancing factor reallocation has faded. Declining unionization of the labour force, smaller collective bargaining coverage, and greater labour and product market flexibility have dampened wage and price pressures over the past decade.

⁕ Technological advances. Automation, the increasing adaptability of computers, robotics, and artificial intelligence have improved production processes in many sectors. At the same time, these factors have lowered demand for routine production and clerical workers and lowered wage and price pressures. In some advanced economies, disinflation has also been attributed partly to price transparency and competitive pressures introduced by the growing digitalization of services, including e-commerce or sharing services.

Brooking Institute apprehends that should these forces recede, recent increases in short-term inflation may become more persistent.

The vicious cycle

Billions of people are facing the greatest cost of living crisis in a generation. A recent UN study (June 2022) has reported that the cost-of-living crisis is due to severe price shocks. Few hard facts:

⁕ The FAO food price index is at near-record levels and 20.8 per cent higher than at this time last year.

⁕ Crude oil has now reached over USD 120 per barrel and energy prices overall are expected to rise by 50 per cent in 2022 relative to in 2021.

⁕ The price of European natural gas in particular has risen ten-fold compared to 2020.

⁕ Fertilizer prices are more than double the 2000–2020 average.

⁕ Maritime transport costs are more than triple the pre-pandemic average.

⁕ Rising interest rates and growing investor uncertainty has eroded both the value of developing countries' currencies, as well as their capacity to borrow in foreign markets. After the first 100 days of the Ukraine war, the currencies of 142 developing countries have depreciated, on average, by 2.8% against the US dollar

The greatest concern is that vicious cycles are beginning to emerge along the transmission channels of the crisis. Higher energy prices, especially diesel and natural gas, increase the costs of fertilizers and transport. Both factors increase the costs of food production. This leads to reduced farm yields and to even higher food prices next season. These, in turn, add to inflation metrics, contributing to increasing interest rate pressures and tightening financial conditions. Tighter financial conditions erode the buying power of the currencies of developing countries, further increasing the import costs of food and energy, reducing fiscal space and increasing the costs of servicing debt.

The UN Report warns that the vicious cycles created by a cost-of-living crisis can also spark social and political instability. Higher inflation means higher food and energy prices, and a higher cost of living. This in turn reduces families' real income, and with it, their living standards and their opportunities for a better future. Some families start making painful trade-offs: reducing meals or the quality of them, dropping out of schools, or reducing healthcare spending. Often these decisions affect women and girls the most. These decisions have worrying long-term effects, from higher poverty levels to rising inequality, lower education, lower productivity and declining real wages. All this reduces the ability of people and governments to cope with a crisis, further fuelling social and political unrest. Here are a few examples.

⁕ Since 2019, the number of people living in extreme poverty has risen by 77 million and the number of people facing acute food insecurity has risen to 193 million.

⁕ Worldwide, three out of five workers, mostly in developing countries, have lower real incomes than before the pandemic.

⁕ In Africa, 58 million people living just above the poverty line are at risk of sliding into poverty due to the combined effects of the pandemic and the war in Ukraine

⁕ About 4.1 billion people lack social protection.

⁕ Nearly 90 million people in Asia and Africa who had previously gained access to electricity, can no longer afford to pay for their basic energy needs.

⁕ Globally, between 2019 and 2021, 30 million people lost access to clean cooking fuel and the global figure now stands at 2.4 billion who lack access.

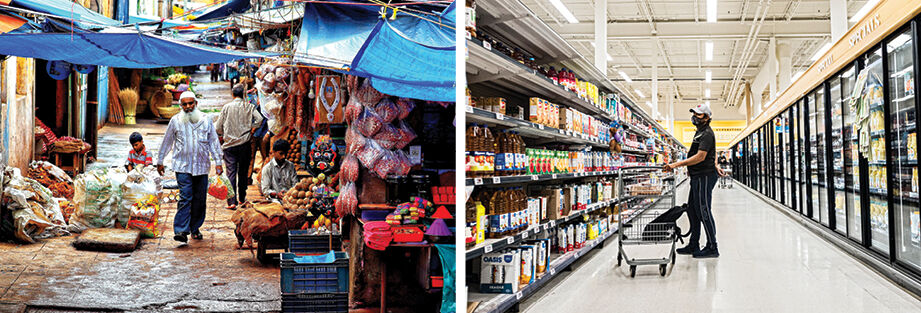

⁕ High food and energy prices will affect the most vulnerable in society the maximum, especially in developing countries, in which more than 50 per cent of the income of the poorest households is spent on food

⁕ In developing economies, public debt levels increased from 55.7 to 65.1 per cent of GDP between 2019 and 2021 and, in 2022, these economies are estimated to require USD 311 billion to service public external debt, a figure that amounts to 13.6 per cent of government revenues.

⁕ Globally, 60 per cent of the poorest countries are in debt distress or at a high risk of debt distress

⁕ ILO has estimated that the social protection financing gap is USD 1.2 trillion per year in developing countries.

Return of stagflation!

The World Bank says most countries are headed for a recession, and warns of a possible return to 1970s' 'stagflation'. Global economic growth is expected to slow down before the end of the year, and most countries should begin preparing for a recession, according to the World Bank's latest global economic forecast released in the first week of June. The rate of global growth is expected to slow from 5.7% in 2021 to 2.9% this year (2022).

"For many countries, recession will be hard to avoid," wrote World Bank president David Malpass. "Several years of above-average inflation and below-average growth are now likely, with potentially destabilizing consequences for low- and middle-income economies. It's a phenomenon—stagflation—that the world has not seen since the 1970s," he wrote.

Stagflation occurs when economic growth goes through a significant slowdown, but inflation and high prices persist. The last time the world went through a stagflationary period was during the 1970s oil shocks, when high oil prices caused high inflation worldwide and a recession in countries that imported large oil volumes from the Middle East.

"The interest rate increases that were required to control inflation at the end of the 1970s were so steep that they touched off a global recession, along with a string of debt crises in developing economies, ushering in a 'lost decade' in some of them," Malpass wrote, adding that the same patterns of subdued growth, high interest rates, and escalating public debt in many countries are playing out today. Resuming normal supply-chain operations and increasing production around the world are key to avoiding stagflation, Malpass said, but it won't be easy.

In its Global Economic Prospects report (June 2022) the World Bank offers the first systematic assessment of how current global economic conditions compare with the stagflation of the 1970s—with a particular emphasis on how stagflation could affect emerging markets and developing economies.

The current juncture resembles the 1970s in three key aspects: (i) persistent supply-side disturbances fuelling inflation, preceded by a protracted period of highly accommodative monetary policy in major advanced economies, (ii) prospects for weakening growth, and (iii) vulnerabilities that emerging market and developing economies face with respect to the monetary policy tightening that will be needed to rein in inflation. However, the ongoing episode also differs from the 1970s in multiple dimensions: the dollar is strong, a sharp contrast with its severe weakness in the 1970s; the percentage increases in commodity prices are smaller; and the balance sheets of major financial institutions are generally strong.

The Foreign Policy (June 14, 2022) has made an important observation on why this global economic crisis is different from the previous ones. This is the first time since World War II that there may be no cooperative way out. One of the remarkable things about the global economic order since World War II has been the flexibility of governments in responding to serious crises. From stagflation and the collapse of the Bretton Woods currency regime in the 1970s to the Asian financial crisis of the 1990s to the global financial crisis in this century, the world's major economies have proven surprisingly adept at finding ways to cooperate to address serious challenges. The current problems—the Russia-Ukraine war, inflation, global food and energy shortages, unwinding asset bubbles in the United States, debt crises in developing countries, and the lingering impacts of COVID-19-related shutdowns and supply chain bottlenecks—may be the most serious crisis of them all, not least because central banks can't print wheat and gasoline! Yet there are few signs of the collective responses that will be needed to meet these challenges. 'Global cooperation has never been more urgent—and seemed less likely', observes the Foreign Policy.

Conclusion

The supply side economics, popularized under US President Ronald Reagan which became the basis of the "trickle-down theory," and epitomized by the famous Laffer Curve, formulated by supply side economist Arthur Laffer, has failed miserably. The salient features of that economic doctrine, which was later followed by Margaret Thatcher of the UK and other global leaders, are: (i) regressive tax policy; (ii) rising real wage-productivity gap (iii) consolidation of monopoly power through mergers and acquisitions; and (iv) widening of economic inequality among the citizens.

During the last four decades, this new liberal economics has created the greatest wealth inequality in the globe threatening to push the world into a severe economic recession. Current disparities have reached the extreme. The top 10 per cent owns roughly 190 times wealth as much of the poorest half of the global population. Income inequalities are not much better. The richest 10 per cent today snap up 52 per cent of all income. The poorest half get just 8.5 per cent. Unless this disparity is reduced by imposing steep wealth and income tax on the affluent section and using that revenue for the welfare of the masses, the situation will worsen.

Economist Ravi Batra – the author of The Great Depression of 1990s, observed, "the financial crisis is just one symptom of a long-festering economic disease — a disease caused by neglecting basic economic principles over the past years'. The root cause of the present crisis is the rising wage-productivity gap‟. Unless this gap is reduced to the minimum so that the aggregate market demand increases to boost further production, the vicious cycle of this crisis will continue.

Views expressed are personal