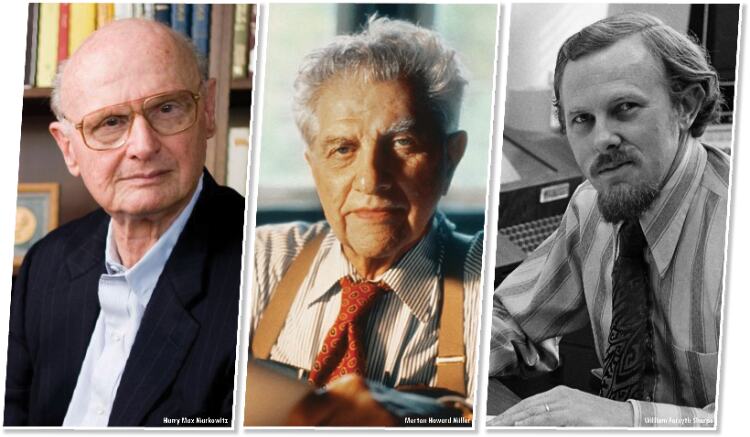

Wizards of finance

Works of Harry Markowitz, Merton Miller and William Sharpe, though critisised for their restrictive assumptions, continue to guide financial markets across the world

The 1990 Nobel Prize in Economic Sciences was awarded to three American economists: Harry Markowitz of the City University of New York (for the theory of portfolio choice), Merton Miller of University of Chicago (for the theory of corporate finance) and William Sharpe of Stanford University (for the Capital Asset Pricing Model)

Markowitz studied liberal arts at undergraduate level in Chicago but later chose to specialize in economics. There, he had the opportunity to study under economists like Friedman, Koopmans, Marschak and Savage. While still a student, he was invited to become a member of the Cowles Commission which was still at Chicago at the time. In 1954, he received a PhD in economics from the University of Chicago with a thesis on the portfolio theory.

Sharpe first enrolled at University of California at Berkeley to study medicine. In the first year itself he changed to UCLA to study business administration, and finally changed to economics. During his undergraduate studies, Armen Alchian became his mentor and Fred Weston introduced him to Markowitz's work. In 1956, Sharpe joined the Rand Corporation, where he also started working for a PhD at UCLA under the supervision of Alchian. Sharpe got his PhD in 1961 with a thesis on a model of security prices.

Miller attended Harvard University as an undergraduate student. He worked during the Second World War as an economist in the division of tax research of the Treasury Department, and received PhD in economics from John Hopkins University in 1952. After this he became a visiting assistant lecturer at the London School of Economics. Miller is best known for the CAPM and his many works with Modigliani.

In this article, we will review the main works of the three economists discussed above and how their work's application has helped shape policies.

The Main works of Markowitz, Sharpe and Miller

Markowitz and the Modern Portfolio Theory

Markowitz was the founder of modern portfolio theory. Prior to Markowitz's research, investing was largely seen in terms of investing in stocks and getting a good return. Markowitz suggested that in light of the risk inherent in stock market investing, it would be better to focus on a 'portfolio' of securities or stocks, so that the risk could be minimized and the return could be maximized. In Markowitz's words: "Since there were two criteria, risk and return, it was natural to assume that investors selected from the set of Pareto optimal risk-return combinations". In technical terms, this is known as the Markowitz efficient set, which is nothing but the optimal risk-return combination of a portfolio. To further explain, this gives us the stocks that will give maximum returns for a given level of risk. Markowitz also introduced the theory of mean-variance portfolio, which basically tells us that the risk is measured by the variance of the distribution around the mean, its range etc., known as variance and covariance in statistical terms. Hence, the qualification of risk and the need for optimisation of return with lowest risk are the contributions of Markowitz.

It may be recalled that the traditional theory of portfolio says that selection of securities should be based on lowest risk, as measured by its standard deviation from the mean of expected returns. The greater the variability of returns, the greater is the risk. The modern Portfolio Theory, on the other hand emphasizes the need for maximization of returns through a combination of securities, whose total variability is lower. In more technical terms, expected returns, the variance of these returns and covariance of the returns of the securities within the portfolio are to be considered for the choice of a portfolio. A portfolio is said to be efficient if it is expected to yield the highest possible return for the lowest risk or a given level of risk. This, in turn, is best achieved through the diversification of the portfolios.

William Sharpe's CAPM

Sharpe is well-known for the Capital Asset Pricing Model (CAPM). Sharpe basically used Markowitz's portfolio theory as the basis for his model. This was published in his essay titled, 'Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk' (1964). Taking off from where Markowitz left, Sharpe suggested that one needed to take higher risk to get a higher return. As the Nobel website tells us:

The basis of the CAPM is that an individual investor can choose exposure to risk through a combination of lending-borrowing and a suitably composed (optimal) portfolio of risky securities. According to the CAPM, the composition of this optimal risk portfolio depends on the investor's assessment of the future prospects of different securities, and not on the investors' own attitudes towards risk. The latter is reflected solely in the choice of a combination of a risk portfolio and risk-free investment (for instance treasury bills) or borrowing. In the case of an investor who does not have any special information, i.e., better information than other investors, there is no reason to hold a different portfolio of shares than other investors, i.e., a so-called market portfolio of shares.

The CAPM model says that the expected total return of a stock should be the risk-free rate of return plus the beta of the investment multiplied by the market risk premium. 'Beta' is nothing but a measure of portfolio risk that cannot be diversified away by mixing stocks. Simply put, it indicates the stock's marginal contribution to the risk of the entire market portfolio of risky securities. Shares with a beta coefficient greater than one have an above-average effect on the risk of the aggregate portfolio, whereas shares with a beta coefficient of less than one have a lower than average effect on the risk of the aggregate portfolio. The CAPM therefore tells us the following:

Expected Total Return = Risk Free return + Beta x market risk premium

In other words, a portfolio with a beta of two should have an excess return that is twice as high as the market as a whole. If the market's expected return is eight per cent and the riskless return is five per cent, the market's expected excess return is three per cent (eight minus five) and the portfolio's expected excess return is therefore 6 percent (twice the market's expected excess return of three per cent). The portfolio's expected total return would then be 11 per cent (six plus the riskless return of five).

Sharpe also created the Sharpe ratio. The Sharpe ratio measures the excess return earned over the risk-free rate per unit of volatility. The ratio tells us if higher returns are due to investment decisions or risk. Two portfolios may have similar returns, but the Sharpe ratio shows which one is taking more risk to attain that return. Higher returns with lower risk are better, and the Sharpe ratio helps investors find that mix.

Merton Miller, the theory of Corporate Finance and the Miller-Modigliani Theorem

Miller is best known for the Miller-Modigliani theorem. This theorem was first discussed in a paper that they wrote in 1958, titled "The Cost of Capital, Corporate Finance and the Theory of Investment". The theorem, also called the invariance theorem, consists of two propositions. The first proposition states that with well-functioning capital markets, the mix of equity and debt used to finance a company is irrelevant to the firm's value, since equity holders can finance their equity by leveraging themselves; if some optimal mix of debt and equity could be found to minimize the cost of capital and increase firm value, then equity holders could simply achieve the same ratio by borrowing themselves regardless of the firm's own capital structure. This theorem was under the assumption of perfect financial markets, zero transaction costs, no taxes and no information asymmetry.

The second proposition leading from the first one was that the company's cost of equity is directly proportional to the company's leverage level. An increase in leverage level induces higher default probability to a company. Therefore, investors tend to demand a higher cost of equity (return) to be compensated for the additional risk. In other words, the dividend policy of the firm does not affect its market value.

It may be noted that the two invariance theorems were based on the assumption that individual stockholders also had access to the same stock market that the firms had. The theorems were therefore also laying down the relation between the firm's decision and the individual investor's decision on investment strategy. Since individuals would balance the risk and the returns, firms may concentrate only on maximizing net wealth, rather than minimizing risks through diversification.

As noted above, the theorems were based on restrictive assumptions of perfect markets, zero transaction costs, zero taxes and no information asymmetry. Later Miller relaxed many of these assumptions, but his conclusions remained largely the same.

Applications to Policy and other areas

Markowitz's primary contribution was the formulation of a rigorous portfolio selection theory, taking into account the trade-off between risk and return under uncertainty. This theory also became the basis for the CAPM model and other research in financial economics. His insight was that the risk of an asset is not the risk of each asset in isolation, but the contribution of each asset to the risk of the aggregate portfolio. Markowitz's theory has been applied world over in evaluating portfolios. Even the performance of market indices (such as Sensex or Nifty) is done using the tools of this theory. This theory has also been applied to non-financial assets but with lesser success.

Sharpe's CAPM is used widely in empirical analysis and has found varied applications. It is routinely used along with the Beta in calculating cost of capital for a firm. In particular, such calculations are critical for mergers and acquisitions, in assessing the pricing of public utilities and comparative analysis of investment strategies. Similarly, Sharpe Ratio, which is a measure of risk-adjusted return, can be used for performance measurement, risk management and to test market efficiency. Many funds routinely give the Sharpe ratio to reflect the volatility.

The Miller-Modigliani theorems have also found applications in the financial world, particularly, the idea of arbitrage. Given that the theorem postulated something dramatic: that a firm's value was independent of its capital structure, it was ignored by most practicing finance professionals. However, it slowly found applications in strategies of various firm, including their dividend policies. Further, firms started looking at their equity structure closely and correlating this with their cost of capital.

Conclusion

The works of Markowitz, Sharpe and Miller were landmarks in the world of financial economics. However, all three have been criticised for their restrictive assumptions (perfect markets, perfect information, zero taxes and zero transaction costs). Further, their works have also found mixed results in various empirical studies. Also, the theories work on 'expected values' and are based on past observations. Projecting these into the future can therefore lead to mixed results. Be that as it may, their theories continue to guide us even today in areas of portfolio selection, assessing risk vs returns, diversification, leverage and similar areas.

The writer is an IAS officer, working as Principal Resident Commissioner, Government of West Bengal. Views expressed are personal