The Copper Imperative

The global clean-energy race hinges on copper, and India must urgently rebuild domestic refining capacity to secure its future and avoid dependence

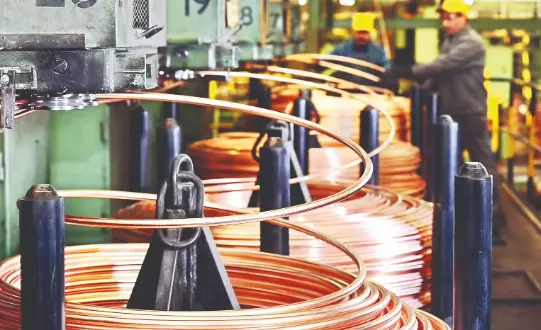

Copper is quietly becoming the world’s most critical industrial metal, the invisible wiring of the 21st-century economy. It powers electric vehicles, clean energy grids, semiconductors, data centres, and even space exploration. As the planet races toward decarbonization, copper has moved from the shadows of commodity markets to the centre of global strategy.

Every electric vehicle uses nearly four times more copper than a conventional car. Solar farms, wind turbines, and grid-scale batteries are equally copper-intensive. The International Energy Agency (IEA) estimates that global copper demand, now at around 26 million metric tonnes (MMT) annually, will climb to 33 MMT by 2035 and to nearly 40 MMT by 2050.

Nations that can secure, refine, and control the copper value chain will command the green industrial era. That race is already underway and is currently led by China and the United States.

In Washington, copper has become a quiet pillar of industrial policy. American policymakers see copper not just as an industrial input, but as a national security asset essential for energy transition and defence technologies.

Against this backdrop, India’s story is one of paradox. Once a regional leader in refined copper, it is now a net importer. Until a few years ago, India’s smelting capacity was anchored by one powerhouse: the Sterlite Copper plant in Thoothukudi, Tamil Nadu. The facility met over a third of India’s copper demand, fueling power, electronics, and renewable industries across the country. That changed abruptly in 2018 when the plant was shut down.

The consequences were immediate. India’s copper trade balance flipped from surplus to deficit. In 2024, India imported copper and copper products worth about USD 10.33 billion, while exports stood at just USD 2.1 billion.

The closure didn’t just idle a plant; it disrupted a national ecosystem. Power infrastructure projects saw costs rise, small manufacturers lost competitiveness, and Tamil Nadu’s non-ferrous industry began to hollow out. Between 2014 and 2018 alone, Sterlite Copper had contributed Rs 13,500 crore to government revenues and supported nearly 25,000 jobs directly and indirectly.

While India grappled with its domestic vacuum, Pakistan stepped into the gap. Through partnerships under the China–Pakistan Economic Corridor (CPEC), Islamabad accelerated development of the Reko Diq and Saindak mines in Balochistan — two of the richest undeveloped copper-gold deposits globally.

By 2024, Pakistan’s copper exports crossed USD 840 million, with over 90 per cent routed to China. In just the first half of 2025, Pakistan shipped USD 482.41 million in copper articles to China. The scale may be small, but the symbolism is not. Pakistan is quietly positioning itself as a raw material supplier within a China-centric industrial network, a role India once played with much greater leverage.

Globally, copper supply is under severe pressure. The IEA projects that by 2050, the world could face a shortfall of up to 8 MMT a year if new capacity isn’t built. China already refines nearly 70 per cent of global output, while the U.S. and the EU are rushing to onshore capacity and secure Latin American mines.

For India, which has pledged 500 gigawatts of renewable energy by 2030 and a net-zero goal by 2070, dependence on imported copper is a strategic vulnerability. A single offshore wind turbine requires several tonnes of copper, and an electric car requires almost 80 kilograms. Without a stable domestic supply, India risks turning its energy transition into an import-led exercise.

The proposed reopening of Sterlite Copper is therefore not just an industrial decision — it is a national strategic imperative. Before its closure, the plant was among the world’s most efficient smelters, contributing 3 per cent of Tamil Nadu’s GDP and sustaining ancillary sectors from fertiliser to cement and electrical components. Even its byproducts were circular-economy assets, replacing 2,00,000 tonnes of river sand and 2,30,000 tonnes of iron ore in construction.

Reopening Sterlite with stricter environmental safeguards, transparent oversight, and modern emission controls could restore over 40 per cent of India’s domestic refining capacity in one stroke. It would also signal that India intends to reclaim its place in the global copper chain rather than outsource its green industrial future.

Copper is more than a metal; it’s the conductor of modern civilisation. The nations that dominate its production and processing will shape the next century’s industrial order. The United States has recognised it. China has mastered it. Pakistan, with Chinese backing, has joined the race.

For India, the path forward is clear. Rebuild smelting capacity, unlock reserves, incentivise recycling, and above all, reopen Sterlite under world-class environmental standards. If the 20th century was defined by oil economies, the 21st will be defined by copper economies. And India must decide — to own the value chain, or be owned by it.

Views expressed are personal. The writer is a senior journalist with diverse experience across leading national news organisations