SEZs Beyond Cities

Expanding Special Economic Zones into remote India can boost exports, jobs and infrastructure while reducing migration and ensuring more balanced regional growth

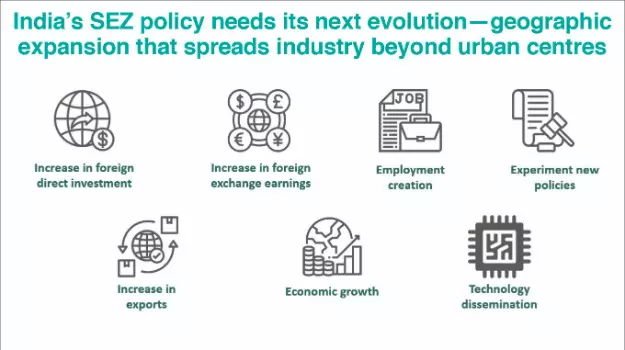

Some legal reforms, if implemented properly, can improve the country’s economy drastically and at a much faster pace. One such reform has been the introduction and gradual liberalisation of Special Economic Zones (SEZs). These zones were created to solve several long-standing challenges faced by industries, such as complicated procedures, unstable and high tax rules, and delays that discouraged foreign investment.

An important next step is to expand SEZs into remote and underdeveloped parts of India. Large parts of rural and semi-rural India still remain untouched by industrial growth. Setting up SEZs in remote districts can bring many benefits, of course, without hampering the environment in any manner. It can attract new industries to places with limited economic activity, create much-needed jobs, improve basic infrastructure like roads, electricity and internet, reduce migration to big cities, support balanced regional development, and encourage local entrepreneurship and skill development.

India is currently focused on strengthening its technological capabilities, increasing manufacturing capacity, and building stronger partnerships with global companies. This focus can be extended to remote areas. To achieve these goals, the country needs simpler rules, predictable tax systems, and a supportive business environment. Creating more SEZs in remote parts, where businesses receive special tax breaks, customs benefits, and easier regulations, would be a major step. In the past, industries struggled under multiple permissions, complex compliance burdens, and uncertain policies. These issues made it difficult for foreign companies to invest confidently in India. The SEZ framework was developed to overcome these hurdles by offering a space with streamlined regulations, faster clearances, and better infrastructure.

With further liberalisation and wider geographical spread, especially into remote regions, SEZs can become a powerful tool for boosting exports, attracting investment, and promoting inclusive, balanced economic growth across the country.

The main legal framework behind SEZs is the Special Economic Zones Act, 2005. This law lays down how SEZs are created, approved, and managed. It also establishes important bodies such as the Board of Approval (BOA), which considers proposals for new SEZs; Development Commissioners, who oversee day-to-day functioning and support units inside SEZs; and a simpler single-window system meant to speed up permissions and reduce red tape. The Act has been amended from time to time to reflect modern needs, including a major amendment in 2019. Supporting this Act are the SEZ Rules, 2006, which provide detailed procedures for land allocation, setting up units, tax benefits, and compliance. These rules are updated frequently, and several amendments were made between 2023 and 2025 to ensure that the system remains investor-friendly and aligned with global standards.

SEZs were created primarily to promote exports, but over the years, they have also become hubs for employment, technology, and regional development. Companies operating inside SEZs receive several major benefits, such as duty-free imports and procurement—businesses in SEZs can import machinery, equipment, raw materials, and components without paying customs duty. They can also buy goods from the domestic market at zero duty, as long as the items are used for authorised operations. This gives companies a big cost advantage, especially in manufacturing sectors like electronics, pharmaceuticals, textiles, and engineering. Income-tax benefits under Section 10AA mean SEZ units receive income-tax deductions or holidays on profits earned from exports for a fixed period. Although these benefits have some clauses, they remain a major attraction for units established within the eligible period. GST zero-rated benefits mean that under India’s GST system, subject to certain provisions and documentation, supplies to SEZs are treated as zero-rated. No IGST is charged when goods or services are supplied to SEZs, businesses can claim refunds easily, and cash flow improves, especially for export-focused companies. Simplified rules and faster clearances ensure that SEZs offer a more liberal and business-friendly environment with fewer regulatory restrictions, simplified procedures, and single-window clearance mechanisms to attract investment and promote exports. Processes relating to customs, foreign exchange, and trade are fast-tracked. They are guided by the SEZ Act, 2005; the SEZ Rules, 2006; the Customs Act, which treats SEZs as special territories for customs purposes; the Foreign Trade Policy (DGFT), which governs exports and imports; and FEMA and RBI regulations, which manage foreign exchange, export receipts, and external borrowings.

While SEZs have helped India grow its export base and attract investment, there is still tremendous untapped potential. Liberalising SEZ rules further, especially in the areas of land use, domestic sales, labour regulations, and compliance, could make India an even more attractive destination for global companies. Taking SEZs to the remotest parts of the country, without hampering the environment, would speed up all-around development.

As the world searches for alternatives to traditional manufacturing hubs, India has a rare opportunity to position itself as a reliable partner. Establishing SEZs in remote areas can be powerful engines of national growth, apart from developing remote regions with speed.

Views expressed are personal. The writer is a practising Advocate in the Supreme Court and High Court of Delhi