Ending a deadlock

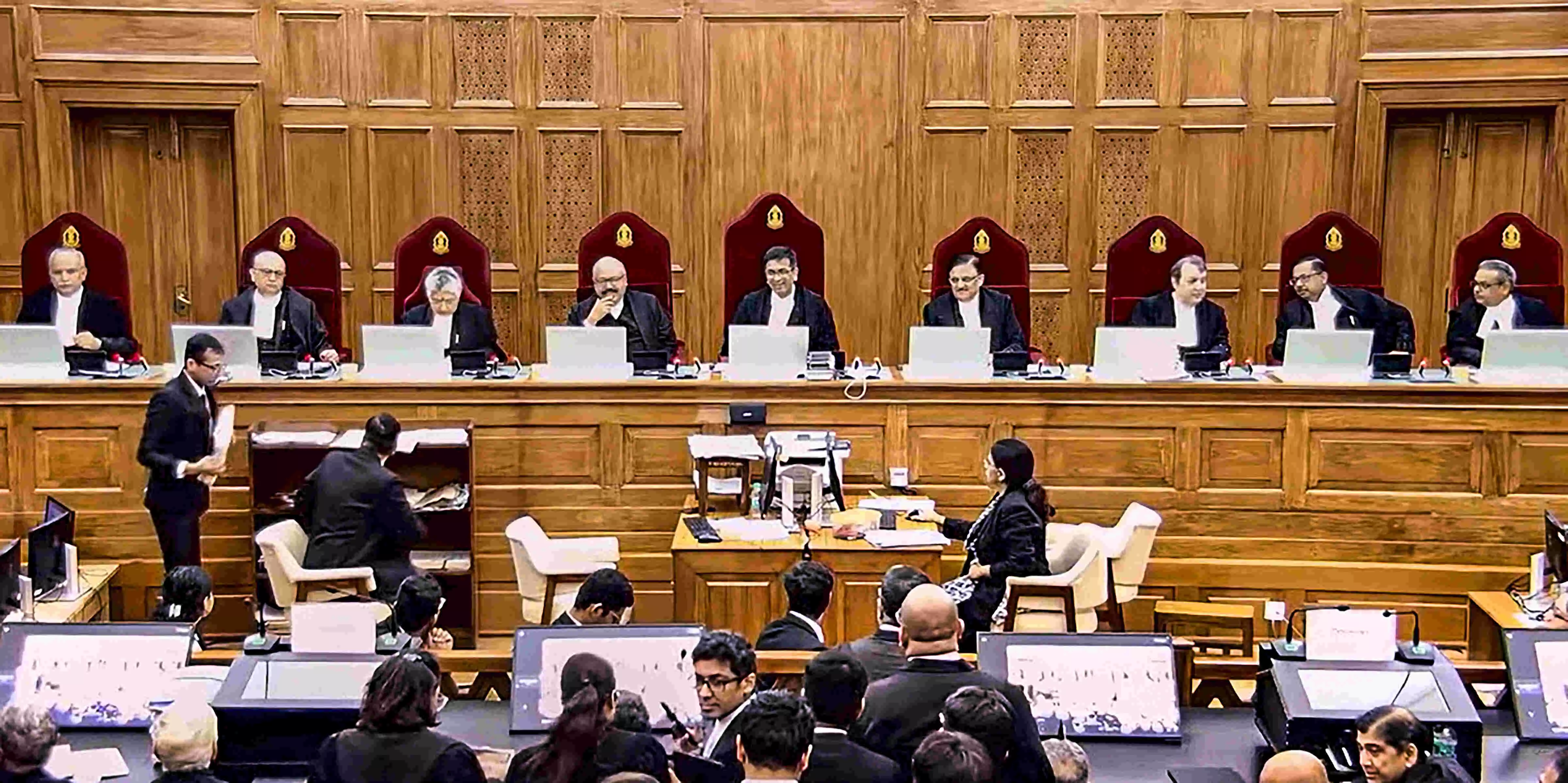

The Supreme Court’s recent judgement permitting states to levy taxes on mining activities within their respective territories is a breakthrough decision with far-reaching implications. The 8:1 judgment, authored by none other than the Chief Justice of India DY Chandrachud, provides much-needed clarity on the legislative competence of states to impose taxes on mining activities. With the verdict, a longstanding legal ambiguity now comes to an end. Experts view this ruling as reinforcing the principles of fiscal federalism and state sovereignty under the Indian Constitution.

The verdict delineates a crucial distinction between royalties and taxes. While royalties are contractual payments from lessees to lessors for the extraction of minerals, taxes are statutory impositions by the state. It explicitly clarifies that royalties, as outlined under the Mines and Minerals (Development and Regulation) Act, 1957, are not equivalent to taxes. It may be recalled that back in 1989, the court had ruled that states could collect royalties but not impose additional taxes on mining and mineral development. The states can now impose taxes in addition to royalties without overstepping their legislative boundaries.

The Supreme Court ruling is a welcome development for states rich in mineral resources. By affirming their right to impose taxes on mining activities, the apex court has empowered them to generate substantial revenue, which can be crucial for their development. CJI Chandrachud minced no words in saying that state legislatures derive their power to tax mines and quarries under Article 246 of the Indian Constitution, read with Entry 49 of List II (State list) of the Seventh Schedule, which deals with tax on lands and buildings. In contrast, the Entry 54 of List I (Union List) is a general provision conferring the Centre the power to regulate mines and minerals development declared by parliamentary law. It doesn’t entail taxation powers. The apex court categorically held that limitations imposed by Parliament in the MMDR Act did not influence State taxation of mining lands under Entry 49 in the State List. The court also examined Entries 23 and 50 of the State List, which deal with states’ power to regulate mines and mineral development, and the power to impose tax on mineral rights, respectively.

The judgment aligns with the spirit of fiscal federalism, which can also be viewed as a basic feature of the Indian Constitution. Fiscal federalism allows states the autonomy to manage their resources and finances while ensuring a balanced distribution of wealth across the nation. Chief Justice Chandrachud clearly stated that undermining the taxing powers of state legislatures would impede their ability to deliver on welfare schemes and services, which in turn would impact the state of infrastructure, health, education, and R&D.

However, one cannot completely overlook the solitary dissenting note of Justice BV Nagarathna who highlighted concerns about granting states unchecked taxing powers. She cautioned against potential market distortions if mineral-rich states impose exorbitant taxes. While her concerns are valid, the majority opinion’s emphasis on the constitutional benchmarks ensures that state taxation powers remain subject to limitations imposed by Parliament. The upcoming hearing (July 31) on whether the judgment should be applied retrospectively or prospectively will resolve the final uncertainties in the case. If applied retrospectively, states could gain significant revenue from past mining activities.