Dual challenge

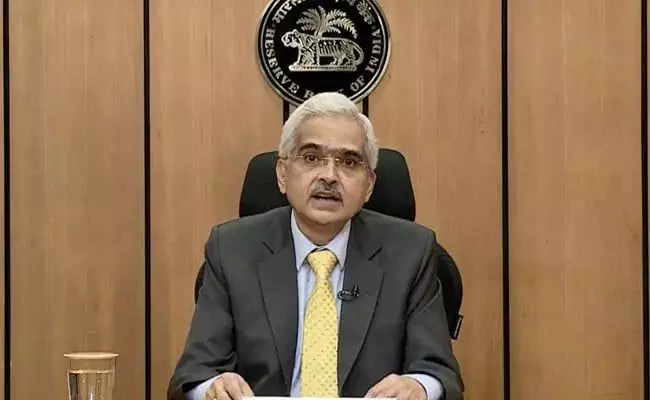

Falling along the expected lines, the Reserve Bank of India (RBI) dialed down its pace of rate hikes to 35 basis points in its December MPC meeting. Prior to this, the RBI had increased the repo rate by 50 per cent each in September and August, and 40 per cent in May — a cumulative hike of 190 basis points. With the 35-basis point increase in the recent MPC meeting, the repo rate now stands at 6.25 per cent. The toning down of the repo rate hike may have come in the wake of the prevailing challenges on the growth front, alongside inflation. While the Central bank's resolve to contain inflation — first within the tolerance band below six per cent and then to the ideal value of four per cent — has been pronounced, the growth challenge remains largely unuttered. The growth projections for the current fiscal have been marginally lowered to 6.8 per cent, with the Q3 growth figures being as low as 4.4 per cent. The RBI governor, however, didn't forget to put forth the caveat that India is still "among the fastest-growing major economies in the world." He particularly cited year-on-year growth in terms of non-food bank credit, passenger vehicle sales and domestic air passenger traffic. Citing double-digit bank credit growth for eight straight months, he said that India remains a "bright spot" in the world. Agricultural growth is also expected to be up to the mark, with the Rabi season getting off to a "strong start." In addition, the manufacturing and the services sectors have also registered an uptick, lately. These assuring claims notwithstanding, ensuring growth remains a serious challenge parallel to containing inflation. It is not a mystery that apart from domestic considerations, RBI's monetary policy decisions are by and large driven by the Fed rate hikes. However, despite the Fed being firm on its monetary policy tightening, if the RBI has reduced the quantum of rate hikes, then there may be some negative hints on the growth side. Alternatively, this can also just be a reflection of slowing down of Fed rate hikes. In future, too, RBI's hopes appear to be incumbent upon the fact that Fed's monetary policy tightening cannot "continue endlessly." Apart from Fed rate hikes, a host of other factors determine the policy decisions of the RBI, which also reflect upon the overall state of the economy and liquidity in the money market. Among the positives, construction activities are witnessing an uptick, agriculture has been resilient, remittances are reported to have surged and food inflation has moderated. On the flip side, export prospects remain fractured, geopolitical uncertainty on account of the Russia-Ukraine war continues and core inflation has shown no signs of abatement. Core inflation, it may be noted, is obtained by excluding food and energy fluctuations from the overall inflation. In his address, the RBI governor has made it amply clear that policy tightening will continue through the current fiscal. In the first place, the MPC has decided to withdraw its accommodative stance, effectively meaning that its focus will be more on containing inflation than promoting growth. Secondly, in light of the projections that Q1 inflation for the next fiscal will stand at 5 per cent and Q2 inflation at 5.4 per cent, the RBI governor confirmed that there "will be no let-up" in the efforts to bring down inflation, first below 6 per cent and then to the 4 per cent target. Against these assertions, the RBI is expected to make one more rate hike in February — taking the terminal rate hike to 6.5 per cent. Some experts also opine that RBI may stall rate hikes beyond February, providing the requisite time lag for the rate hikes made till date to show impact on the ground. However, nothing can be said firmly, as challenges continue and the Fed remains adamant.