Achievable objective

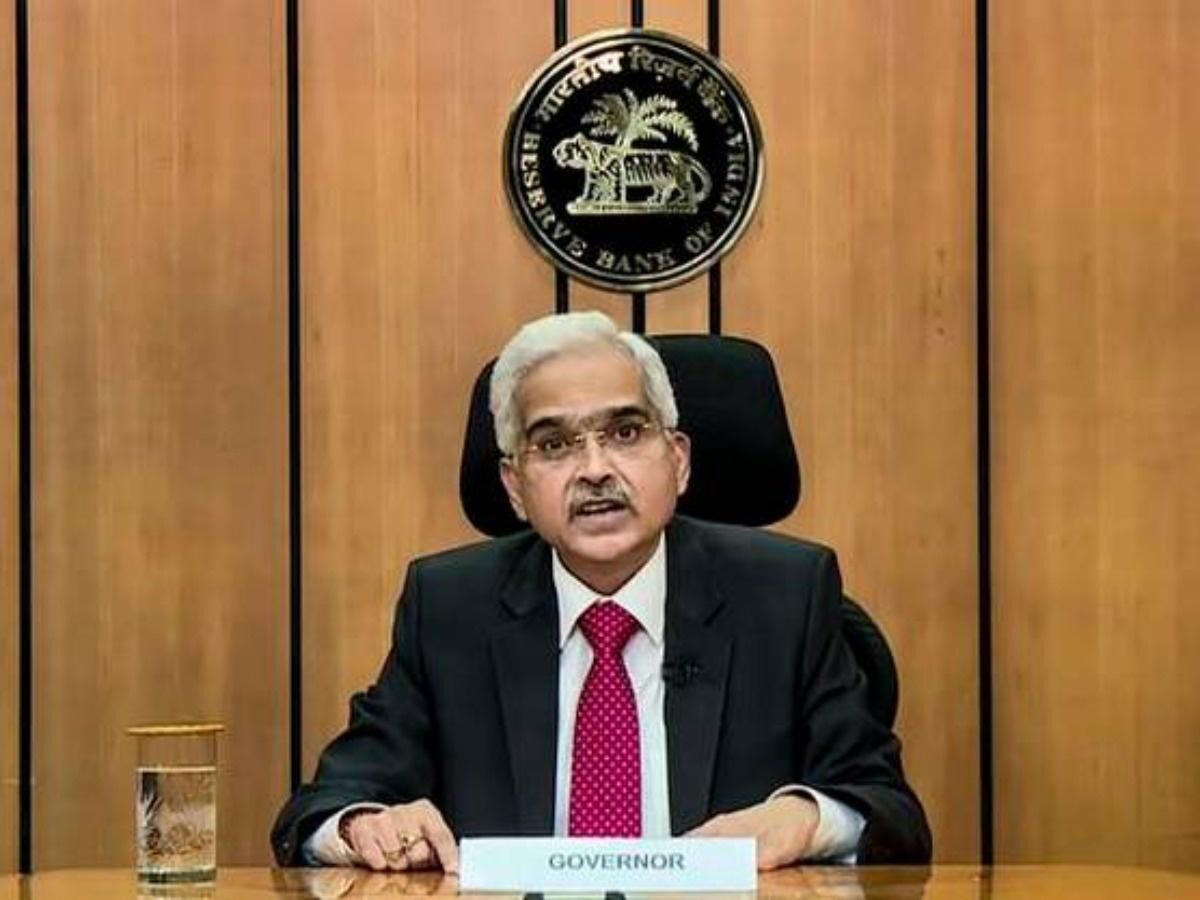

Along the expected lines, the Reserve Bank of India (RBI) has raised the repo rate by 50 basis points (bps) to 4.90 per cent in its recent Monetary Policy Committee (MPC) review meeting. Earlier, just over a month ago in an off-cycle meet, the RBI had raised the repo rate by 40 bps to 4.40 per cent. The RBI has now aligned its actions with Central Banks across the world in taming inflation. Its move is also in sync with the government's actions aimed at reining in inflation. More importantly, by making a shift from 'accommodative' to 'withdrawal of accommodation' stance, the Central Bank has sent a clear signal that it will likely raise policy rates in coming MPC meetings as well. Increase in repo rate appeared imperative as the baseline Consumer Price Inflation (CPI) is now projected at 6.7 per cent for FY 2022-23, up from 5.7 per cent projected during April. The quarterly breakdown goes as follows — Q1 at 7.5 per cent; Q2 at 7.4 per cent; Q3 at 6.2 per cent; and Q4 at 5.8 per cent. Evidently, the Q3 projections too are beyond the RBI's threshold limit. These estimates are based on the assumption of a normal monsoon and average crude oil prices at USD 105 barrel. The RBI has primarily attributed the soaring inflation rate to the Russia-Ukraine war. It also enumerated responsible factors including stunted rabi output on account of heatwaves and high fuel prices. The Russia-Ukraine war is showing no signs of abatement as of now but the government's slashing of excise duty on petrol and diesel has certainly helped in maintaining a tab on inflation. The RBI, in a recent survey, has stated that after the excise duty cut, three-months-ahead inflation expectations have moderated by 190 basis points. The intensity of monsoon and rabi output will remain important. The RBI noted that 75 bps of the 100 bps increase in the revised inflation forecast for FY23 is attributable to food inflation. While the RBI has played its part quite well, the government should consider turning up with assistive policies to ensure that food production and supply remain intact. Reining in inflation has proved to be an uphill task for countries across the globe but, for India, with its sound economic fundamentals and coordinated efforts of the government and the Central Bank, the task is achievable. It may be noted that inflation may even be obstructing India's path to growth. However, the Monetary Policy Committee has exuded confidence in the economy by retaining the real GDP growth forecast at 7.2 per cent for FY 2022-23. The quarterly breakdown goes as follows: 16.2 per cent in Q1, 6.2 per cent in Q2, 4.1 per cent in Q3 and 4.0 per cent in Q4. With the RBI having prioritised its policies "to control inflation without losing sight of the growth requirements," one can sense a spirit of reassurance. Experts are expecting further hikes in policy rates in next MPC meetings. It is high time that both the government and the Central bank continue to work in tandem to contain second-round effects of supply side shocks on the economy. RBI's revised inflation targets appear achievable.