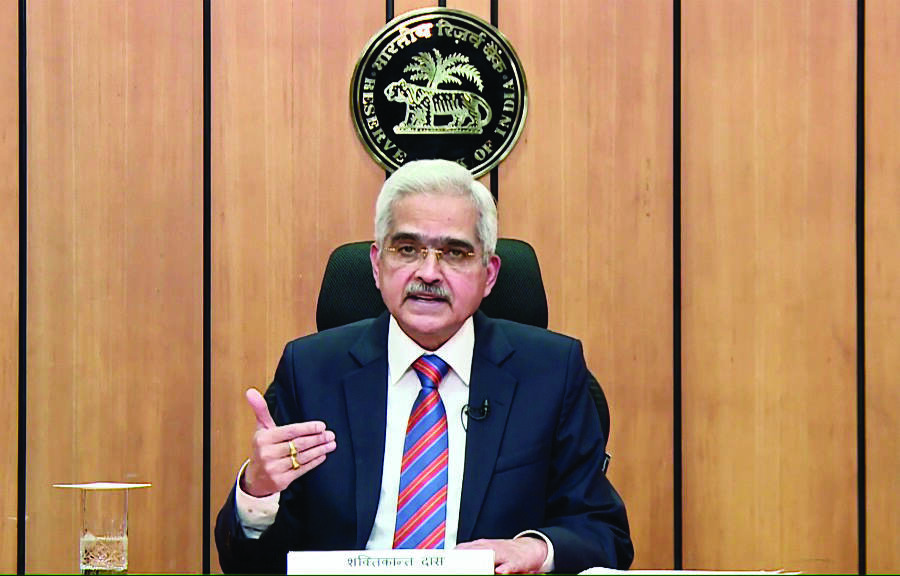

Short-term reward-seeking culture should be avoided: RBI Governor

Mumbai: The Reserve Bank of India Governor Shaktikanta Das on Thursday said businesses should avoid having an aggressive short-term reward-seeking culture without considering the build-up of excessive risks in their balance sheets.

Das said doing business involves risk taking. But before taking the risk, the upside and downside will have to be carefully considered.

"Businesses should avoid aggressive short-term reward-seeking culture without regard for the build-up of excessive risk in the balance sheet," Das said while delivering a speech at the Iconic Week celebrations, as part of the Azadi Ka Amrit Mahotsav', to mark the 75th anniversary of Independence.

The event was organised by the Central Board of Indirect Taxes and Customs (CBIC) here.

The common characteristics of some of the inappropriate business models or strategies that have come to the RBI's notice includes inappropriate funding structure, building asset liability mismatches, which are highly risky and not sustainable, he said.

Besides, unrealistic strategic assumptions, particularly excessive optimism about capabilities, growth opportunities and market trends may lead to poor strategic decisions, he noted.

He said the RBI has mandated a host of disclosure for its regulated entities to ensure that they make full disclosure of all material information in their financial statements.

Tarun Bajaj, Revenue Secretary and Vivek Johri, Chairman, CBIC were also present at the event.

Meanwhile, the Reserve Bank of India will soon come out with regulatory architecture for digital lending platforms, many of which are unauthorised and illegal, Governor Shaktikanta Das said on Thursday.

There have been increasing cases of alleged suicides of borrowers due to harassment by a few of the operators of digital lending apps.

"I think very soon we will be coming out with a broad regulatory architecture, which should be able to address the challenges that we are confronted with regard to lending through digital platforms, many of which are unauthorised, unregistered and, should I say, illegal," Das said while delivering a lecture on - Indian Businesses (Past, Present and Future).