Sensex jumps 1,016 pts over RBI policy, easing Omicron concerns

Mumbai: The Sensex skyrocketed 1,016 points while the Nifty rallied past the 17,400-mark on Wednesday as easing concerns over the Omicron variant and RBI's accommodative policy stance galvanised investor sentiment.

Bulls were enthused by a positive trend in global markets amid reports that the new coronavirus strain is unlikely to be more severe than the Delta variant, removing market concerns regarding its economic impact. Investors saw their wealth rise by more than Rs 3.96 lakh crore on Wednesday.

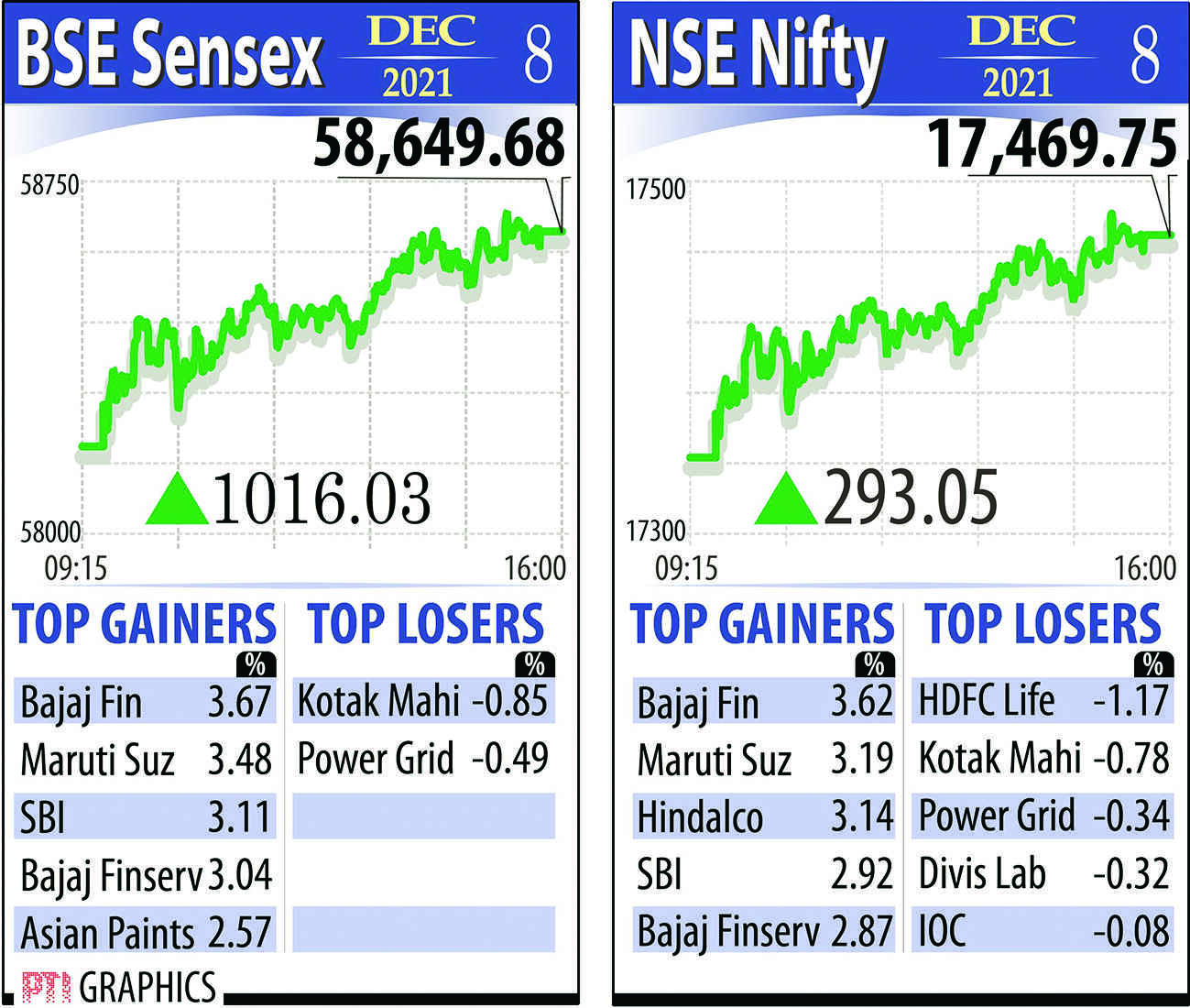

Extending its winning run to the second straight session, the 30-share BSE Sensex zoomed 1,016.03 points or 1.76 per cent to finish at 58,649.68. This was its biggest single-day jump since March 30 this year, when it had surged 1,128.08 points.

Similarly, the broader NSE Nifty rallied 293.05 points or 1.71 per cent to 17,469.75.

Bajaj Finance was the top gainer in the Sensex pack, spurting 3.67 per cent, followed by Maruti, SBI, Bajaj Finserv, Asian Paints, ICICI Bank and Infosys.

In contrast, Kotak Bank and PowerGrid were the only laggards, slipping up to 0.85 per cent. The Reserve Bank of India (RBI) on Wednesday kept borrowing costs at a record-low for the ninth consecutive time as it decided to continue supporting economic growth.

The six-member Monetary Policy Committee (MPC), which has paused rate changes since August last year, unanimously decided to keep the benchmark repurchase rate at 4 per cent and voted 5-1 to retain its accommodative policy stance as long as necessary.

The central bank also kept the GDP growth projections unchanged at 9.5 per cent for the current fiscal and retained the inflation forecast of 5.3 per cent for the full year.

The bullish undertone was reflected in the sectoral indices and advance-declines as the market breadth was healthy with small and midcaps too participating in the rally, he noted.

Most of the rate-sensitive auto, financial and realty stocks ended in the green.

All sectoral indices ended on a positive note, with BSE auto, teck, telecom, IT and metal indices climbing as much as 2.24 per cent. Broader BSE midcap and smallcap indices rose up to 1.50 per cent.

Global equities mostly continued their post-Omicron rebound. In Asia, bourses in Shanghai, Hong Kong, Seoul and Tokyo ended with significant gains.

Meanwhile, international oil benchmark Brent crude inched up 0.60 per cent to $75.89 per barrel.

The rupee staged a smart recovery from intra-day lows to close with a marginal 2 paise loss at 75.46 against the US dollar.

Foreign institutional investors remained net sellers in the capital markets, pulling out Rs 2,584.97 crore on Tuesday, as per provisional data.