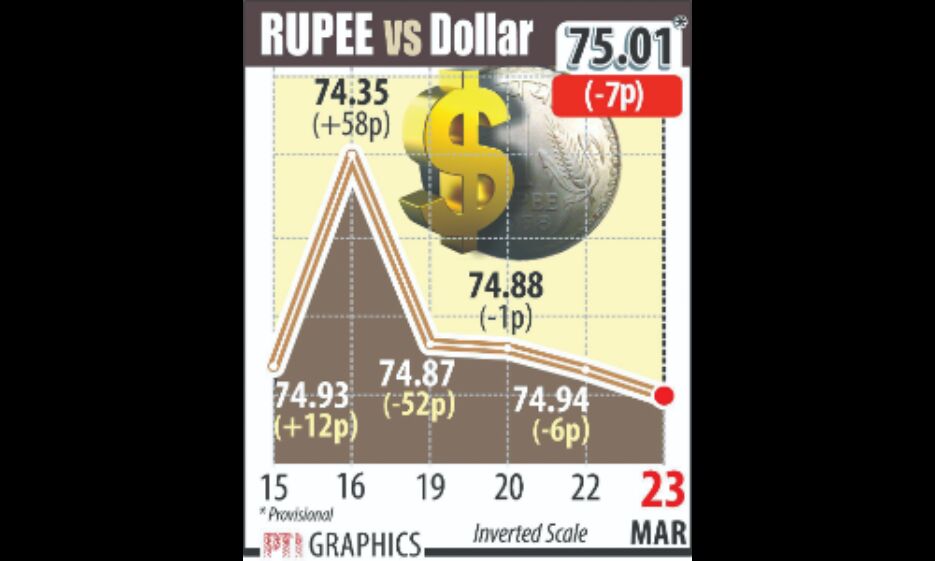

Rupee falls by 7 paise to close below 75 against dollar

Mumbai: Falling for the fourth session in a row, the rupee on Friday closed below the 75 mark against the US currency for the first time in nearly two weeks as a record spike in COVID-19 cases and losses in the domestic equities weighed on investor sentiment.

Forex traders said heavy selloff in domestic equities amid fears that a rapid resurgence of COVID-19 cases in the country can disrupt economic recovery kept investors on edge.

At the interbank forex market, the local unit opened lower at 75.02 against the previous close of 74.94 and traded in the range of 74.75 to 75.07 during the day.

The rupee finally ended at 75.01, the lowest closing level since April 12, registering a fall of 7 paise over its previous close. In the four sessions since Monday, the rupee has dropped by 0.89 per cent or 66 paise.

"The second wave of COVID-19 in India is keeping market risk sentiment very light and the USDINR spot is afloat. So, the USDINR bulls will continue to be on driver's seat, but we will only have to look for RBI intervention. We expect a broader USDINR range to be 74.50-75.50," said Rahul Gupta, Head Of Research- Currency, Emkay Global Financial Services.

With a record single-day rise of 3,32,730 new coronavirus infections, India's total tally of COVID-19 cases climbed to 1,62,63,695, while active cases crossed the 24-lakh mark, according to the Union Health Ministry data updated on Friday.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, fell 0.34 per cent to 91.02. Brent crude futures, the global oil benchmark, were trading 0.06 per cent down at USD 65.36 per barrel.

On the domestic equity market front, the BSE Sensex ended 202.22 points or 0.42 per cent lower at 47,878.45, while the broader NSE Nifty declined 64.80 points or 0.45 per cent to 14,341.35.

Foreign institutional investors (FIIs) remained net sellers in the capital markets, as they pulled out Rs 909.56 crore on Thursday, according to the provisional data.

On a weekly basis, the local unit has depreciated 66 paise against the US dollar.

"The Indian rupee depreciated against the US dollar this Friday and this week, as a continuous surge in coronavirus cases raised fears of continued economic pain and foreign equity outflows," said Sriram Iyer, Senior Research Analyst at Reliance Securities.

However, dollar sales likely by the Reserve Bank of India, along with exporter covering capped large-scale losses in the domestic unit, he added.

Moreover, added fears of downgrades from rating agencies due to the rise in COVID-19 cases also weighed on sentiments, Iyer said.

According to Dilip Parmar, Research Analyst, HDFC Securities, the rupee depreciated amid surge in virus cases and risk-off sentiments.

"In the near-term, the rupee is likely to remain under pressure on rising COVID-19 cases and lockdowns/restrictions across states weighing on sentiments along with foreign fund outflows from domestic equities," he said.

The rupee expected to witness high volatility in trading range as on one side the weaker economic activities adding to depreciation pressures while on the other hand weaker dollar index and central bank's intervention is expected to provide support.

Spot USDINR is expected to consolidate in the range of 74.60 to 75.25 range in coming days.