Rupee falls 26 paise to close at 85.87 against US dollar

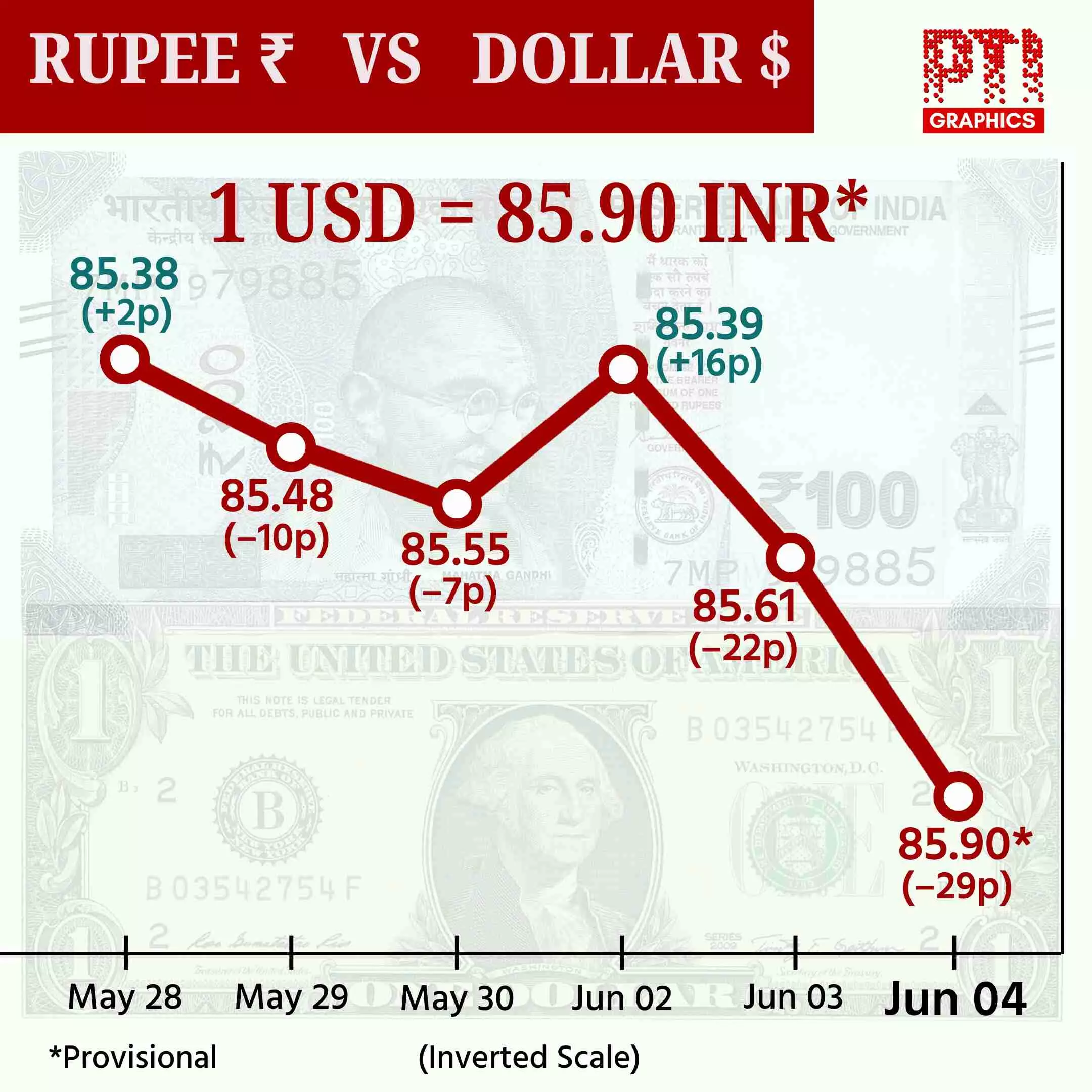

Mumbai (PTI): The rupee depreciated for the second consecutive session and settled for the day lower by 26 paise at 85.87 against the US dollar on Wednesday, largely driven by strong dollar demand from importers.

Forex traders said the local unit remained under pressure on geopolitical tensions between Russia-Ukraine and elevated crude oil prices.

At the interbank foreign exchange, the domestic unit opened at 85.69 and moved between the high of 85.69 and a low of 86.05 against the greenback during the day.

The unit closed the session at 85.87 against the dollar, registering a loss of 26 paise from its previous close. On Tuesday, the rupee depreciated 22 paise to settle at 85.61 against the US dollar.

The local unit registered the second consecutive session of fall and has lost 48 paise over the greenback.

"The Indian rupee extended its depreciation for a second consecutive day, emerging as the weakest performer among Asian currencies. This decline was driven by strong dollar demand from importers, a lack of intervention, and weaker-than-expected PMI figures," said Dilip Parmar, Senior Research Analyst, HDFC Securities.

On the domestic macroeconomic front, the Indian services growth broadly steadied in May and was underpinned by healthy demand conditions, new client wins and greater staffing capacity. The seasonally adjusted HSBC India Services PMI Business Activity Index was at 58.8 in May, marginally up from April's 58.7.

Market participants are now keenly awaiting the outcome of the Reserve Bank of India's monetary policy meeting for direction trade.

The Reserve Bank's rate-setting panel started its three-day brainstorming on monetary policy on Wednesday and the outcome is scheduled to be announced on June 6.

Experts are of the view that the RBI may reduce the repo rate by 25 bps on Friday and another similar cut in the next policy. SBI research expects the central bank to go in for a "jumbo" rate cut of 50 bps in June itself.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading lower by 0.15 per cent at 99.07.

Brent crude, the global oil benchmark, rose 0.24 per cent to USD 65.79 per barrel in futures trade.

"Technically, the spot USDINR has broken out upwards, forming a bullish chart pattern. The bias for the pair has turned positive, suggesting a further appreciation towards 86.50 in the coming days, with support now established at 85.30," Parmar added.

In the domestic equity market, the 30-share BSE Sensex surged 260.74 points, or 0.32 per cent, to close at 80,998.25, while the Nifty rallied 77.70 points, or 0.32 per cent, to 24,620.20.

Foreign institutional investors (FIIs) purchased equities worth Rs 1,076.18 crore on a net basis on Wednesday, according to exchange data.