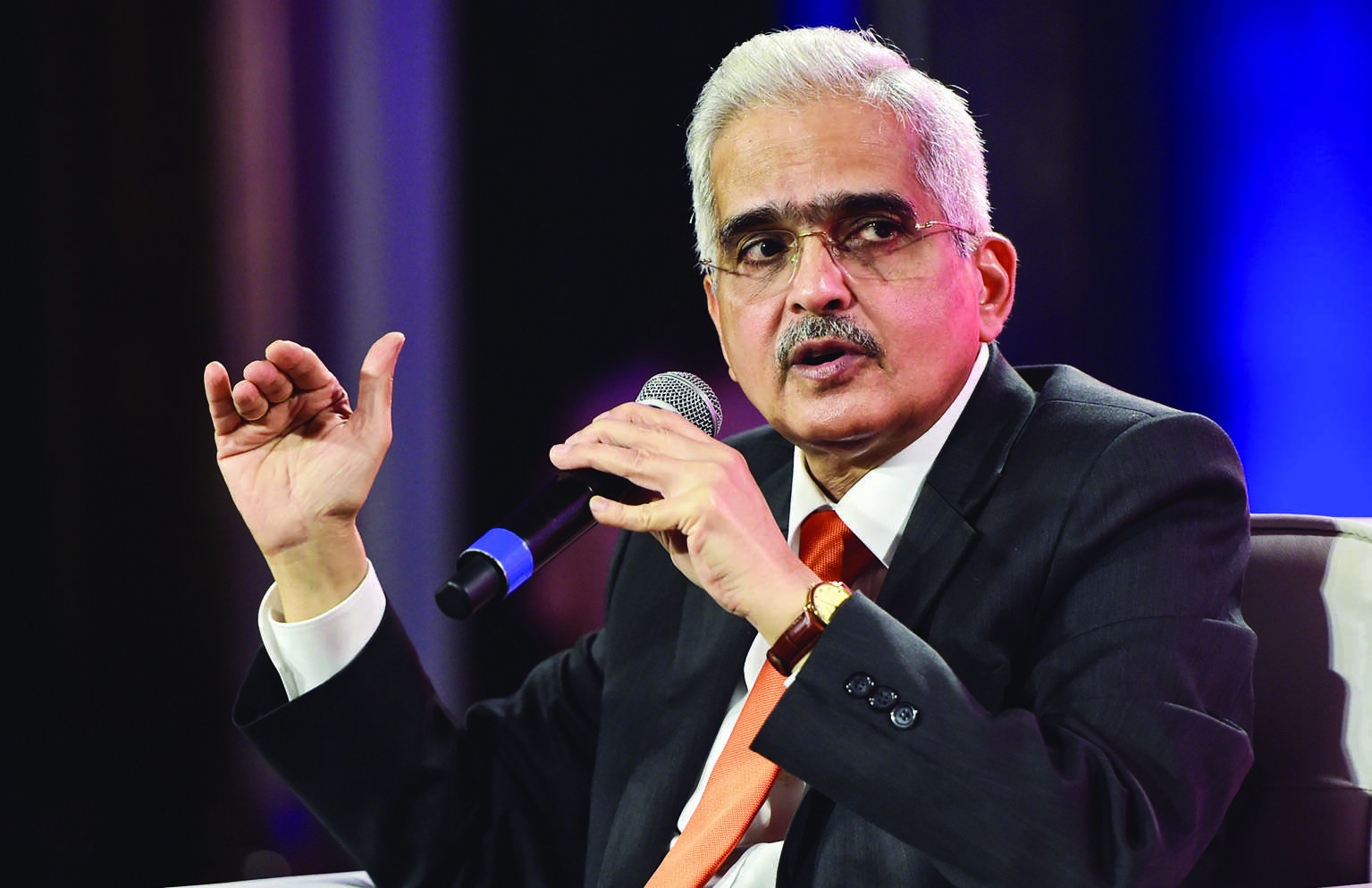

RBI will ensure soft landing of economy, says Governor Das

Mumbai: Reserve Bank of India Governor Shaktikanta Das on Friday said the central bank will ensure that the economy has a soft landing wherein inflation is closer to 4 per cent, with minimal impact on growth.

Das said retail inflation appears to have peaked and the Monetary Policy Committee (MPC) in its upcoming meeting in August will review the inflation projection of 6.7 per cent for the fiscal 2022-23.

"Our endeavour shall be to ensure a soft landing for our economy where inflation is brought down to closer to the target of 4 per cent over a period of time. At the same time, the growth sacrifice is also within manageable limits," the governor said at a banking conclave organised by Bank of Baroda.

Das said the country had reached a kind of soft landing till the war broke out in Europe. This has resulted in new challenges such as rise in commodity, crude prices and their impact on the country; monetary policy tightening by other central banks and their spillovers; capital outflows and currency depreciation, which are beyond RBI's control.

The governor said any decision of RBI with regard to liquidity and policy rates always takes into consideration the kind of impact it is going to have on growth and revival of economic activity. However, in sequence of priorities, RBI's focus currently is on inflation followed by growth, Das said.

Speaking on the flexible inflation targeting framework, Das said the regime has worked very well for the country.

Under the flexible inflation targeting framework, RBI is expected to maintain retail inflation at 4 per cent (+/- 2 per cent).

"So far as India is concerned, the framework has worked well before the pandemic, during the pandemic and even now, I would say that we are very much in line with the requirements of time in terms of steps that need to be taken," he said.

The governor also said that since the adoption of the inflation-targeting framework in 2016 till the onset of Covid in February 2020, the average CPI (Consumer Price Inflation) was 3.9 per cent.

"We had a huge shock coming from Covid, and because we have flexibility inbuilt into the (inflation) target of 4 per cent (plus/minus 2 per cent), the MPC decided to use that flexibility to tolerate a slightly higher inflation.

"It is that flexibility, which is built into the inflation targeting framework, which allowed the MPC and RBI to reduce policy rates, inject huge amount of liquidity and several other measures to fight the impact that the Covid was producing on the financial sector as well as on the real economy," the governor said.

He also said higher inflation leads to negative interest rates which will act as a big disincentive to savers and have an impact on the entire investment climate of any country.

He said the crisis such as Covid and the current war in Europe have produced a lot of consequences on the real sector, and hence having an inflation target and trying to achieve it ensures that the aspect of financial stability is maintained not only in India but the world over.

"Therefore, I feel that the (inflation targeting) framework has worked well and needs to continue. My personal opinion and also it is the opinion of all of us in the RBI that let us not shift the goal post to suit our convenience because the larger requirement of the economy and the financial sector is to have such a framework," he said.

Das said in the upcoming policy, MPC will review the inflation projection of 6.7 per cent for FY 2023, announced in the June policy as there is softening of retail inflation.

"As it would appear, inflation appears to have peaked. Please mind my words, it appears to have peaked and it has moderated from 7.8 per cent to 7.04 per cent, and now it is 7 per cent," Das said.

On the macroeconomic situation, the governor said the Indian economy remains relatively better placed, drawing strength from its macroeconomic fundamentals.

The financial system is well-capitalised, asset quality indicators have improved, balance sheets are stronger, and banks have returned to profitability.

There is a healthy pickup in credit demand and the external sector is well-buffered to withstand the ongoing terms of trade shocks and the portfolio outflows, he added.