'GST 2.0 a remarkable step; Govt will work on FICCI CASCADE’s recommendations to curb illicit trade'

New Delhi: Mr. Arjun Ram Meghwal, Minister of State (Independent Charge), Ministry of Law and Justice, Government of India, today while addressing the FICCI-CASCADE’s ‘MASCRADE 2025’ emphasized that GST 2.0 is not just about taxation—it is about making life easier for households and businesses. “From filing 37 GST returns in a year in 2017 to only 3 today, this reform shows how governance can truly respond to industry’s voice. At the same time, we must clearly define illicit trade and work collectively to eliminate it. I assure you that the recommendations emerging from MASCRADE 2025 will be taken to the Government and acted upon," he added.

Mr. Anil Rajput, Chairman, FICCI CASCADE, said, “I congratulate our Hon’ble Prime Minister for announcing the historic and bold GST 2.0 reforms, which is another step toward Viksit Bharat. GST 2017 transformed our taxation landscape, and now GST 2.0 builds on that foundation with simplified rate structures and greater efficiency. GST 2.0 truly embodies the vision of ‘One Nation, One Tax.’ At FICCI CASCADE, we have long advocated for rational tax structures to reduce illicit trade. High tax rates create price gaps that fuel smuggling and counterfeiting. GST 2.0 addresses these concerns, and I urge policymakers to continue keeping the structure balanced to discourage illicit markets.”

“Building on the spirit and success of Operation Sindoor, which demonstrated how clarity of purpose, precision, and coordination can dismantle entrenched threats, I want to unveil a new framework for our collective action against illicit trade. ‘SHIELD’ offers a structured and strategic approach to combating illicit trade in India. S is for strategic monitoring through tech-enabled surveillance across supply chains. H stands for Harnessing Technology like AI, blockchain, and analytics to detect anomalies. I is for Industry Collaboration, urging businesses to share intelligence and support enforcement. E denotes Enforcement, calling for swift action and deterrence. L is for legal reforms, advocating stronger laws and faster trials. Lastly, D means Demand Reduction, stressing public awareness to curb consumption of smuggled and counterfeit goods and disrupt illicit markets at the root. I also want to acknowledge the tireless efforts of our enforcement agencies—Customs, BSF, CRPF, DRI, CEIB, and our intelligence services. In the past year alone, seizures of illicit goods have risen sharply, and contraband worth thousands of crores has been intercepted,” he added.

In her video address, Ms. Gael Grooby, Director, Policy and Standards, World Customs Organization, said, “I congratulate FICCI for its leadership in tackling illicit trade through this important platform. Since our founding in 1952, the WCO has worked to support legitimate trade while countering illicit flows. This year’s WCO theme is ‘Customs Delivering on Efficiency, Security, and Prosperity’. Through initiatives like Operation STOP, we’ve disrupted counterfeit medical supply chains and protected consumers and economies alike. However, today’s landscape is changing. E-commerce has revolutionized trade, and while it creates opportunities, it also enables the rapid spread of counterfeits. To address this, we are investing in AI, real-time data sharing, and detection technologies to help customs better manage the rising volume of small packages. With India’s support, our Customs Enforcement Network (CEN) now offers enhanced data visualization tools.”

Mr. P K Malhotra, Former Secretary, Ministry of Law & Justice, Govt. of India, and Think Tank Member, FICCI CASCADE, said, “There are serious economic and social costs of illicit trade. While globalization has brought immense opportunities, it has also enabled a parallel economy—smuggling, counterfeiting, tax evasion, and trafficking that undermines our progress toward the UN Sustainable Development Goals. In India, the challenge is urgent. As we aim to become a $30 trillion economy by 2047, we must tackle this issue with sustained, coordinated action, backed by robust enforcement and clear, enforceable laws. Today’s discussions made it evident—illicit trade is no longer a fringe problem. It operates like a global, organized network, exploiting legal ambiguities and enforcement gaps. This fight cannot be won by governments alone. Industry must invest in authenticity and consumer protection. Citizens must be aware and vigilant. And we need deeper international collaboration to enable joint investigations, intelligence sharing, and harmonized standards.”

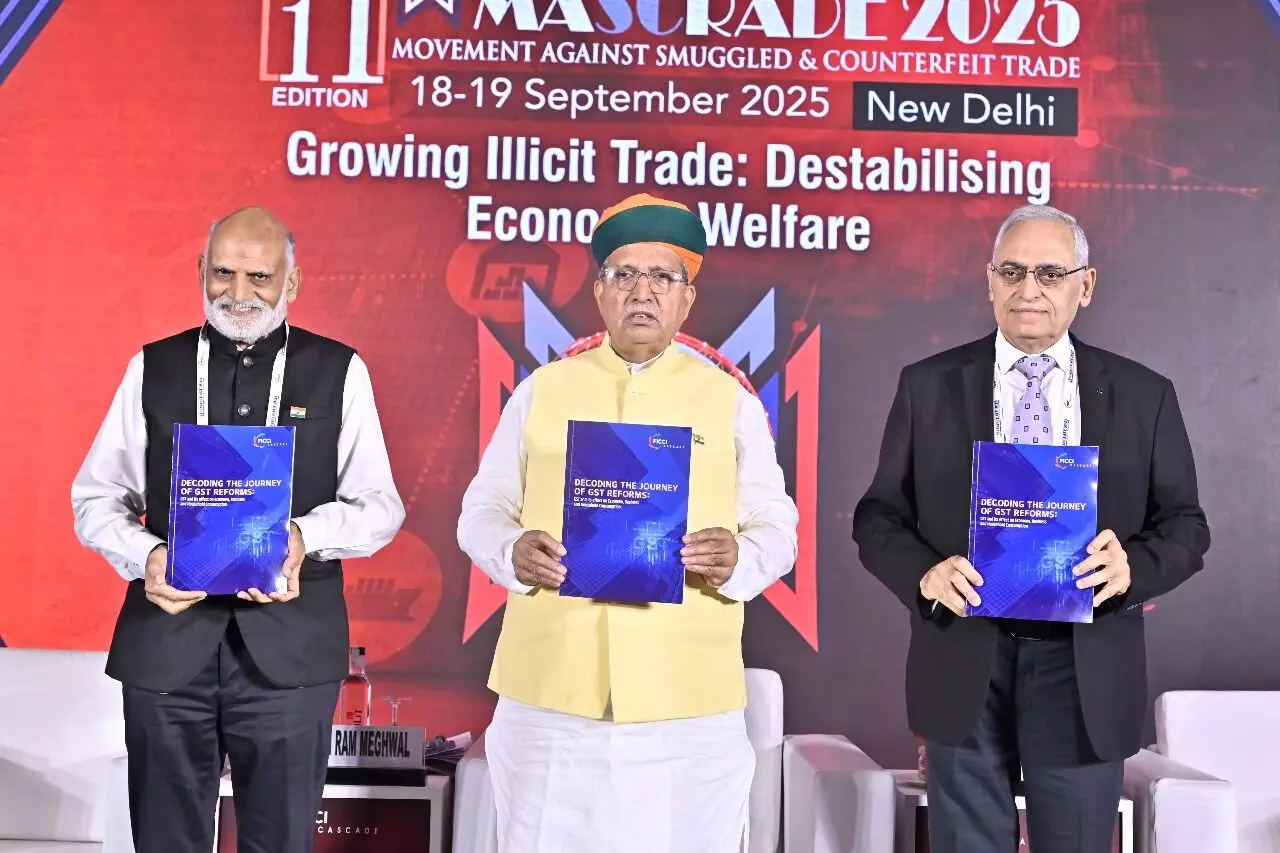

During the event, FICCI CASCADE, jointly with the Thought Arbitrage Research Institute (TARI), released its report – ‘Decoding the Journey of GST Reforms: GST and Its Effect on Economy, Business and Household Consumption’. The report affirms that GST 2.0 marks a landmark reform, reshaping India’s indirect tax system to directly improve ease of living for households and ease of doing business for enterprises.

Highlights of the Report:

In terms of ease of living, which translates into relief for households and cheaper everyday goods, the study highlights that GST 2.0 almost triples the share of items taxed at 5%—rising from 54 consumption categories under GST 1.0 to 149 categories under GST 2.0. For rural households, the share of exempt and merit goods in their consumption basket rises sharply from 56.3% to 73.5% and for urban households, this share climbs from 50.5% to 66.2%. As a result, effective GST incidence for rural families falls from 6.03% to 4.27%, while for urban households it reduces from 6.38% to 4.38%. This means more disposable income in the hands of consumers, which in turn will fuel discretionary spending on services, retail, and local businesses.

For businesses, especially MSMEs, GST 2.0 introduces rationalized rates that address distortions caused by the inverted duty structure. The study shows that sectors critical for rural employment and manufacturing—such as tractors, farm machinery, fertilizers, textiles, handicrafts, auto components, and construction inputs—are now subject to lower, more rational rates.

The report cautions that GST 1.0’s high tax rates created arbitrage opportunities that expanded illicit markets. Between 2017–18 and 2022–23, illicit FMCG markets surged by over 70%, packaged foods by nearly 100%, and illicit tobacco trade crossed ₹41,000 crore. This thriving parallel economy disproportionately affected lower and middle-income groups while draining government revenue.

Every rupee spent on legitimate goods strengthens the formal economy and builds confidence among businesses, while every rupee lost to illicit trade weakens consumer safety and public revenues. By moderating the standard slab to 18% and shifting a wide range of essentials into the 5% category, GST 2.0 reduces the price gaps that fuel smuggling and counterfeiting. This is expected to significantly strengthen consumer safety, protect legitimate businesses, and reinforce the formal economy.

The study also points to areas requiring vigilance. The introduction of a third 40% slab for demerit goods, particularly tobacco, risks perpetuating illicit markets. The study notes that between 2018–19 and 2022–23, the tax component of the illicit tobacco market quadrupled from ₹3,812 crore to ₹16,168 crore, with its share in the total illicit tobacco market rising from 15% to nearly 54%. FICCI CASCADE urges that a balanced approach to demerit taxation is essential to disincentivize smuggling and protect consumer welfare.

The conference saw participation from senior officials, global experts, and representatives from various global organizations such as European Union Intellectual Property Office, World Intellectual Property Organization, Global Initiative Against Transnational Organized Crime, United Nations Office on Drugs and Crime, International Chamber of Commerce, etc. Speakers emphasized the need for collaborative action to curb smuggling, counterfeiting, and illicit trade.

Enforcement officers, school children, and journalists were felicitated at the anti-counterfeiting and anti-smuggling awards ceremony held during MASCRADE 2025.