Corona spooks benchmarks as investors lose Rs 3.53 lakh cr

Mumbai: The Sensex plunged 883 points while the Nifty crashed below the 14,400-level on Monday as the worsening COVID-19 situation in the country triggered an across-the-board selloff.

Fresh lockdowns announced by some states have stoked concerns over the economic recovery, while another sharp drop in the rupee also weighed on risk appetite, traders said.

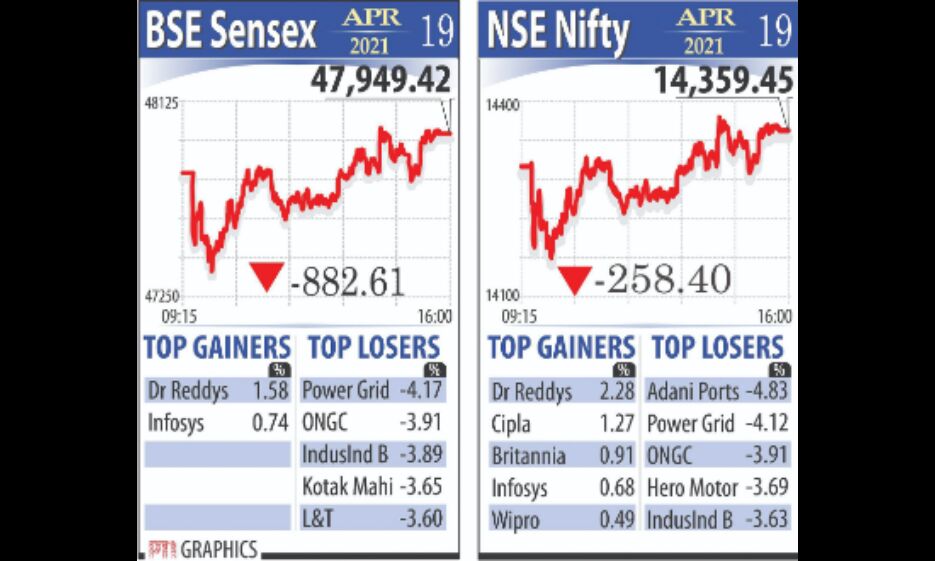

After crashing over 1,469 points in early trade, the 30-share BSE Sensex pared some initial losses to close at 47,949.42, down 882.61 points or 1.81 per cent.

Similarly, the broader NSE Nifty tanked 258.40 points or 1.77 per cent to finish at 14,359.45.

PowerGrid was the top loser in the Sensex pack, slumping 4.17 per cent, followed by ONGC, IndusInd Bank, Kotak Bank, L&T, Bajaj Finserv, Asian Paints and M&M.

Only Dr Reddy's and Infosys managed to end in the green, rising up to 1.58 per cent.

"Domestic equities, which were looking resilient for last couple of days, fell sharply on sharp spike in COVID-19 cases across the country and enhanced economic restrictions imposed by several states. Announcements of wider mobility restriction by Rajasthan and Delhi governments dented investors' sentiments," said Binod Modi, Head Strategy at Reliance Securities.

Barring pharma and IT, which remained resilient, all key sectoral indices witnessed sharp correction. Financials and automobiles witnessed steeper correction. Notably, volatility index soared by over 11 per cent, which does not augur well, he added.

Investor wealth tumbled by Rs 3.53 lakh crore on Monday, with the market capitalisation of BSE-listed companies standing at Rs 201.77 lakh crore.

India's total tally of COVID-19 cases crossed 1.50 crore with a record single-day rise of 2,73,810 new coronavirus infections, while the active cases surpassed the 19-lakh mark, according to the Union Health Ministry data updated on Monday.

Sector-wise, BSE realty, capital goods, power, auto, industrials, finance and telecom indices plunged up to 3.96 per cent, while healthcare index closed higher.

Broader BSE midcap and smallcap indices skidded up to 1.93 per cent.

Global equities were in a better shape as investors awaited key corporate earnings.

Elsewhere in Asia, bourses in Shanghai, Hong Kong, Seoul and Tokyo ended on a positive note.

Stock exchanges in Europe were also largely trading with gains in mid-session deals.