‘Challenge of illicit trade looms larger than ever before’

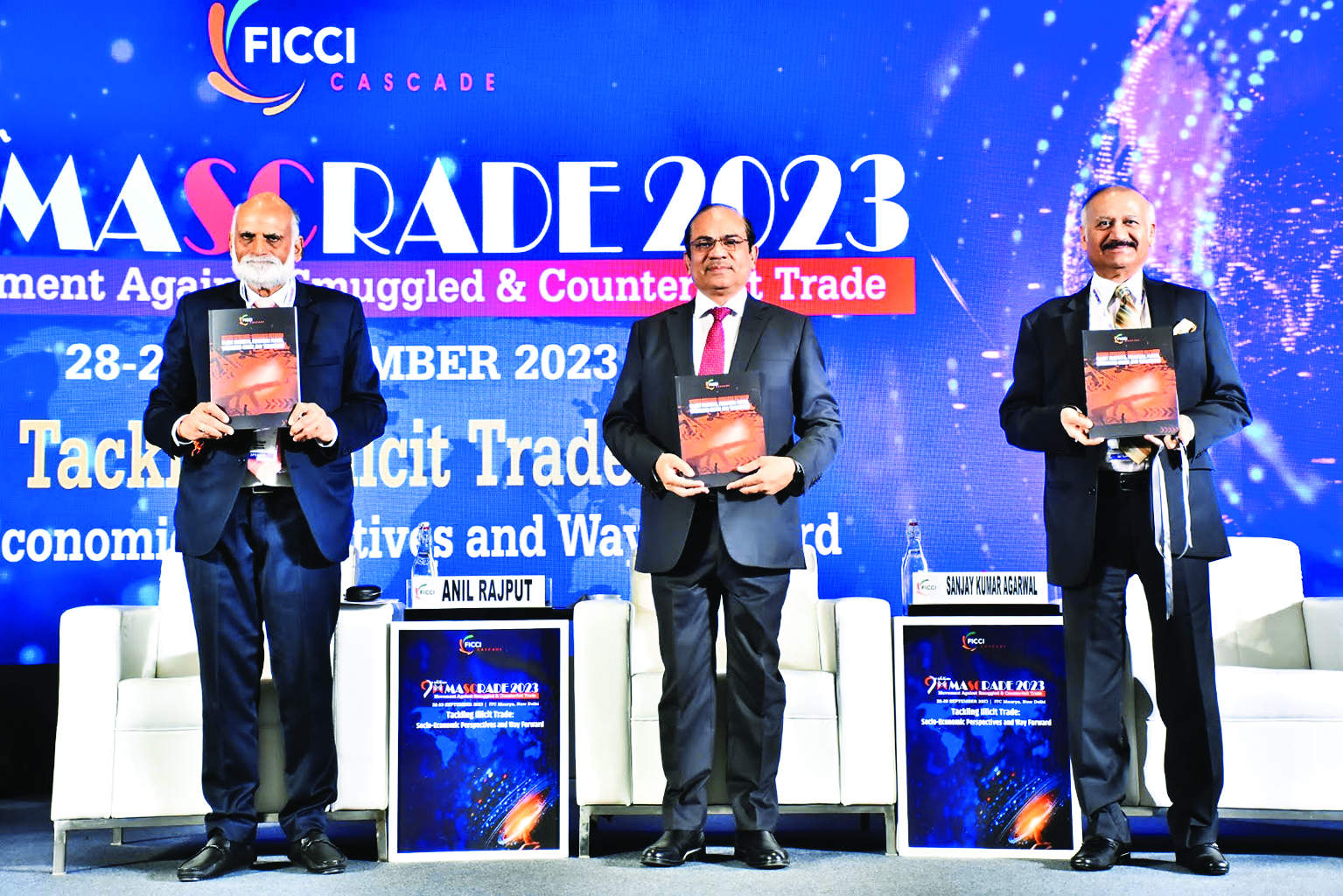

NEW DELHI: Sanjay Kumar Agarwal, Chairman, Central Board of Indirect Taxes and Customs (CBIC) on Thursday said that when India is rising as a global force in international trade and when our interconnectedness has transcended geographical boundaries, the challenge of illicit trade looms larger than ever before.

Addressing the inaugural of the two-day 9th edition of ‘MASCRADE 2023’, organised by FICCI CASCADE, Agarwal said, “Illicit trade undermines national security, risks legitimate manufacturing, leaks government revenue, jeopardises public health and safety, and erodes the trust of consumers and investors alike. Tackling this issue is fundamental for safeguarding India’s economic stability, ensuring fair competition, and fostering an environment conducive to sustainable growth and ease of doing business. CBIC plays a crucial role in the fight against illicit trade in its entirety,” he added.

Speaking on the rising figures of GST revenue, Agarwal said that month after month the GST revenue has crossed the mark of Rs 1.6 lakh crores. The GST revenue collection was Rs 1.87 lakh crores in April this year, the highest ever. The buoyancy of revenue collection is 1.43 of nominal GDP growth, meaning thereby that growth in revenue collection is not only by GDP growth, but a major contribution is made by increased compliance levels. He further stated that the government is taking all steps to encourage self-compliance. “An environment is being created so that the fraudsters are not allowed to enter in the ecosystem and pollute it. The recent decisions taken in successive GST Council meetings, to make the suitable changes in return filing are in that direction only, so that menace of fake ITC is curbed,” he added.

To enhance the compliance, he said that the department has taken steps from soft approach of nudging the taxpayers for timely and accurate filing of returns, to selecting for return scrutiny or Audit.

Speaking on the Customs, Agarwal said that the department is fully committed in the country’s efforts to bring down the logistics cost from level of 13-14 per cent of GDP to the level of 8 per cent in line with such levels in developed world. “For success of ‘Gati Shakti’ program, each and every component in logistics chain is important and need to be closely monitored. Customs is leaving no stone unturned,” he emphasized.

On anti-smuggling front, he stated that whether it is a case of outright smuggling or by concealment in trade consignments, customs officers are keeping a vigilant eye over the perpetrators and syndicates involved in such illegal activities.