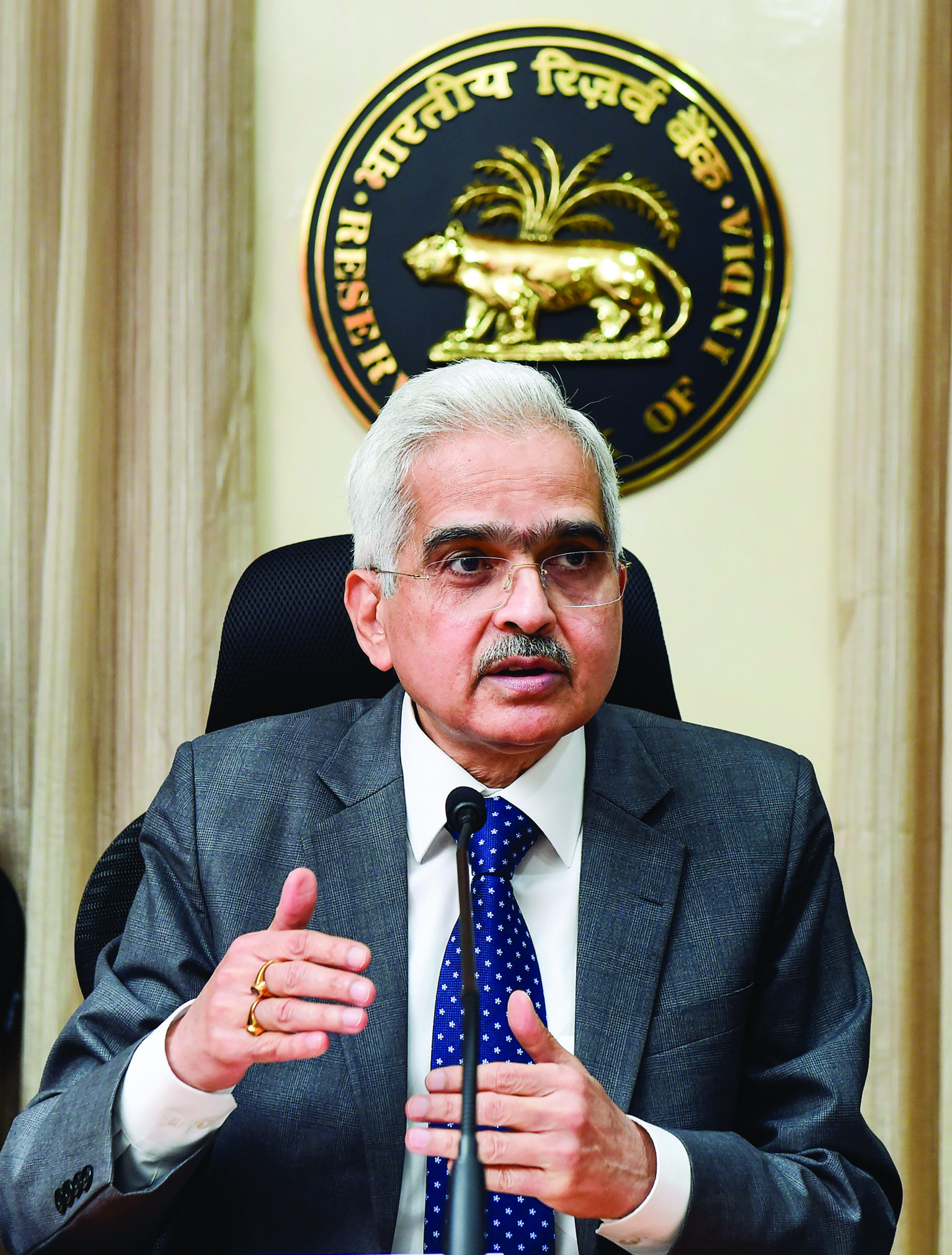

RBI stands firm against ‘crypto mania’, Das reiterates concerns

Mumbai: In a defiant stance against the recent approval of Bitcoin ETFs in the US, RBI Governor Shaktikanta Das on Thursday reiterated the central bank’s unwavering opposition to cryptocurrencies. Speaking at a financial sector seminar, Das underlined that India will not “emulate” other countries’ regulations blindly, prioritising its own economic stability and financial security.

He cautioned against the potential for a “crypto mania” in emerging markets like India, drawing parallels to historical asset bubbles like the Tulip Mania in the Netherlands.

“What works for another market may not be suitable for us,” Das stated, reiterating the central bank’s and his personal stance against private cryptocurrencies due to their threat to financial stability. “The question is, what gains do we truly seek by venturing down this path?” asked Das.

He underscored that even the US regulator, amidst granting ETF approval, issued warnings to investors about the inherent risks. “Our position remains unchanged, regardless of anyone else’s actions. We are not in the business of simply imitating others,” Das asserted.

The remarks come against the backdrop of the SEC’s landmark decision, seen as a significant step in crypto mainstreaming. ETFs offer a familiar and regulated avenue for institutional investors to access bitcoin. “While I refrain from commenting on another country’s regulatory decisions, I urge caution due to the acknowledged risks by the regulator itself,” Das stressed. “The Tulip mania serves as a stark reminder of the potential dangers of asset bubbles. The world, especially emerging markets, cannot afford a similar “crypto mania” with such dire consequences.”

On the upcoming vote-on-account, Das expressed confidence in the current government’s fiscal prudence, believing the interim budget will not trigger inflationary pressures. He further highlighted the government’s proactive supply-side measures implemented since the Russia-Ukraine conflict to curb price rises.

with agency inputs