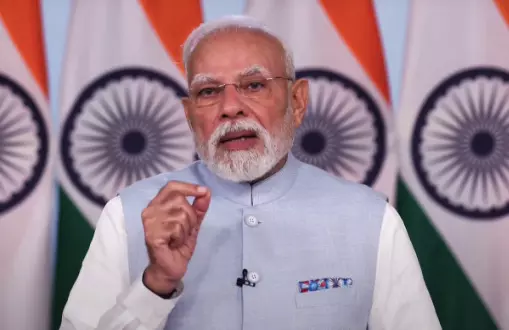

PM Modi says ‘swadeshi goods will power India’s growth’ as GST reforms take effect

New Delhi: Prime Minister Narendra Modi on Sunday hailed the rollout of India’s next-generation Goods and Services Tax (GST) reforms, set to take effect from Monday, describing it as a major step towards strengthening the nation’s economic self-reliance. Speaking on the eve of Navratri, Modi said the reforms would benefit consumers and businesses alike, while promoting indigenous products as a driver of prosperity.

Addressing the nation in a 19-minute broadcast, Modi described the new GST rates as the beginning of a “GST bachat utsav” or savings festival. He said the reduction in tax rates across a wide range of products would make essential and aspirational goods more affordable, providing relief to households across income groups.

“This is an important step for Atmanirbhar Bharat. With the sunrise tomorrow, the next-generation GST reforms will come into effect,” the prime minister said. He urged citizens to embrace swadeshi goods, asserting that supporting locally made products would strengthen the economy in the same way the freedom movement drew strength from indigenous industries.

Modi highlighted that these reforms, coming months after the government raised the income tax exemption for annual earnings up to Rs 12 lakh, would create a “double bonanza” for citizens. “People will save Rs 2.5 lakh crore from these

twin initiatives,” he said, noting that the measures would reduce daily expenditures and enhance savings. The prime minister also called on state governments to foster an environment conducive to investment and manufacturing. He underlined that collaboration between the Centre and states was key to realising the vision of a self-reliant India.

“In every home and shop, there should be pride in swadeshi products. This is not just about buying Indian goods; it is about accelerating the country’s growth,” Modi said, urging citizens to be mindful of the origin of the items they purchase. He noted that many everyday products, including combs and other small items, are often imported, and encouraged consumers to choose domestic alternatives.

On the business front, Modi welcomed the sector’s proactive role in passing on the benefits of reduced GST rates to consumers. He said that the new structure simplifies taxation, with only two primary slabs—5 per cent and 18 per cent—covering most goods and services. He highlighted that essential items such as food staples, medicines, personal care products like soap and toothpaste, and insurance services would now be either tax-free or attract only 5 per cent tax.

According to Modi, nearly 99 per cent of items previously taxed at 12 per cent have now been moved to the 5 per cent bracket. He said the move resolves decades of complexity, where citizens and traders faced multiple overlapping levies across states, increasing costs and hindering business efficiency.

Recalling a report he read shortly after taking office in 2014, Modi illustrated the inefficiency of the old system, noting that it was easier for a company to transport goods from Bengaluru to Europe and back than to move them from Bengaluru to Hyderabad due to multiple local taxes. He said that by 2017, the government worked with stakeholders to bring about the landmark “one nation, one tax” system.

The GST Council, comprising the Centre and state governments, has now revised rates on about 375 goods and services. The majority of items, from kitchen staples to electronics, medicines, and automobiles, will see lower taxes, benefiting both consumers and micro, small, and medium enterprises (MSMEs). Modi said MSMEs and cottage industries would play a central role in strengthening India’s self-reliance, adding that boosting domestic manufacturing was crucial for the country’s economic resurgence.

Under the new structure, luxury items will attract a 40 per cent tax, while tobacco and related products will remain in the 28 per cent plus cess category. The previous four-tier system of 5, 12, 18, and 28 per cent, with additional cesses on luxury and sin goods, is now streamlined, making compliance simpler for businesses.

Among the items that will become more affordable are everyday essentials like ghee, paneer, butter, snacks, ketchup, jam, dry fruits, coffee, and ice cream. Aspirational goods such as televisions, air conditioners, and washing machines will also see price reductions.

Modi said the GST reforms reflect the government’s guiding principle of “naagrik devo bhawah,” meaning “citizens are like gods,” and are designed to ease the financial burden on households while improving the ease of doing business. He described the rollout of the reforms as a continuation of India’s journey toward economic modernization, noting that the 2017 GST implementation was a historic milestone in creating a unified tax system.

“The reduced GST rates will benefit every citizen—from the poor and middle class to youths, farmers, women, traders, and shopkeepers,” he said. Modi added that the reforms are expected to attract investment and accelerate the nation’s growth trajectory.

With the implementation set for the first day of Navratri, the prime minister said the timing adds symbolic significance to the launch. “The GST bachat utsav will bring happiness to every household, making essential goods more accessible and promoting the spirit of local manufacturing,” he said.

Modi called on all Indians to proudly buy and sell swadeshi products, linking individual choices to the larger goal of a prosperous, self-reliant India. “When we make every shop and every home a symbol of swadeshi, we accelerate the nation’s development,” he said, underscoring that the reforms are as much about economic efficiency as national pride.