Parliament passes new income tax bill to replace 6-decade old law

New Delhi: Parliament on Tuesday passed a new income tax bill to replace the six-decade-old Income Tax Act, 1961, that will come into force from April 1, 2026.

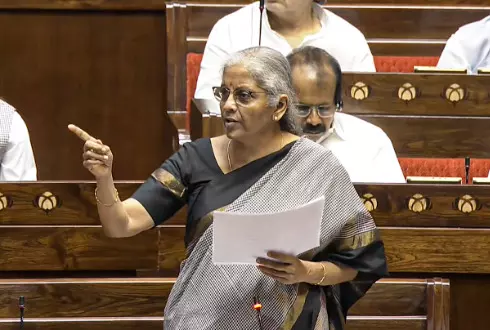

Piloting the Income Tax Bill, 2025, in the Rajya Sabha, Finance Minister Nirmala Sitharaman said it does not impose any new tax rate and only simplifies the language, which is required for understanding the complex income tax laws.

The new bill removes redundant provisions and archaic language and reduces the number of Sections from 819 in the Income Act of 1961 to 536 and the number of chapters from 47 to 23.

The number of words has been reduced from 5.12 lakhs to 2.6 lakhs in the new income tax bill, and for the first time, it introduces 39 new tables and 40 new formulas, replacing the dense text of the 1961 law to enhance clarity.

"These changes are not merely superficial; they reflect a new, simplified approach to tax administration. This leaner and more focused law is designed to make it easy to read, understand and implement," Sitharaman said while replying to a short debate in the absence of the Opposition in the Rajya Sabha.

Along with the Income Tax Bill, 2025, the House also returned the Taxation Laws (Amendment) Bill, 2025, to the Lok Sabha that had passed these money bills on Monday.

"To remove confusion, I want to say that the aim of bringing in this new law is to simplify the language and lucidity, which is required for understanding," the minister said.

Sitharaman further emphasised that Prime Minister Narendra Modi had given clear instructions - Covid or no Covid - tax burden on people should not be increased.

"We have not increased any new tax," she said.

She said the taxpayer-friendly Income Tax Act 2025, replacing the 1961 Act, is a milestone for the country's financial system.

"I am shocked that the Opposition doesn't want to participate. The Opposition had agreed in the Business Advisory Committee to debate the bill in both the Lok Sabha and the Rajya Sabha," she said.

Most often, the Opposition says, she noted, "you don't want to discuss anything, we want to have charcha. We agreed for 16 hours of charcha in the Lok Sabha and 16 hours of charcha here (Rajya Sabha)...where are they today".

The Opposition had earlier staged a walkout from the Rajya Sabha, demanding a discussion on special intensive revision of the voters' list in Bihar.

The new income tax bill was drafted within a record time of 6 months and introduced in the Budget session in February 2025.

The drafting of the new bill involved nearly 75,000 person-hours, with a team of dedicated officers of the Income Tax department working tirelessly.

The minister informed the House that soon the finance ministry will be issuing FAQs and an information memorandum for more information on the new legislation.

She further said ministry officials are busy formulating rules, which will be simpler like the bill.

As the new law will come into force from April 1, 2026, the computer systems of the income tax department are required to be rebooted to operationalise the new legislation.

The Taxation Laws (Amendment) Bill, 2025, also passed by voice in the Rajya Sabha, incorporated changes in the scheme of block assessment with regard to Income Tax search cases, and would provide for certain direct tax benefits to public investment funds of Saudi Arabia.

It seeks to amend the Income Tax Act, 1961 and also the Finance Act, 2025.

The government in July announced that all tax benefits available under the New Pension Scheme (NPS) shall apply to the Unified Pension Scheme (UPS), which was implemented from April 1, 2025.