India needs to guard against impact of financialisation in policy making: Eco Survey

India needs to guard against the dominance of financial markets in shaping policy and macroeconomic outcomes, a phenomenon known as 'financialisation' to achieve the goal of Viksit Bharat by 2047, the Economic Survey 2024-25 said on Friday. The consequences of financialisation are evident in advanced economies, where it has led to unprecedented levels of public and private sector debt -- some visible to regulators and some not, it said.

Economic growth in such contexts becomes overly reliant on rising asset prices to offset leverage, exacerbating inequality and asset market considerations that may overly influence public policies, particularly regulatory ones, it added. As India strives to align its financial system with its economic aspirations Viksit Bharat by 2047, it should strive to maintain the fine balance between financial sector development and growth on the one hand and financialisation on the other, it noted. It means that the country has to chart its path with respect to its context, considering the levels of financial savings in households, its investment needs, and levels of financial literacy, it said.

Ensuring that incentives in the sector are consistent with national growth aspirations is a policy imperative, it said. The survey stressed that India's financial sector has performed well amid unfavourable geopolitical conditions. On the monetary front, system liquidity, represented by the net position under the Liquidity Adjustment Facility, remained in surplus during October-November 2024, the survey said. The financial parameters of banks continue to be strong, reflected in improved profitability indicators. The gap between the growth of credit and deposits of SCBs has narrowed, with deposits keeping pace with loan growth.

The financial sector is witnessing a moment of positive flux, with several changes taking shape, it said, adding that firstly, there is a rise in the share of consumer credit in overall credit extended by banks. Between FY14 and FY24, the share of consumer credit in the total bank credit increased from 18.3 per cent to 32.4 per cent. "Secondly, there has been a rise in non-bank-based financing in recent years. Banks' share in total credit has declined from 77 per cent in FY11 to 58 per cent in FY22. Simultaneously, there has been a rise in NBFCs and bond market financing," it said. Thirdly, it said, equity-based financing has catapulted to popularity, with IPO listings growing six times between FY13 and FY24 and India being ranked first globally in terms of the number of IPO listings in FY24.

India needs 8% growth for 2 decades; deregulation, land-labour reform for Viksit Bharat: Survey

India needs to grow at 8 per cent for up to two decades to become a developed nation by 2047, the Economic Survey said on Friday, pitching for a slew of reforms, including land and labour, to achieve the ambitious target. It further said that to achieve this growth, the investment rate must rise to 35 per cent of GDP, up from the current 31 per cent, and develop the manufacturing sector further and invest in emerging technologies such as AI, robotics, and biotechnology.

India will also need to create 78.5 lakh new non-farm jobs annually till 2030-32, achieve 100 per cent literacy, develop the quality of our education institutions, and develop high-quality, future-ready infrastructure at scale and speed. "...the faster economic growth that India needs is only possible if the union and state governments continue to implement reforms that allow small and medium enterprises to operate efficiently and compete cost-effectively... The focus of reforms and economic policy must now be on systematic deregulation," the Economic Survey 2024-25 said. The survey also said there should be minimum regulations as small and medium enterprises have limited managerial and other resources at their disposal. The list of areas in which systematic reforms are needed includes land, labour, building, utilities and public service delivery. "Ease of Doing Business (EoDB) 2.0 should be a state government-led initiative focused on fixing the root causes behind the unease of doing business," the survey said. It said where the union government sets the primary law, states also have the option to deregulate by amending subordinate regulations. States should consider these options while identifying opportunities for deregulation. "To realise its economic aspirations of becoming Viksit Bharat by the time of the centenary of independence, India needs to achieve a growth rate of around 8 per cent at constant prices, on average, for about a decade or two," the survey said.

Need enhanced deregulation for MSMEs; challenges in regulatory environment persist: Eco Survey

Highlighting the need for enhanced deregulation for micro, small and medium enterprises, the Economic Survey 2024-25 on Friday said some challenges remain in the regulatory environment. The regulatory compliance burden holds back formalisation and labour productivity, limits employment growth, chokes innovation and depresses growth, according to the survey tabled in Parliament by Finance Minister Nirmala Sitharaman. "The faster economic growth that India needs is only possible if the union and state governments continue to implement reforms that allow small and medium enterprises to operate efficiently and compete cost-effectively," it stated.

Without deregulation, other policy initiatives will not deliver on their desired goals, emphasised the economic survey, adding that by empowering small businesses, enhancing economic freedom, and ensuring a level playing field, governments can help create an environment where growth and innovation are not only possible but inevitable. It further stressed that Ease of Doing Business (EoDB) 2.0 should be a state government-led initiative focusing on fixing the root causes behind the unease of doing business. In the next phase for EoDB, it added, states must break new ground on liberalising standards and controls, setting legal safeguards for enforcement, reducing tariffs and fees, and applying risk-based regulation. Citing examples from other countries, the survey stated, "The need to find growth avenues in an export-challenged, environment-challenged, energy-challenged, and emissions-challenged world means we need to act on deregulation with a greater sense of urgency."

It also outlined a three-step process for states to review regulations for their cost-effectiveness systematically. The steps include identifying areas for deregulation, thoughtfully comparing the regulations with other states/countries and estimating the cost of each of these regulations on individual enterprises. Recognising that the government has implemented several policies and initiatives over the last decade to support and promote the growth of MSMEs, the survey said, "some challenges in the regulatory environment remain". It observed the tendency for firms in India to remain small and the logic for it often is to be under the regulatory radar and steer clear of the rules and labour and safety laws, adding that the biggest casualties of this are employment generation and labour welfare, which most regulations were originally designed to encourage and protect, respectively. The survey said governments can help businesses become more efficient, reduce costs, and unlock new growth opportunities by reducing excessive regulatory burdens. Regulations increase the cost of all operational decisions in firms. The Union government has undertaken deregulation by implementing process and governance reforms, simplifying taxation laws, rationalising labour regulations, and decriminalising business laws. "On their part, states have also participated in deregulation by reducing compliance burdens and simplifying and digitising processes," the survey said. The assessment of states as per the Business Reform Action Plan (BRAP) formulated by DPIIT shows that deregulation helps spur industrialisation.

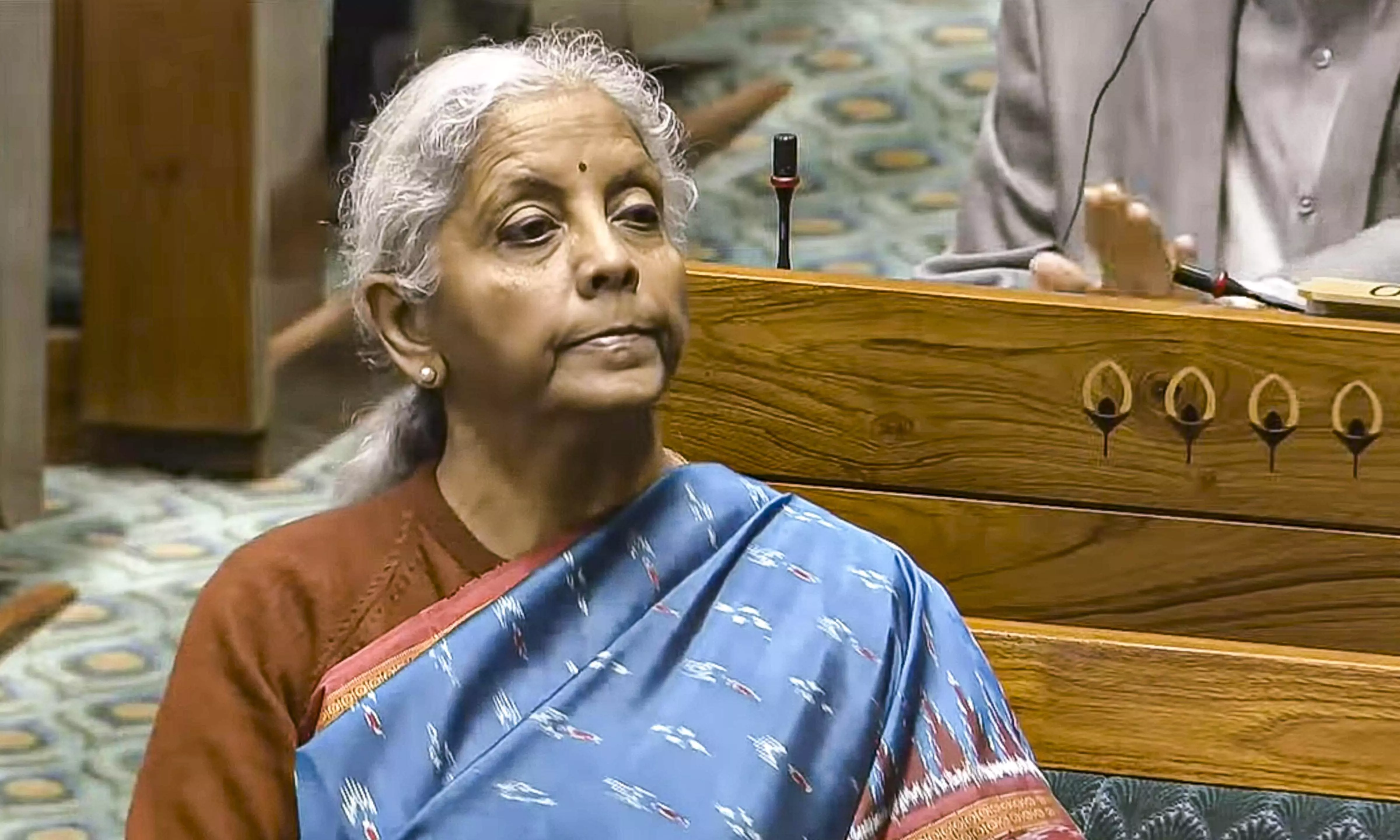

Finance Minister Sitharaman tables Economic Survey 2024-25 in LS

Finance Minister Nirmala Sitharaman on Friday presented the Economic Survey 2024-25 in the Lok Sabha. The Economic Survey is an annual document presented by the government ahead of the Union Budget to review the state of the economy. The document also provides an overview of the short-to-medium-term prospects of the economy.

The Economic Survey is prepared by the Economic Division of the Department of Economic Affairs in the Ministry of Finance under the supervision of the chief economic adviser. The first Economic Survey came into existence in 1950-51 when it used to be a part of the budget documents. In the 1960s, it was separated from the Union Budget and tabled a day before the presentation of the Budget. The Union Budget for 2025-26 will be presented by the Finance Minister on Saturday.