Bumpy road ahead

The budgets of 13 states reflect curtailed expenditure even in critical sectors like health on account of lower revenues during the pandemic

Bihar, Chhattisgarh, Gujarat, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Uttar Pradesh, West Bengal and Uttarakhand have recently presented budgets for the financial year 2021-22. In their budgets, the negative impact of the Corona pandemic reflects clearly.The current financial situation and budgetary provisions of the states make it clear that the Corona pandemic has aggravated the economic crisis in the states.

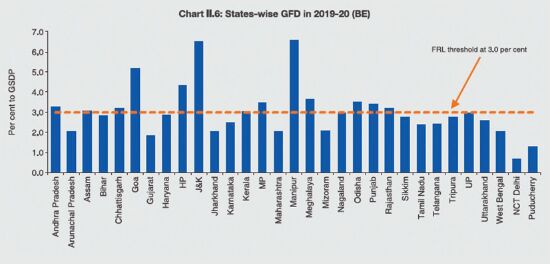

Corona has reduced the income of these states, while their spending has increased. The fiscal deficit has increased due to the higher expenditure than income. The fiscal deficit of these states, i.e the gap between income and expenditure, is estimated to reach the level of 4.5 per cent of Gross State Domestic Product (GSDP) in the fiscal year 2020-21. However, the average fiscal deficit is estimated to be 3.3 per cent of GSDP in the Budget presented for the financial year 2021-22. It shows that in the next financial year, the negative impact of the Corona pandemic will reduce. According to the revised estimate of the current financial year, the fiscal deficit of these states can reach the level of Rs 5.8 lakh crore, while in the next financial year it may come down to Rs five lakh crore. It may be noted that the fiscal deficit of these states is still below the alarming level due to implementation of corrective measures and reduction of expenditure on many fronts.

The pandemic has not had the same impact on the economic condition of all states. The level of fiscal deficit is high in a few states. At the same time, it is less in some other states. The reason for higher fiscal deficit is due to the state's population, number of migrant labourers, health infrastructure, weak or strong supply chain, nature of business, etc.

At the national level, the National Statistical Office (NSO) has projected a contraction of 8 per cent in real terms to gross domestic product (GDP) for the fiscal year 2020-21, while on a nominal basis it is projected to shrink by 3.8 per cent. However, in the Union Budget presented for the FY 2021-22, it is projected to grow at a rate of 14.4 per cent.

Some states have generously estimated the nominal GSDP in the current financial year as compared to FY 2019-2020, which reflects on per capita GSDP. According to data from states like Karnataka, Uttar Pradesh and West Bengal, the GSDP may increase by more than Rs 10,000 in FY 2020-21 compared to FY 2019-20, while at the national level, In FY 2020-2021, per capita GDP can be reduced by about 7,200 rupees as compared to FY 2019-2020. The difference in data between national and states level shows that something is missing in their statistics either at states level or national level. This contradiction may bring changes in estimates at NSO data.

In the Corona era, states' earnings from CGST and SGST have not gone as expected. Earnings from CGST and SGST were 21.2 per cent lower than the revised budgetary estimate. Not only this, the revenue from VAT and sales tax levied on crude oil and products made by it is also 14.7 per cent lower than the budgetary estimate.

To make up for the shortfall in earnings, states have cut spending and borrowing money. Capital spending has been cut by states by about 11.3 per cent. Despite this, there has been a 6.6 per cent increase in this aspect from FY 2019-20 to FY 2020-21, which can be considered a good sign for the economy, as capital expenditure is usually incurred to strengthen the infrastructure. This is also very much needed at the moment. The maximum increase in per capita debt of 20 per cent has been done in the state of Karnataka. The per capita debt of states such as Karnataka, Kerala and Uttarakhand are estimated to be more than Rs 60,000 in FY 2021-22.

Revenue expenditure has been less during FY 2020-21 as compared to capital expenditure. Under the capital expenditure, the government usually spends on the acquisition of property, upgrading and maintenance of buildings, technology, equipment, etc. It is also used to invest in new projects. At the same time, under the revenue expenditure, the expenditure is done on various government departments and services, loan instalment, interest payment, subsidy etc. It is also spent on items such as payment of taxes, fees, penalties etc.

The Corona pandemic has proved that health is precious for life. For this reason, some states have placed special emphasis on the health sector in the budget of 2021-22 to make all the health-related resources accessible and affordable for common people, but six out of 13 states have spent less on health and family welfare in the financial year 2020-21. Though, they have made much more provisions in amount for current financial year to bring betterment in the health sector for the financial year 2021-22. At the same time, five states have increased the budget for health and family welfare by more than 20 per cent in the financial year 2021-22. However, due to lack of revenue, other states have not been able to give the required attention to the health sector in the budget.

The Central and state governments have understood the importance of research and development in the health sector during the Corona period. They have understood that strengthening the health sector is of paramount importance today. However, except for a few exceptions, the health services in rural, town, city and metropolitan areas are in a state of disarray presently. There is an acute shortage of skilled human resources and health related equipment. By strengthening the health sector, we can fight against the corona virus or other disasters like these.

In the budgets of 13 states presented for the financial year 2021-22, the average expenditure on health and family welfare has increased at the rate of 6.5 per cent, while the Central Government has increased this element by 117.6 per cent in the Budget. It is clear from the data that the states' dependence on the Centre for access to health facilities is very high.Here, the Reserve Bank of India has also estimated in a study on 'State Finance- A Budget of 2020-21' that the coming few years will be very challenging for the states. Therefore, states will have to empower themselves financially with the help of effective strategies.

The writer is the Chief Manager in the Department of Economic Research at the Corporate Centre of State Bank of India, Mumbai. Views expressed are personal